Dubai

UAE indices bounced back on Tuesday as traders hunted for bargains after the recent fall, even as Gulf Finance House outperformed.

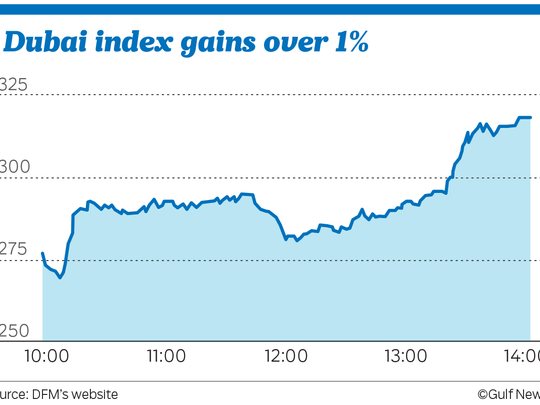

The Dubai Financial Market General Index closed 1.39 per cent higher at 3,317.97,

“Local markets had seen a reasonable correction in last couple of weeks, leading to attractive value in some of the blue chips,” said Vijay Harpalani, fund manager at Al Mal Capital.

Dubai Islamic Bank (DIB) and Emaar Properties helped prop up the market. DIB closed 1.90 per cent higher at Dh5.35, while Emaar Properties closed 0.93 per cent higher at Dh6.50.

Among other stocks, Ajman Bank closed 1.35 per cent higher at Dh1.50, while Dubai Entertainments closed more than a per cent higher at Dh1.51. Out of a total of 34 stocks traded on the exchange, shares of 26 firms rose, while other four fell. The rest remained steady.

Outperformer

Gulf Finance House has outperformed compared to the index.GFH has gained 22 per cent in last couple of weeks compared to nearly 9 per cent fall on DFM.

“We expect the stock to hold strong over the immediate support zone at Dh1.01 and any recovery on the market shall trigger further buying and target previous high at Dh1.13-1.22 in the short term,” Shiv Prakash, senior analyst with National Bank of Abu Dhabi Securities in a note.

Traders will be looking at quarterly results after Emirates NBD missed the analysts expectations.

“The results announced so far have been quite satisfactory in otherwise a challenging backdrop. We expect third quarter corporate earnings seasons to mixed, with some disappointments,” Harpalani said.

The Abu Dhabi Securities Exchange General Index closed 1.16 per cent higher at 4,269.34. Aldar Properties closed 0.07 per cent higher at Dh2.64, while First Gulf Bank closed 3.77 per cent higher at Dh11. Eshraq Properties closed almost flat at Dh0.77. Out of a total of 28 stocks, shares of 11 firms rose, while other 10 fell. The rest remained steady.

In Saudi Arabia, the Tadawul index closed 1.86 per cent lower at 5,460.94 because of weak earnings.

“The third quarter corporate earnings announcements in KSA have been quite subdued so far, confirming difficult economic conditions. Analysts’ estimates still have to be revised down to reflect new economic reality, in which case, valuations may not appear that attractive. In the short-term, there is uncertainty over policy which clouds visibility over earnings outlook,” said Harpalani.

Elsewhere in the Gulf, the Qatar exchange index closed 0.56 per cent higher at 10,484.09. Muscat Securities MSM 30 index closed 0.16 per cent lower at 5,651.07.