Easing liquidity conditions to reduce funding costs of Saudi banks

External sovereign debt issuances expected to boost banking sector liquidity

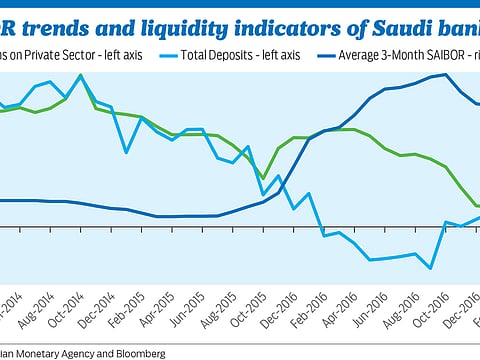

Dubai: The consistent decline in Saudi Interbank offered rate (SAIBOR) is expected to bring down the overall funding costs of Saudi banks and improve their profitability in the future according to banking sector analysts,

Last week, the three-month Saudi Interbank Offered Rate (SAIBOR) fell below the central bank repo rate of 2 per cent its lowest level since April 2016.

“This is credit positive for Saudi banks’ funding costs and confirms that liquidity conditions in Saudi Arabia have eased since the third quarter of 2016 after significant tightening last year because of falling oil prices. We expect liquidity pressures to moderate in 2017 compared with 2016, primarily as a result of subdued credit growth, which will, however, reduce banks’ profits,” said Jonathan Parrod, an analyst at Moody’s.

In October 2016, the SAIBOR reached its highest level since January 2009 at 2.4 per cent, reflecting tougher funding conditions for banks because of Saudi government spending cuts and payment delays, which in turn put pressure on corporate cash flows and profits. This translated into a 2 per cent year-on-year decline in customer deposits as of September 2016, which, combined with sustained credit growth of a 7 per cent year-on-year increase as of September 2016, pushed up banks’ net loan/deposit ratio to 86 per cent as of September 2016 from 77 per cent at year-end 2014.

However, this trend has reversed since the third quarter of 2016 with large liquidity injections into banks following a $17.5 billion international sovereign bond issuance in October 2016 and the payment of $28 billion of overdue bills to Saudi contractors settled in the fourth quarter of 2016, which led to significant loan repayments to banks.

Saudi Arabia’s government debt rose sharply in 2016, although remaining low by international standards. Preliminary budget data indicates that government debt rose to SAR316.5 billion in 2016, equivalent to 13.2 per cent of GDP.

Saudi Arabian government started borrowing internationally for the first time in 2016. The issuance of international debt would be a seminal departure for Saudi Arabia, which has thus far only issued domestic sovereign debt. Saudi Arabia raised a $10 billion syndicated loan in May 2016 and $17.5 billion through a sovereign bond issued in October 2016.

Saudi Arabia’s sovereign bond was particularly vital in improving liquidity in the banking system, with domestic funding sources stretched. Meanwhile, domestic debt in 2016 stood at SAR213.4 billion ($56.9 billion).

According to the Saudi Arabian Monetary Agency (SAMA), banks’ liquidity conditions improved in the last months of 2016. In the last quarter of 2016, the M3 indicator for money supply increased 2 per cent quarter on quarter, after relatively flat to negative growth since the second quarter of 2015.

Customer deposits grew by around 2 per cent quarter on quarter, fuelled by a 4 per cent rise in deposits from the private sector and reversing a declining trend since the start of 2016. At the same time, loan volumes contracted by 3 per cent in the second half of 2016 after the government resumed settling its bills, which allowed contractors to repay banks loans. The loan repayments to banks were partly reflected in SAMA’s balance sheet as a reduction in government deposits allocated for public projects.

These combined effects led to an improvement in banks’ net loan/deposit ratio to 83 per cent as of December 2016 from a peak of 87 per cent as of June 2016. “Although we expect liquidity pressures to remain moderate over the next 12-18 months against the backdrop of low credit growth, which we expect at around 3 per cent, deposit growth will remain challenging. Corporate profits and savings will remain constrained by subdued economic conditions, with our estimate for non-oil GDP growth at 2 per cent in 2017,” said Olivier Panis, vice president — senior credit officer at Moody’s,

Analysts expect government to increase external fund raising. The government needs to fund its fiscal deficit either through its reserves and deposits with banks, or via debt issuance. However, because domestic debt issuance can crowd out bank liquidity government is likely to opt for more external debt in the funding mix.

“We expect the government to raise external debt again in 2017 to help reduce the pressure on domestic funding sources and help ease banking sector liquidity conditions,” said Shailesh Jha, an Economist at ADCB.

Analysts expect foreign demand for Saudi Arabia’s debt will be supported by the SAR’s peg to the dollar and the dollar strength.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox