Big investors are looking further afield to plough cash into Indian stocks, believing that growth momentum is set to accelerate in a few months as falling interest rates and rising consumer spending deliver a strong boost to manufacturing activity.

India’s $2 trillion economy, the third-largest in Asia after China and Japan, is expanding at around 7.5 per cent a year. New policy initiatives underway such as opening the door wider to foreign investment and changes to tax administration should pave the way to more than 8 per cent annual growth.

In a world that is either stagnating or nudging ahead at a snail’s pace, India could emerge as the engine to drive growth elsewhere, much like China over the past decade or so. The benefit of a massive domestic market, where the middle class is expanding at a rapid rate, could provide the launch pad for companies to reap the dividend.

New Delhi is pushing hard to roll out next April a Goods and Services Tax (GST), which would do away with a plethora of state and municipal levies with a uniform tax across the country. Talked for years the GST is finally reaching fruition, and fund managers are excited at the prospect.

“There will be an incredible increase in earnings for many companies …. as much as 20 per cent in some cases,” investment guru Mark Mobius told ET Now television channel. With GST in place there will be a bigger market for companies, he said, and it would lead to consolidation and the emergence of larger conglomerates with the strength to expand and compete internationally.

“It is very important to emphasise that the consumer market in India is enormous but it is now divided. It is segmented. With the GST, you will see a combining of these forces so that you then have the rise of really huge consumer product companies, consumer service companies, etc. It can be very exciting.”

“In the next three or four years, you can see 20-30-40 per cent increase in earnings with the proper GST implementation,” said Möbius, who is executive chairman of Templeton Emerging Markets Group.

Banks upbeat

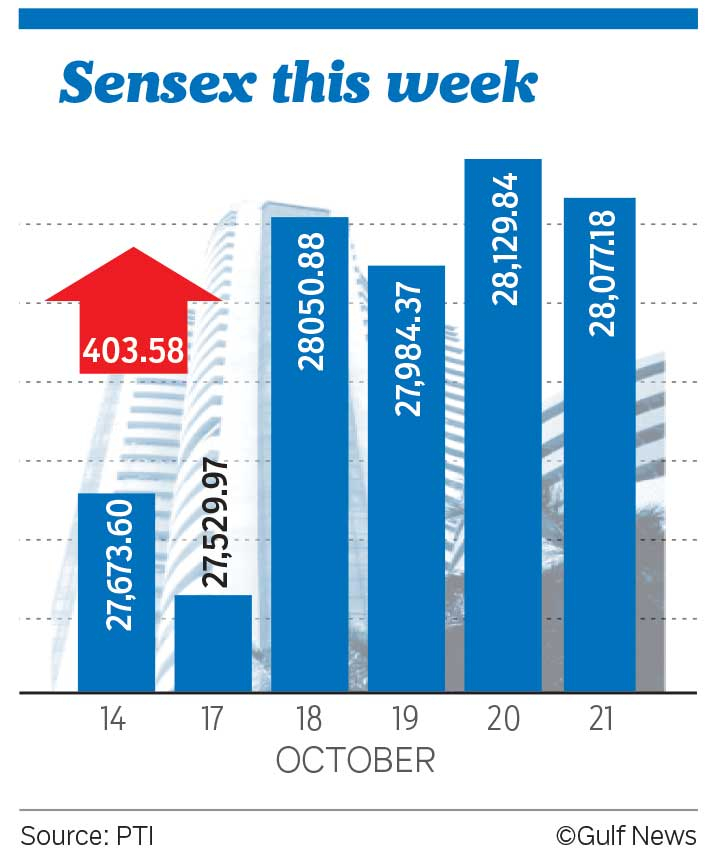

Both the benchmark stock indices posted their biggest weekly gains in seven weeks, riding the crest of confidence revival. While the top-30 Sensex climbed 1.5 per cent to 28,077.18, the broader 50-share Nifty rose 1.3 per cent to 8,693.05.

