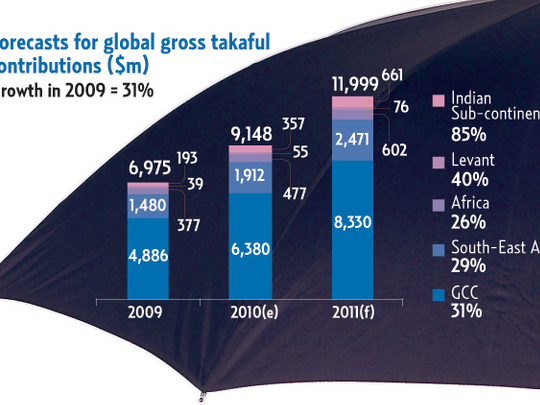

Dubai: Global Takaful (Islamic insurance) contributions are expected to grow 31 per cent this year to $12 billion (Dh44 billion) this year compared to $9.15 billion in 2010, according to an Ernst & Young's World Takaful Report 2011: Transforming Operating Performance, unveiled at the sixth Annual World Takaful Conference 2011 yesterday.

"The takaful industry and its core markets have experienced another challenging year, where positive signs of economic recovery and improved business sentiment were shaken by the socio-political uncertainty witnessed across the Middle East and North Africa [Mena] region in the first quarter of 2011," said Ashar Nazim, Executive Director and Islamic Financial Services Leader, Ernst & Young.

The takaful industry is concentrated mainly in the Mena and Southeast Asia regions, with Saudi Arabia (contributions totalling $3.86 billion in 2009), Malaysia with $1.15 billion and the UAE ($640 million) being the top takaful markets.

Performance

Most GCC markets have experienced a slowdown in takaful growth with only the Saudi takaful market remaining strong due to the continued rollout of compulsory medical insurance.

Sudan, with contributions of $340 million, is the most significant market outside these regions. In addition, Egypt, Bangladesh and Pakistan are growing at a rapid pace.

"The industry is not without risks, but its potential remains an important feature of Muslim emerging markets for many indigenous and global insurance players," Nazim said.

In terms of regions, takaful contributions in the Indian subcontinent grew by 85 per cent, making it the world's fastest growing takaful market. It was followed by the Levant (40 per cent), GCC (31 per cent), Southeast Asia (29 per cent) and Africa (26 per cent ).

"The Mena takaful market is much younger than the Malaysian market and, therefore, has not yet achieved the same level of scale. This affects the operating performance of the takaful players. Within the Mena region, the GCC is a more competitive market with a larger number of players and will drive growth for the industry. Key takaful markets are characterised by low insurance penetration rates and comparatively high rates of economic growth, leading to a positive outlook for the sector as a whole," Nazim said.

In terms of individual countries, Indonesia topped the takaful market with a growth rate of 67 per cent, followed by Bangladesh (58 per cent) and Saudi Arabia (34 per cent).

Lower return

The takful industry in general is facing a lower return on equity (RoE) due to intensified competition that small local firms face from established conventional players. In the GCC, average RoE of conventional insurers was 11 per cent while the takaful sector posted 10 per cent in 2010.

In Malaysia, the average RoE was 16 per cent for conventional insurers and 6 per cent for takaful operators.

Malaysia boasts significantly lower claims ratios than the GCC, largely due to the difference in dominant business lines.

The GCC is dominated by general takaful whereas in Malaysia it is mostly family takaful.

Most industry CEOs interviewed by Ernst & Young agreed that it is no longer business as usual. More than 70 per cent of respondents identified competition as a key risk going forward.

Overall, the Ernst & Young report observes that family takaful market remains underpenetrated and is estimated to contribute only 5 per cent of gross contributions in the Mena region. By comparison, conventional life in 2009 contributed 58 per cent of gross global insurance premiums.

Family takaful in Malaysia is highly penetrated and is estimated to contribute 77 per cent of net takaful contributions in 2010.