Dubai: Mohammad Rafiq has spent most of his time in repackaging electronic goods in a narrow lane in downtown Deira since the 1990s. In those days it was mostly electronics and household appliances destined for Russia.

One customer a day was good enough to keep a team busy for a few days. They used to order TV sets, refrigerators and washing machines by the hundreds. Not because they had too much dirty linen, but because they had a lot of hard cash to spend to meet the demand back home and make a killing.

The collapse of the Soviet Union opened the door for many Russians — and for many electronics dealers in Dubai.

Suddenly electronics showrooms mushroomed as did the cargo agencies. One of them was Rafiq’s employer.

Although things have changed a lot since the Russian wave, Rafiq still packs —but the size of the cartons has become smaller. These days, he repacks mobile phones and accessories — mostly destined for East and West African markets. Rafiq’s customers used to stay in unbranded one-star or two-star hotels where lobbies used to be stuffed with cartons.

For years, these hotels served foreign merchants and Dubai’s trade very well. In the 1970s and ‘80s they were hotbeds for small-time South Asian traders until the Russians and East Europeans began to flood the market.

At the beginning of the new millennium they were replaced by traders from East and West Africa and Afghanistan.

Rafiq does not understand global politics. But the change in the traders’ demographics tells him that things have changed in certain parts of the world. His idea of economy changed with the types of goods he packs — from electronics to mobile phones. Also, he measures the hearts of his customers by the amount of tips given to him.

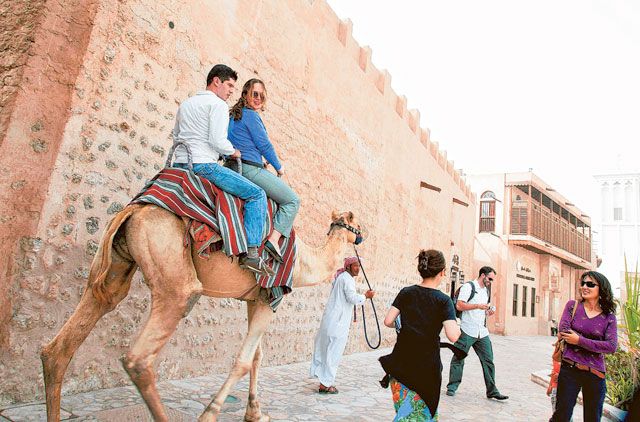

Today some of his Russian customers travel back to Dubai as tourists — with their children and the hefty cash made from the trade — to show the next generation the place that helped them create their fortunes. Today they check into five-star properties. Their shopping lists include the Cartiers, Guccis and Armanis.

For the last four decades, these unbranded downtown hotels helped Dubai’s trade and exports to thrive without getting much attention. Within this period, Dubai has graduated from a trading outpost to a global economic hub.

These hotels, however, still serve a growing number of traders on a bed and breakfast basis. Like the ‘easyhotels’ without the branding.

“These downtown hotels are now suffering from low occupancy, mostly utilised by the African traders who fly in to buy goods — mobile phones and auto spare parts and accessories,” Saifuddin Ahmed, Managing Director of Thakkar Asia Travels and Tours, who has been serving this market for the last two decades as a travel consultant, says.

“Their rates have fallen from Dh350 to Dh150 these days due to lack of demand. Now people are looking at quality. They do not want to stay in a filthy room.”

Meanwhile, on the other side of the metropolis, luxury hotels continued to thrive as tourism, trade and retail sectors remain key to the region’s economic diversity.

Revenues of hotels and hotel apartments in Dubai recorded 22 per cent growth to Dh9.79 billion during the first six months of 2012, compared to the same period in 2011. The number of guests staying in hotels and service apartments increased 10 per cent to 5.02 million during the same period, many of them staying in budget hotels.

