The celeb factor

Are celebrity-sponsored credit cards worth the swipe? Features writer Sanaya Pavri explores the scope for such cards in the UAE

Hollywood icons, football players, reality show divas, world athletes and even cartoon characters have been used to sell everything from dishwashing detergents to destinations — and lately credit cards.

“In today’s consumer age, the influence of celebrities on our behaviour can be seen everywhere,” says Janna Herron, Credit Card Analyst, Bankrate Inc. US, a consumer financial services company. “Banks and financial institutions have woken up to celeb power as a means of reaping huge rewards for business.”

Over a decade ago, American Express launched The American Express Tiger Woods credit card, which came with a substantial annual fee but offered several golf-related benefits — free lessons, discounts, and free rounds of golf. Woods, who had been affiliated with American Express since 1997, had a five-year endorsement until 2007 that reportedly paid him $5 million (about Dh18.3 million) a year.

Another sports figure to have his face plastered on plastic is Olympic star Michael Phelps. With his impressive performance at the London Olympics last year agents estimated that the golden boy could make anywhere from $10 million to $50 million in endorsement money over the next year, with a fair chunk of this coming from Visa — Phelps was the face of the new debit card offered by Visa.

Brand association

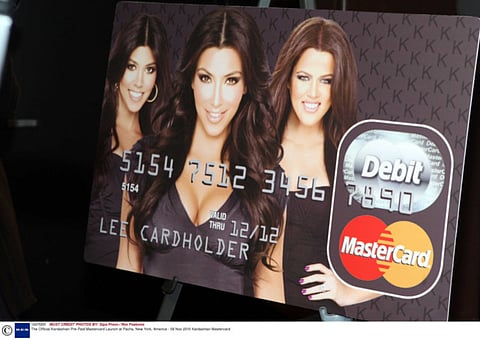

On the other hand, Kim Kardashian’s new credit card, The Kardashian Kard, launched amid huge fanfare in November 2010, didn’t last a month. The card was loaded with fees, and when the card came under slack for being too expensive, the Kardashian sisters, Kim, Kourtney and Khloe, withdrew their endorsement, resulting in a $75-million lawsuit for contract breach. They won the case, leaving Revenue Resource Group, the creators of the card, with the damages.

If the potential risk is this big, then why are banks and financial institutions increasingly jumping on the celebrity bandwagon?

“When banks and financial institutions offer cards linked to your favourite celebrity or icon, they are building a strong brand association and creating much more tailored individual offerings that are not based on how much a customer earns.

“When you take out your card at a till or throw it into the pile to pay for lunch, and it has Justin Bieber or Tiger Woods on it, it defines who you are and what you stand for, without worrying whether the card is silver, gold, black or platinum,” says Maclean.

New demographics

Celebrities sell and using the marketing influence and huge social media outreach of teen idols is a smart move to reach an entirely new demographic, points out Maclean. A few years ago MyPlash Prepaid Cards took advantage of the Twilight phenomenon to release a series of reloadable prepaid gift cards. The Twilight Saga: Eclipse Prepaid MasterCard cards aimed at teenagers was a huge success.

The Bieber-endorsed card by SpendSmart Payments Company was introduced at the beginning of the year and the teen icon is being paid $3.75 million for a 14-month contract, reported Forbes.

Teens aren’t the only new demographic being targeted with celebrity bait. Herron says first-generation immigrants and minority communities such as Hispanics are also being targeted with the help of celebrities.

Lopez comes from a humble background, points out Herron. “This prepaid card is often the first financial tool being used by a lot of consumers and for that demographic Lopez stands for strong values.”

The big differentiator

As consumers become increasingly sophisticated and niche, they are interested in enriching experiences rather than simply owning things. MasterCard’s global Priceless Cities programme was developed through these insights on consumer behaviour. “What we saw was that brand awareness was one thing. But, to see a change in behaviour, it was important to create a strong link to — and incremental value in — the things they are most passionate about, whether it’s travel, sports, shopping, culinary or arts and entertainment,” says Darwish.

Taking this forward, in April Grammy Award-winner Justin Timberlake teamed up with MasterCard in an innovative, two-year relationship focused on brand collaboration and the delivery of truly unforgettable fan experiences for MasterCard cardholders and Justin Timberlake fans worldwide.