The good news is that both UAE markets found support around their uptrend lines, thereby maintaining the overall bullish outlook. In addition, oil looks to have found at least a temporary bottom that should lead to a further bounce following a sharp five-day sell-off. This should help support bullish sentiment in the local markets.

Dubai

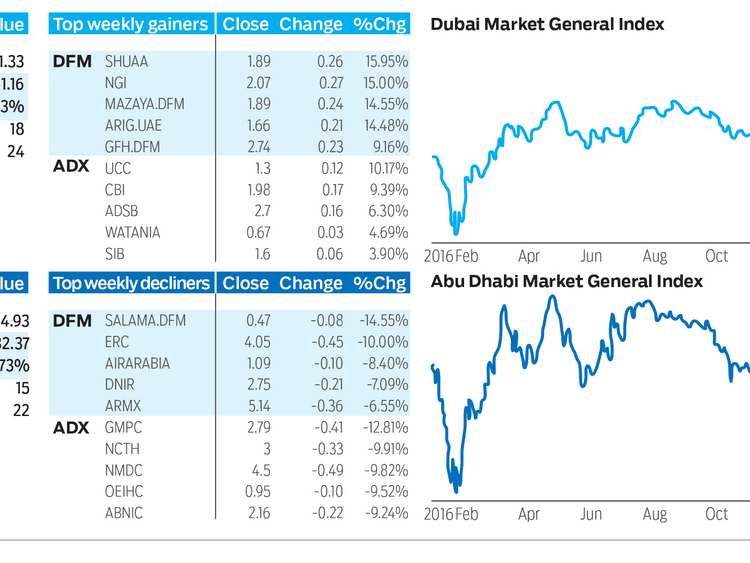

The Dubai Financial Market General Index (DFMGI) was flat last week, rising only 1.16 or 0.03 per cent to close at 3,521.33. There were 18 advancing issues and 24 declining, while volume rose to a three-week high.

Earlier in the week the index dropped to a low of 3,456.92 where it found support. That’s right around the support zone of the long-term uptrend line. Price was rejected at the line leading to a strong rally on Thursday with 16-day high volume. That line represents outside support of the uptrend that began off the January 2016 low. Since price bounced off it with momentum the odds favour an eventual continuation of the uptrend.

At the same time the area around last week’s low has become an important lower price barrier for the uptrend. The support zone was tested and held over five days as selling was consistently met with support from buyers. This is bullish price behaviour and points to higher prices in the coming one to three weeks. Consequently, a decisive drop below that support zone is bearish and starts to put the integrity of the long-term uptrend at risk.

At the low the DFMGI was 7.5 per cent off the 2017 high of 3,738.69 reached in early-February. Although it’s too early to say for sure until we see subsequent price action, it looks like the correction is over. If it is over it would be the smallest correction in terms of percentage decline out of the three larger corrections that have occurred since the index bottomed in January 2016. The two prior corrections were each over 11.0 per cent. Relative positive performance of the current correction is another bullish indication as it shows buyers jumping in more aggressively earlier than they had in previous corrections. This makes sense given the overall improvement in the larger trend following moves above prior highs in December and January.

The week ended just off the high of 3,523.30. A daily close above that high will give the next short-term bullish signal with the index then heading towards the two-week high of 3,583.79. The next potential resistance zone would then be around 3,655/57.

Abu Dhabi

Last week the Abu Dhabi Securities Exchange General Index (ADI) was down 32.37 or 0.73 per cent to end at 4,424.93, the lowest weekly close in fifteen weeks. Market breadth leant on the bearish side with 22 declining issues against 15 advancing, while volume was just slightly higher than the previous week.

Although the ADI ended the week down less than 1.0 per cent it was off 2.3 per cent at the low of the week at 4,355.26. That low put the index 7.6 per cent off the 2017 peak of 4,715.05 hit eight weeks ago.

Support for the week was seen in the area of the long-term uptrend line with the index spiking to a four-day closing high on Thursday. It ended the week just below a price area that was the support level during two previous declines, from 4,439 to 4,436.65, and now faces potential resistance. Once we see a daily close above that zone the potential for a continuation of Thursday’s rally improves.

As we move into the future the uptrend line gains importance as a potential support zone for the uptrend. Future approaches should see signs of support in the area of the line. At the same time a decisive decline below that line will signal an increase in bearish sentiment by market participants.

Last week it was noted that on the way down the ADI had a gap between the daily closing price and next day’s opening price two weeks ago. Such gaps generally fill. This means that the opening of the gap of 4,589.06 can be watched as a potential target. Subsequently, a daily close above the recent swing high of 4,668.77 improves the potential for the index to exceed the 2017 high of 4,715.05.

Stocks to watch

Deyaar Properties closed up 2.29 per cent last week to 0.58. The stock has been hovering around support of 0.56 for the past week or so and may be about to complete the second bottom of a potential double bottom trend reversal pattern. The first bottom occurred at 0.556 four weeks ago. That put the stock 18.7 per cent off its most recent peak of 0.684 reached in January.

The double bottom will not trigger until there is a decisive rally above 0.61. More aggressive entries can be found earlier and thereby provide tighter risk management as a drop below the 0.556 will be bearish and negate the potential bullish double bottom pattern.

Near-term strength is next indicated on a move above the six-day high of 0.58, and confirmed on a daily close above that price level. The next target would then be around 0.61, followed by the five-week at 0.62. Based on a breakout of the double bottom Deyaar has the potential to reach at least 0.655, if not higher.

Bruce Powers, CMT, is chief technical analyst at www.MarketsToday.net. He is based in Dubai.