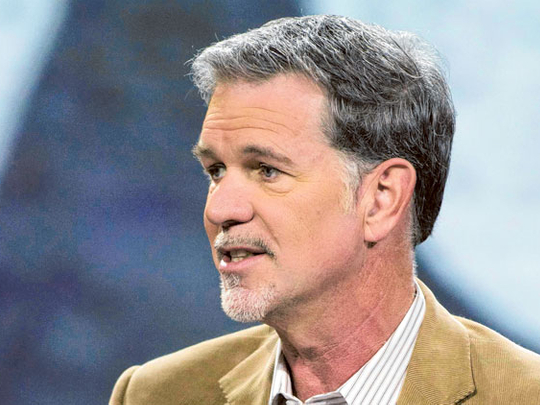

New York: Netflix is facing scrutiny from government regulators for a Facebook post by its CEO in July that may have boosted the online video company’s stock price.

Neflix said on Thursday that the Securities and Exchange Commission informed it that its staff is recommending civil action be brought against the company and CEO Reed Hastings. The reason: Hastings’ July 3 post in which he said Netflix’s online video viewing “exceeded 1 billion hours for the first time ever in June”.

The SEC says posting on Facebook doesn’t amount to fair public disclosure of information that is material to investors.

Shares in Netflix rose more than 6 per cent on the day of Hastings’ Facebook post. On the first day of trading following the July 4 holiday, its shares rose another 13 per cent.

Hastings used Facebook again Thursday to comment on the investigation, which he called a “fascinating social media story”. He argued that the information was not material to the stock price, had been disclosed and reported on earlier and that because he had 200,000 followers at the time, it was widely disseminated.

Hastings has been on the board of directors of Facebook since June 2011 and as of November 14 owned 72,639 Facebook shares.

“We think posting to over 200,000 people is very public, especially because many of my subscribers are reporters and bloggers,” he said in his post on Thursday.

The SEC says Hastings’ July post contained material investor information that must be disclosed in a regulatory filing or news release.

But Hastings said similar information was disclosed on the company blog in June.

On June 4, the blog states that Netflix’s online customers were “enjoying nearly a billion hours per month” of streaming video. That announcement also was not put in a press release or an SEC filing.

It’s not the first time a CEO from an Internet company has run into trouble with securities authorities for promoting their company through digital means.

In August 2011, Groupon Inc. CEO Andrew Mason got in hot water for sending a long email to thousands of employees explaining “why I’m so excited” about the company’s then-upcoming initial public offering of stock, including a discussion of the company’s use of controversial financial metrics.

Mason’s email went out after the company had already filed IPO papers with the SEC, after which executives are not allowed to further promote the stock to investors. That episode was resolved and Groupon stock began trading publicly on November 4, 2011.

Netflix shares rose $2.80, or 3.4 per cent, to $86.17 on Thursday, a day after the company announced a multi-year licensing deal with Disney. The stock fell $1.06, or 1.2 per cent, to $85.11 in after-hours trading.