Dubai:

Emaar Properties recovered from its key support level on Tuesday, even as traders awaited for its listing of the development unit on Wednesday.

Emaar Properties hit a low of Dh7.42, the lowest since June 8, before closing 1.04 per cent lower at Dh7.60.

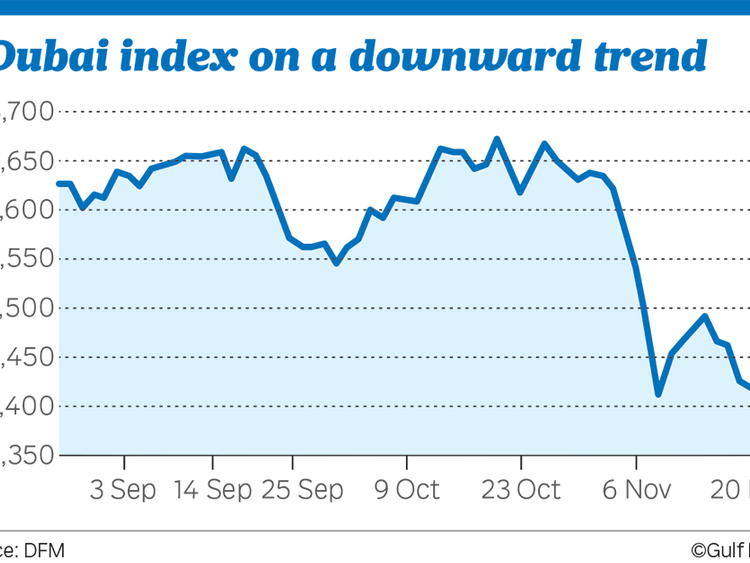

“We expect the stock to take support at Dh7.45 level with trend reversal at Dh7.75,” said Shiv Prakash, senior analyst with National Bank of Abu Dhabi Securities. The Dubai Financial Market General Index closed 0.17 per cent lower at 3,410.99.

Despite weakness in the Dubai index, Gulf Finance House stood firm, ending in the positive territory. Gulf Finance House closed 0.61 per cent lower at Dh1.65. DP World closed more than 2 per cent higher at $24.50.

Dubai Islamic Bank closed 0.33 per cent higher at Dh6.04.

The Abu Dhabi Securities Exchange general index was supported by news of the primary offer of Adnoc unit. The Abu Dhabi Securities Exchange general index closed 0.5 per cent higher at 4,310.19.

Abu Dhabi Commercial Bank closed 0.15 per cent higher at Dh7.23. Etisalat closed 0.2 per cent higher at Dh16.3. Elsewhere in the Gulf, Saudi Arabia’s Tadawul index closed 0.38 per cent lower at 6,778.32. Transportation and energy firms were the worst hit in trade.

The Qatar exchange index closed 0.98 per cent lower at 7,731.44. The Muscat MSM 30 index closed 0.16 per cent lower at 5,076.92. The Kuwait Stock Exchange index closed 0.41 per cent lower at 6,231.97.

Expect massive volatility in Emaar Development shares

Amid falling Dubai index speculative traders will shift their focus on Emaar Development, which list their shares on Wednesday. There will be a bout of volatility from traders who were allotted the shares, because of the absence of circuit filters, according to analysts.

“We are hopeful Emaar Development would open to a positive response from investors. The guaranteed dividend yield for 3 years, of more than 8 per cent will see many yield chasing buyers,” said Vrajesh Bhandari, portfolio manager at Al Mal Capital.

Shareholders of Emaar Properties, whose share price is expected to follow the movement in the unit, will get a one time special dividend in January, while shareholders of Emaar Development will get dividends worth billions of Dirhams for the next three years.

“We have seen very good allocations for our funds and clients. We intend to be long term shareholders in the company given our belief in the fundamentals of the Dubai economy,” Bhandari said.

Meanwhile to attract more traders, brokers like Al Safwa Mubasher are offering 40 per cent cash back on traders commission.