Dubai

Speculative trading was at its peak on the first day of trading after Arabtec’s rights issue, as traders chose to ignore fundamentals, analysts said.

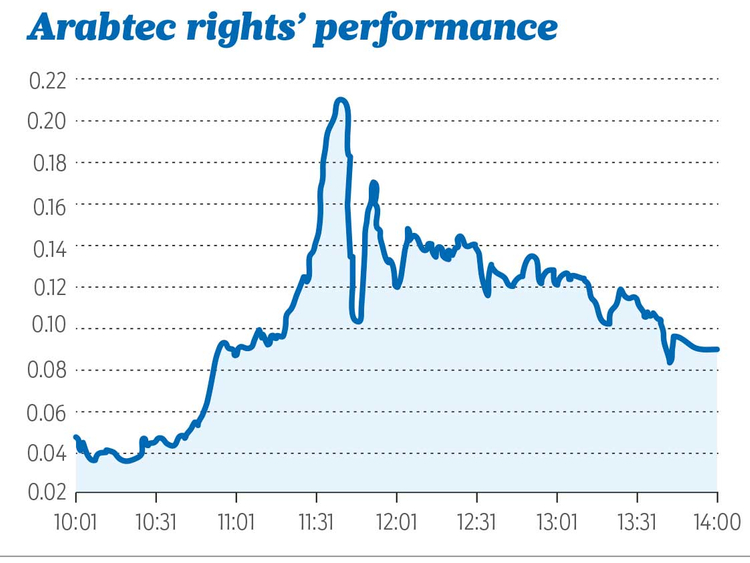

In the first 40 minutes of trade, Arabtec’s new rights traded between Dh0.03-Dh0.05, and then gained momentum to see a one-way rally to Dh0.215, up 2,050 per cent, with 600 million rights changing hands.

“This was unjustified activity and not value trading. There is no reason for the rights issue to be trading at a positive value and for sure no reason to reach 20 fils,” Marwan Shurrab, head of high net worth and retail equity brokerage, Al Ramz told Gulf News.

Rights price was set at Dh1 and the premium was placed at Dh0.090 at close, on a day when Arabtec share price closed lower at Dh0.762.

About 1.1 billion rights changed hands at close, contributing to 78 per cent of the total traded volume of 1.4 billion shares in Dubai market.

Low risk, high returns

“Most traders opted to buy with the intention to trade and not to subscribe, as the current price of the underlying stock is 24 per cent lower than the rights offer price of Dh1,” said Shiv Prakash, senior analyst with National Bank of Abu Dhabi Securities said in a note.

NBADS advised to buy at open from Dh0.01-0.05, on expectation of a lower risk and higher reward ratio, “as on the losing side they will lose only the premium which is 1 fil or at what price they buy.”

Trading activity may persist for another session, however sellers may emerge from third session onwards. Trading in Arabtec rights will end on May 21.

Arabtec will issue rights of Dh1.5 billion to shareholders with Abbar Investments ready to subscribe to rights, as part of the restructuring plan to bail out the loss-making firm.