Dubai: In the world of apps, coming in later needn’t be always be a competitive disadvantage. Even when you are going head-to-head with global names that have already won themselves a lot of recognition. Because, being local has its own merits.

While no one is out to recreate a social media network to take on Facebook, it sure is happening within the ride-sharing app space. In China, India and the UAE, there are domestic operators taking on the might of Uber. And winning rides and investors, with Careem late last year raising an additional $350 million (Dh1.28 billion) for a $1 billion valuation.

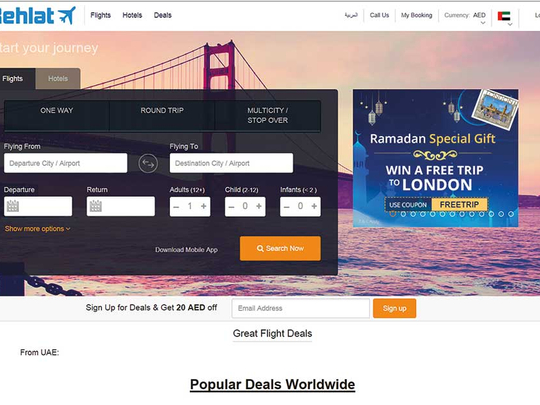

Ride-sharing needn’t be the only domain where there is everything to play for in the Gulf context. The promoters of Rehlat, the travel and flight booking site, sure are hoping so. It launched operations in Kuwait in 2013-14 and since the summer of 2016 has extended the reach to the UAE and Saudi Arabia as well.

Bader Al Bader |

“There are OTA [online travel agency] players like Booking.com and Expedia have an enormous amount of market share at the global level,” said Bader Al Bader, CEO and one of the co-founders. “But here, their share of the overall travel market is still small. That’s why we believe there is still room to grow for OTAs.”

Rather than try and reach out to as wide an audience as possible, Rehlat is targeting raising brand awareness — and usage — within categories. It has found quite some traction with the blue-collar expat base in these markets.

“I was actually surprised that they would be the first takers,” said Al Bader. “More so because this was one user category which did not have a high credit card penetration. But in Kuwait, where we launched, getting on K-Net [a payment gateway for small transactions] helped get those initial booking volumes. We took out placements in Indiansinkuwait.com, a portal popular with one of our key target demographic, and that generated 7,000 visits on the first day itself. When we had enough of a business, that’s when it was decided to widen our options and talk to more IATA-licensed agencies.

“To get the best fares, you need access to an IATA agency and you need to find partners who are reliable. And we never went exclusive with any agency because we didn’t want a situation where it led to very few sales in the initial period.

“And in each market the need is different — Saudi Arabia with its huge numbers of domestic flights, that’s where the action tends to be. For travel to India, low-cost carriers are what we seeing demand for, and in Kuwait, it is with a mix of travellers.”

There is quite a high level of investor interest for digital/online solution providers as more of the region’s young gravitate towards such platforms. The first five months of the year have been rife with such activity. Souq’s deal with Amazon may have garnered much of the headlines, but there have been quite a few standouts, such as the one for JadoPado and the $41 million funding bagged by the delivery services provider Fetchr.

For Rehlat, Al Bader has relied on equity and “support from family and friends”; there are no plans to tap external funding in the near term.

“The immediate priority is to get into as many Mid East markets as possible... Egypt looks a good bet and we will expand slowly,” he added. “In the OTA domain, apart from the global brands, there are a few regional names such as Musafir and Tajawal.

“But there’s still lots of room to grow. We are making month to month profits to an extent. Only if it makes sense will we align with a partner — but they need to be aligned with our thinking.

“One market Rehlat will not enter is south Asia — domestic airline ticket prices in India are so low that there’s little — even no — margin for an OTA. It’s cut-throat and I definitely don’t want to go against someone like Makemytrip, which acquired Ibibo [last year] in a near $2 billion deal.”

“Our best interests are to focus on getting it right in the Mideast. One can read all the business books, but at the end of the day, you need to learn from what is actually happening. You build on that earned intelligence.

“We definitely learnt on the fly — I had no idea on what an ideal business strategy should be.”

In the age of digital disruptions, sometimes that can work to one’s benefit.