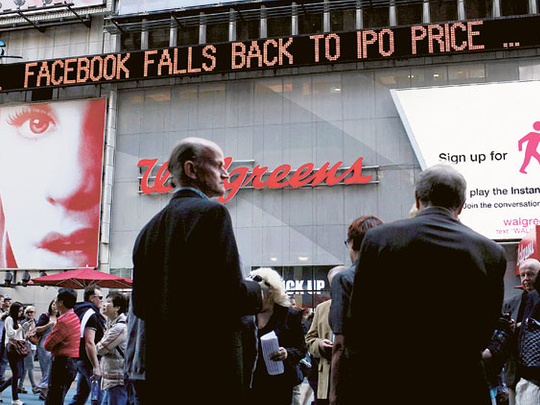

New York : Facebook's initial public offering, plagued by trading errors and a 16 per cent drop in the share price, will push more individual investors out of a stock market they already distrust after the financial crisis.

"This is clearly the latest in a long string of events that is eviscerating the confidence investors have in the market," said Andrew Stoltmann, a Chicago lawyer who represents retail investors. "The perception is Wall Street jiggered this IPO so the underwriters made money, Facebook executives made money and the small investor got left holding the bag."

Individual buyers' willingness to venture into stocks was undercut by difficulties in executing trades on the first day of trading on May 18, Facebook's subsequent decline and questions over whether the firm and underwriters selectively disclosed material, non-public information.

"If you have a lot of angry people out there, they're going to express their anger in different ways," said Steve Sosnick, equity risk manager for Timber Hill, the market-making unit of Greenwich, Connecticut-based Interactive Brokers Group. "One of them may be with their feet."

The IPO produced the worst five-day return among the largest US deals of the past decade. The 13 per cent decline through May 24 exceeded the ten per cent drop by MF Global Holdings in its first five sessions. Visa did best among the biggest deals, rising 45 per cent. Some retail investors still haven't moved off the sidelines after pulling out of the market during the 2008-09 financial crisis. The Standard & Poor's 500 Index has made no progress in more than a decade, currently trading at levels first seen in 1999 following two bear markets that wiped out about 50 per cent from the index. The May 6, 2010, rout known as the flash crash erased $862 billion (Dh3,166 billion) in less than 20 minutes, undermining confidence in the structure of equity markets.

Investors have withdrawn money from mutual funds that invest in US stocks for five straight years as of December, according to the Investment Company Institute, a Washington-based trade group. US households held about $8.1 trillion in corporate equities at the end of 2011, about 16 per cent less than the $9.6 trillion they held in 2007, according to Federal Reserve data released in March.

‘Icing on cake'

Increased volatility, high correlation among stocks and the flash crash are among a "whole basket-load of things" that have caused retail investors to be sceptical for several years, said Ron Sloan, who oversees about $11 billion as chief investment officer of the US core equity team for fund manager Invesco. "This is just the icing on the cake."

Patricia Arroyo, 53, a psychologist and executive coach in Boston who manages her own investments, said: "What shakes my investor confidence more than the glitches is to see all the institutional investors, insiders and favoured clients get all the advantages in these situations."

After Facebook said on May 9 growth in advertising had failed to keep up with user gains, analysts at some banks underwriting the deal cut their earnings estimates, said people familiar with the process. The new estimates were relayed to institutional investors.

Arroyo had avoided Facebook and instead purchased about 50 shares of social-gaming company Zynga, speculating that a pop in Facebook's price would benefit the stock of the San Francisco-based company. Trading of Zynga was halted twice because of volatility on the day Facebook started trading. Zynga's stock fell 20 per cent in the past week.

Federal securities regulators and the US Senate's banking committee have said they will or may review the Facebook offering. Buyers of the stock have sued Facebook, the sale's underwriters and Nasdaq OMX Group, the exchange handling the listing. New York-based Nasdaq was overwhelmed by order cancellations and trade confirmations were delayed on the first day of trading.

Brokerages whose customers had trouble executing Facebook trades, including Fidelity Investments and Charles Schwab, said they are trying to resolve complaints.

"Fidelity senior management has been working with regulators, market makers and Nasdaq to represent all of our customers' trading issues from May 18 and we will continue to do so in order to persuade Nasdaq to mitigate the impact on our customers," Stephen Austin, a spokesman at Fidelity, said in a phone interview. Schwab also is continuing to address any concerns that remain for its customers, Michael Cianfrocca, a spokesman for the San Francisco-based brokerage, said in an email.

The Facebook fallout has eroded hopes the debut would revive the appetite for stocks among individuals. Trading in Facebook accounted for about 20 per cent to 30 per cent of revenue-generating trades at online brokers on May 18, Richard Repetto, an analyst at Sandler O'Neill & Partners in New York, said in an emailed report on May 23.

Despite trading problems and losses, many investors who have already purchased the stock are continuing to hold on, said John Dominic, vice-president of trading for Trade-King, an online broker in Florida.

Brokers lose out

Retail investors weren't the only ones who lost money as Facebook shares declined last week. Knight Capital Group estimated that it lost about $30 million (Dh110 million) to $35 million trading Facebook because of technical problems at Nasdaq, the firm said in a filing with the US Securities and Exchange Commission on May 23. The brokerage and market maker is based in Jersey City, New Jersey.

Citadel Securities, the Chicago-based broker run by hedge-fund manager Ken Griffin, lost as much as $35 million, according to a person with knowledge of the firm.

—