Dubai

While cement and steel prices have remained stable, those on a host of other building materials saw 60-70 per cent price increases stemming from higher shipping costs in the last six months. This has been inflating local construction costs and if it continues could prove too high a burden for an industry still on the recovery track, sources said.

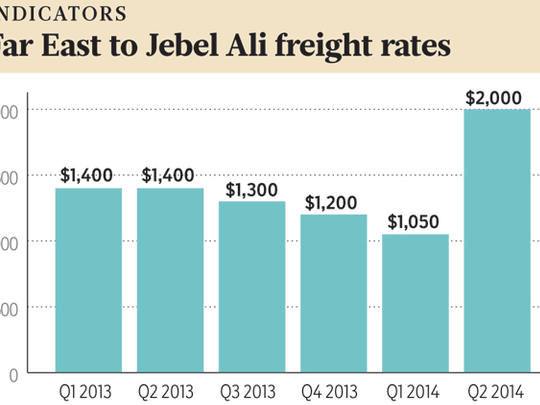

“Anything building material commodity — wood panels, sanitary ware, electrical and interior fitouts — that’s being shipped in from the Far East is bearing the price hike,” said Rizwan Sajan, chairman of Danube Group. “So, a 40-foot container from China now costs $1,800 against $1,000 in January. This has got nothing to do with production constraints at Chinese manufacturers and all to do with the arbitrary hikes by shipping companies.

“There’s no way the freight costs can be absorbed by the importer; these are being passed on to the contractors. And because the shipments are done daily, there’s very little that can actually be done to hedge costs.”

Local Construction activity has stepped up a gear or two since early 2013, helped by a mix of government-led projects as well as those led by developers returning to the market with a series of ambitious off-plan launches. Market sources confirm that tendering activity is up significantly compared with the same period last year.

According to research by MEED, regional markets might have seen $71 billion in construction-related awards by the end of last year; Saudi Arabia has $75 billion in contracts under construction followed by the UAE at $70 billion and Qatar at $44 billion.

“As against the one or two enquiries that contractors used to receive a month in the past, they are now fielding 18-20 enquiries,” said Sajan. “The Gulf’s construction sector has made a strong comeback — but for this to be sustained it needs to see a return of the one million workers that left during the crisis.”