Mumbai India’s worst-performing stocks look like good value to the asset manager spun off from the country’s oldest mutual-fund company.

Health care and technology are the only sectors in the red this year in India, where the wider market has soared to new highs. Lupin Ltd and Dr Reddy’s Laboratories Ltd are the biggest losers on the S&P BSE Sensex, down more than 30 per cent each.

India’s drugmakers are facing lower prices for generic drugs in the US — their biggest market — and more scrutiny from the regulator there. The US is also the most important region in terms of sales for the local technology industry and the main source of concern. Donald Trump’s plan to tighten working-visa regulations threatens the bottom line of the likes of Infosys Ltd, which has also been buffeted by a boardroom battle.

“Pharma at the current valuations seem to be pricing in the current problems,” said Swati Kulkarni, a fund manager at the $20 billion (Dh73.64 billion) UTI Asset Management Co, which was spun out of Unit Trust of India in 2003 as part of a government bailout. “If you look at the balance sheet of these IT companies, they are cash rich and offer higher return on capital.”

Kulkarni, who oversees about $1.5 billion in assets, is overweight both sectors and investing in drug companies targeting chronic diseases, she said in an interview this month. As far as the software companies go, Infosys is the largest holding at her UTI Dividend Yield Fund and the second biggest at the UTI Mastershare. Both funds have climbed about 19 per cent so far this year, matching gains in the Sensex, data compiled by Bloomberg show.

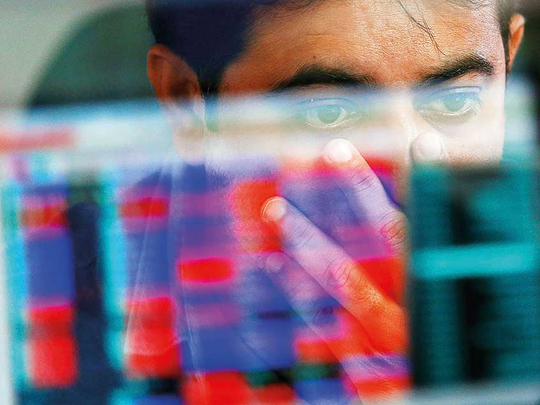

The Sensex is being driven by an influx of cash from retail investors. They are flocking to the stock market as regulatory changes, including Prime Minister Narendra Modi’s surprise cash ban last year, dent returns from real estate and gold, the traditional favourites.

Kulkarni, a 24-year industry veteran, said her funds are only doing as well as the benchmark index this year because of her focus on blue chips, which are lagging behind stocks in smaller firms. The S&P BSE MidCap Index, for instance, has rallied 28 per cent since January 1. The Mastershare fund’s strategy calls for at least 80 per cent of large-cap holdings, she said.

“We might lose the opportunities” offered by mid caps, Kulkarni said. “But, we have to be style pure and transparent and can’t be tempted by current momentum.”

Her disciplined investment approach and focus on capital-efficient companies with large cash flows was noted by Morningstar Investment Adviser India Pvt in a March report on women in the local money-management business.

Kulkarni is one of only 18 women fund managers in India, or 7 per cent of the industry, the report said. At least 20 per cent of managers in markets including Hong Kong, Singapore, France, Spain and Israel, are women. The picture in India may soon change, Kulkarni said.

“I see a lot more women now joining the industry and also managing funds,” she said.