Abu Dhabi: The UAE Central Bank announced on Sunday the approval of a new set of regulations with regard to bank loans and other services offered by the banks enabling individual customers to borrow up to 20 times their salary or monthly income.

"The value of the loan is tied-up to the borrower's income. The repayment period is set at 48 months, which is sufficient for repayment," the Central Bank said, adding the new regulations cover car loans, overdraft facilities and credit cards and require the banks to disclose the interest rates they charge on loans and facilities.

Specific source

As well, the new regulations require that repayment installments should not exceed 50 per cent of the borrower's gross salary or any regular income from a specific source.

"The new regulations will be published in the official gazette and one month later, they will be effective," Central Bank Governor Sultan Nasser Al Suwaidi told reporters at a news conference.

"Terms and conditions of availing different types of loans will be approved by Emirates Banks Association," he added. As a result of the global financial crisis, in a bid to compensate themselves for the loss in revenue, UAE banks had increased their service fees and introduced new fees that were not there two years earlier, Al Suwaidi said.

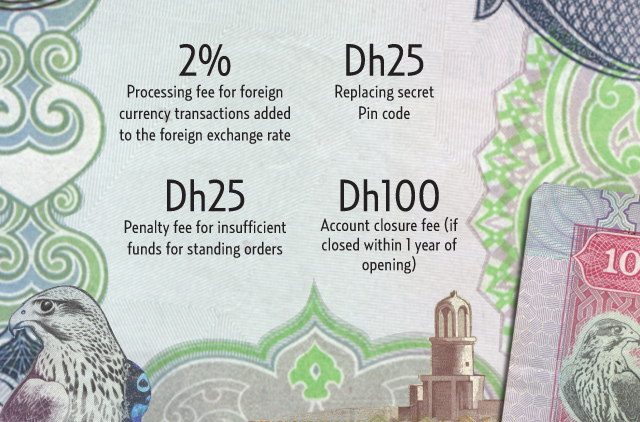

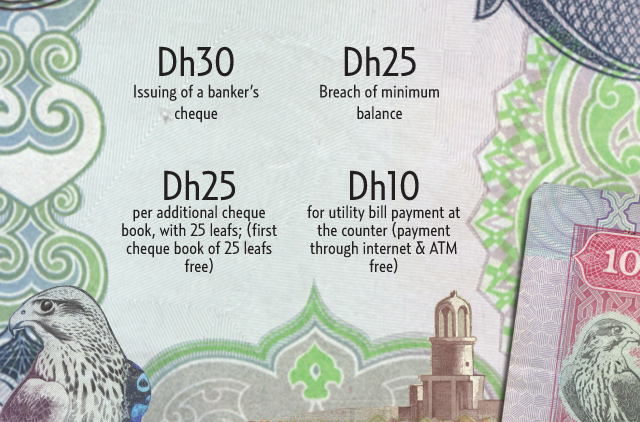

He said that under the new regulations, the maximum amount banks can charge individual customers for services have been reduced to a reasonable level.

"These are slightly above some countries in the region, but not as large as the banks want," said Al Suwaidi.

Asked if the decrease in bank fees would result in the banks raising interest rates on personal loans or other products, Al Suwaidi said: "There is an article in the new regulation which prohibits banks from increasing the interest rate on loans because the customer charges are getting lower."