As banks look at innovative ways to serve the needs of their customers, creating a safe and secure platform for electronic transactions has been their topmost mission. In keeping with this goal, most UAE banks have already introduced chip- and PIN-compliant debit cards, which is a UAE Central Bank mandate.

“We at Emirates NBD started introducing chip- and PIN-enabled debit cards back in 2009,” says R. Sivaram, Senior VP and Head of Cards Business, Emirates NBD. “In the UAE market, we have observed that more than 90 per cent of transactions on debit cards are only for withdrawing cash and only 10 per cent are used to make actual purchases at merchant stores. Our endeavour is to educate these customers and give them more confidence in using their debit card for all their purchases, since the chip and PIN cards are a convenient and secure means for hassle-free electronic transactions.

“Also, now in the UAE, we assess that more than 95 per cent of the merchants’ terminals are chip-compliant. Since these new debit cards are secure, customers have greater confidence in using these cards for purchases. Our aim is to encourage customers to use debit cards over cash.” Sivaram says continuous education of the convenience and security aspect of the chip and pin has resulted in a growth in the usage of debit cards at point of sale (POS), accounting for about 15 per cent of Emirates NBD’s debit card transactions, a figure that is growing rapidly.

Secure and encrypted

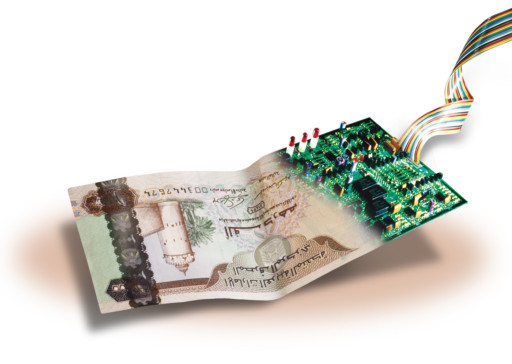

The chip and PIN-enabled card is a next-generation debit card, primarily introduced to support and create EMV compliance, says Prashant Khattar, Managing Director of Infinia Services and Solutions, a customised loyalty solutions company. “EMV stands for Europay, MasterCard and Visa, a global standard for inter-operation of integrated circuit cards (IC cards or chip cards) and IC card-capable POS terminals and ATMs, for authenticating debit card transactions. This is being introduced to safeguard the customer from any fraudulent transactions,” Khattar says.

These cards have an embedded computer chip that store information in a fully secure, encrypted environment, making it the safest possible way to transact at any merchant establishment on a debit card, says Nimish Dwivedi — Head of Payments at Mashreq.

On older ATM cards, customer data was stored on a magnetic strip, and these cards were later made available for consumer purchases through POS machines placed at various merchant outlets. The transaction was validated by the customer’s signature on a slip with the amount and customer’s card number, says John Chang, Head of Retail Banking, Noor Islamic Bank.

Chang adds, “The merchant verifies the signature at the back of the card and the slip signed by the customer to authenticate the transaction. With the increase in usage of POS machines, fraudsters have been able to download the data from the magnetic strips and use the information with fake cards. This most often happens at dining outlets where the card is taken away from the customer to swipe it in the machine. Before chip and pin this was the favoured point of compromise.

“However, with the introduction of the chip and PIN, the POS machine does not read the data until the customer enters his PIN and for this the machine comes to the customer with the card. So the chances of compromise are limited and even if the card is copied the criminal still needs the PIN to download the data from the chip,” adds Chang.

Benefits and usage

Cloning these cards is much more difficult, and they have enhanced the security for both customers and banks in case of any fraudulent transactions, says Syed Hassan Abbas, Senior Vice President, Citigold Wealth Management — Segment Head. “The key to fraud prevention is the PIN number that the cardholder assigns to the debit card. The PIN-enabled terminals make it easier to keep the plastic in sight throughout the transaction and the chances of any future potential fraud are substantially mitigated,” adds Abbas.

From a user perspective there is no difference in using the card at an ATM, as the PIN is used in both EMV chip cards as well as non-EMV magnetic stripe cards, says Venkatesh Srikantan, Head of UAE Retail and Business Banking, Barclays. “However, for POS transactions, the PIN will now be utilised more. The age-old advice still holds true: never keep the card and PIN together, memorise the PIN and do not write it down.”