Bank stocks led the rally after debt-laded Essar Global struck a deal to sell its refinery arm and related facilities to a group of investors including Rosneft PJSC at a $13 billion enterprise value. Essar, owned by the billionaire Ruia brothers, said in a statement that it intends to reduce debt at both the holding company and its operating companies.

Standard Chartered would be one of the biggest winners from the deal, Citigroup said in a research note. The bank, which has a big exposure in India, is likely to receive $2.1 billion in loan repayment.

ICICI Bank and Axis Bank are among the domestic lenders to Essar and they should receive some repayment of sticky loans.

Like the Ruia brothers whose $18 billion investment in steel-to-energy before the commodity prices slumped caused a debt pile up, several other Indian companies are grappling with similar problems. Banks have been under pressure because of sharp increases in provisioning for bad debts. The government is also tightening the screw on defaulters.

The bank index rallied 4 per cent over the week.

Noting fundamental improvements such as New Delhi’s efforts to reduce risks to the nation’s credit rating and support industries like steel and renewable energy, Morgan Stanley is betting big on India.

“There has been a re-rating from a very weak story to one of the better stories across emerging markets,” Warren Mar, New York-based head of emerging-market credit strategy, told Bloomberg.

“In Asia ex-Japan, the place where we have done well is India, Indonesia, in that order, and to a lesser extent China. It’s a reflection of our positioning and our conviction trades.”

Telecoms weigh on Reliance

Energy conglomerate Reliance Industries Ltd reported a September quarter profit of Rs72.06 billion, in line with market expectations, and up from Rs50.35 billion on a like-to-like basis from the year ago period, helped by strong gross refining margins of $10.1 per barrel, well ahead of the regional Singapore benchmark.

Revenue rose 9.6 per cent from a year earlier to Rs816.51 billion.

Reliance, which controls the world’s largest refining complex at Jamnagar in Gujarat, can handle high sulphur content but cheap crude oil to reap higher margins. An upgrade underway is expected to further boost margins by $2 to $3 per barrel.

The company, helmed by India’s richest man, Mukesh Ambani, gets 95 per cent of its profit from oil refining and petrochemicals, but has been investing aggressively to expand in retail, telecoms and e-commerce. It has spent more than $20 billion on a nationwide telecom network, and in September launched commercial operations of its Jio 4G mobile services.

Offering telecoms free until the end of December, Reliance Jio Infocomm has won 16 million customers in the first month. The launch, however, has triggered a price war among rivals. Jio is adding about half a million subscribers a day, Anshuman Thakur, head of strategy, told reporters.

Concerns that the telecoms investment would be a drag on earnings for some years weighed on the company’s shares, which fell 2.2 per cent on Friday after the results to Rs1,064.40. Reliance Jio spent Rs137 billion to buy airwaves in the latest round of auctions this month.

ACC disappoints

Cement maker ACC stunned investors by reporting a 28.1 per cent fall in quarterly profit to Rs841 million, sharply lower than Rs1.9 billion expected by analysts. Poor operating performance and high interest costs squeezed earnings. Revenue dropped seven per cent to Rs24.71 billion. Its shares shed 4.8 per cent over the week.

The company said it expects to commission remaining part of an integrated project at Jamul in Chhattisgarh state, and was upbeat about prospects.

“We expect our volumes to pick up as the newly commissioned units stabilise, especially in the fast growing eastern regions. On the overall demand side, we maintain an optimistic outlook for the economy in the coming months,” it said in a statement.

Wipro cautious

After the market closed on Friday Wipro Ltd, the country’s third-largest software services company, posted a 7.6 per cent drop in quarterly profits, weighed down by higher employee costs. And, like its bigger rivals Infosys Ltd and Tata Consultancy Services, the company faces headwinds due to difficult world economy.

“As we look forward, the demand environment is mixed in a seasonally weak quarter affected by furloughs and lower number of working days,” Chief Financial Officer Jatin Dalal said about the outlook for the December quarter.

The author is a journalist based in India.