Earlier this month, two regional banks made headlines after a $45-million (about Dh165.2 million) cyber heist. BankMuscat and National Bank of Ras Al Khaimah (Rak Bank) were among a set of global lenders that were hit when a gang of cyber criminals hacked their way into a database of prepaid debit cards and targeted cash machines around the globe. While Rak Bank says its customers have not suffered any losses, Bank Muscat is examining its options to recover the money, media reports say.

But anyone can be a victim of fraud. Ali Imran Rizvi, the regional HR head for GlaxoSmithKline, received an SMS recently when his credit card was used at a Walmart in Tampa, Florida, for shopping worth $500. He rang the bank immediately and had his card blocked. Rizvi, who had used the same card at a Walmart store in San Francisco, was asked to fill out a transaction form and wait a month before investigations were concluded and the cash was refunded. While he’s happy that the alert prevented a second transaction on his card, Rizvi isn’t thrilled that the mere use of his card at a convenience store resulted in his details being stolen.

Another Dubai resident, who declined to give his name, wasn’t so lucky. This gentleman, a Pakistani expatriate, was abducted at gun point in his home town of Karachi and forced to give his credit card PIN. The thugs then withdrew cash worth Dh7,000 from different ATMs in the city. However, the victim was not compensated for the illegal use of his card from the UAE-based bank that had issued it.

Customers can never be too careful, says Raman Muralidharan, Regional Head of Customer Value Management, Retail Banking and Wealth Management, HSBC. Banks do the best they can to protect the customers but by leaving no clue of your transaction behind, no matter how small it is, you are helping the banks in keeping cyber thieves at bay, he says.

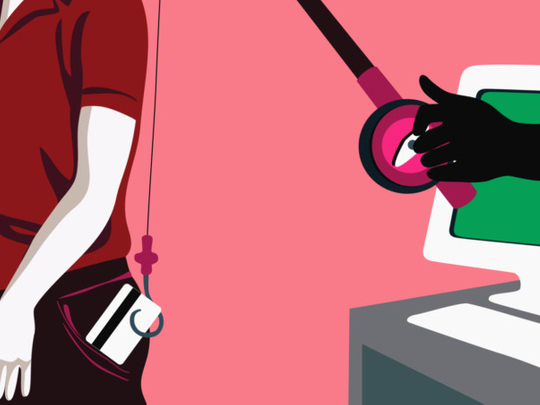

Websites give various tips on how to prevent fraud, including regularly updating contact information with the bank, monitoring the card’s movements while shopping, not carrying plastic unless absolutely necessary, cancelling pre-authorisations obtained on cards when checking out from a hotel or returning a rental car and looking out for signs of tampering or extra fixtures attached to an ATM.

Fraudsters are evolving and so are the banks, trying to add new layers of security to protect their customers. One such security tool, Muralidharan adds, is HSBC’s sophisticated fraud monitoring system, which reviews card transactions to detect unusual spending patterns and flag them up as potentially suspicious transactions.

He says all HSBC ATMs in the UAE are also equipped with anti-skimming Card Protection Kits, which prevent customer cards from being copied through fraudulent activity.

Like many other banks in the UAE, HSBC’s debit cards are chip-enabled, which provides extra security. The bank, in line with the UAE Central Bank guidelines, is also launching EMV chip-enabled credit cards in the UAE this month. The extra layer of security provided by chip and PIN plays a key role in creating a secure environment and minimising unauthorised use of card information.