Economic vulnerability, oil price volatility and limited employment generation are the key factors driving GCC nations to diversify away from its oil and gas industry. With the depletion of oil reserves and limited gas reserves in countries such as Oman, Bahrain and Dubai, these countries have been shifting their focus from oil to the non-oil sector.

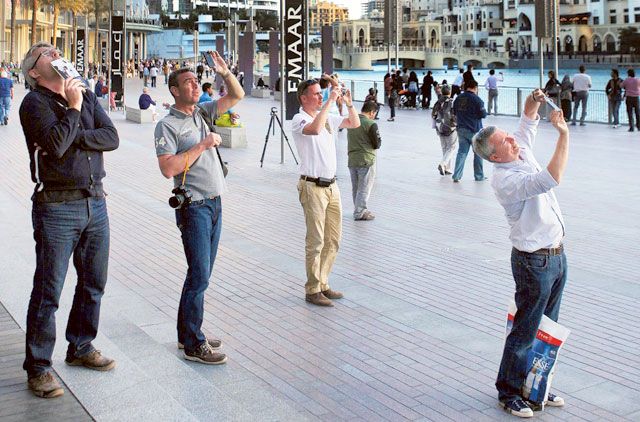

As a part of this shift, the governments of the GCC nations are strengthening their respective tourism sectors and developing the infrastructure to facilitate it. This is not only likely to aid leisure demand for hotels but also business demand as the development of other service sectors is likely to make the business environment attractive for corporate players.

“The evolution of the GCC hospitality industry is a fine example of the efforts of the GCC governments to diversify their economies and reduce their reliance on oil-based revenue,” Rohit Walia Executive Vice Chairman and CEO of Alpen Capital Group, said. “Favourable economic conditions combined with infrastructure development, increased bids to host high- profile global events and government support to the private sector have steadily increased the tourist arrivals and facilitated growth in the hospitality industry.”

The Gulf’s tourism sector now needs to focus more on branded budget hotels to diversify its offering that will help the industry to defy challenges during economic uncertainty.

“Given the economic slowdown, the anticipated budgetary cuts by individuals and businesses and the consequent down-trading, hoteliers are strengthening their budget hotel pipeline to meet demand,” said a latest report by Alpen Capital.

Luxury hotels still dominate the 78,915-strong pipeline of hotel rooms of the GCC‘s hospitality industry whereas only 11 per cent of the room supply in the upcoming hotel pipeline is attributed to budget hotels (three star and two star or less) which provide accommodation at lower prices.

While budget hotels account for about 33 per cent and 24 per cent of total hotel rooms in more developed markets like the US and France, the GCC region lags behind.

Kuwait offers the highest proportion of budget hotels in the region (22 per cent), followed by the UAE (17 per cent) and Saudi Arabia (10 per cent). About 6,800 new budget rooms are expected to come online over 2012–1610.

“Given the growing popularity of GCC countries as a tourist leisure hub and a rise in corporate inflow, budget hotels seem to be a better alternative amid the current global economic crisis. Corporates are under pressure to reduce operating costs due to persistent economic troubles. Therefore, in order to curtail travelling costs, they may seek affordable but comfortable accommodation brands that would not compromise on the quality of service provided,” the report says.

In addition, religious tourists during the Haj and Umrah are likely to seek budget hotels as the continuing crisis has impacted purchasing power.

Tourism receipts in the GCC grew at an average annual rate of 12.3 per cent during the last ten years to reach $72.1 billion (Dh264.60 billion) last year, according to the World Travel and Tourism Council (WTTC). This is 4.9 percentage points higher than the global average annual growth of 7.4 per cent over the same period (2002-2011) to reach $3.96 trillion.

In terms of tourism receipts, the UAE remains the biggest market with $38.3 billion, the WTTC statistics show. However, it terms of international arrivals, Saudi Arabia outnumbers the UAE.

Nearly 44 per cent of all international tourists land in the kingdom – primarily due to religious tourism. UAE receives about 30 per cent of the Gulf’s inbound tourists.