Abu Dhabi: Aldar Properties’ asset management portfolio is set for growth during the next few years with the development of new hotels, residential units and retail outlets currently on the way, according to Talal Al Dhiyebi, Aldar’s executive director for asset management.

“We have 77 million square metres of land bank within the emirate of Abu Dhabi. That gives us the opportunity to develop different asset classes in different areas, [and provide] different products for the market be it residential product for sale or lease, retail, community shopping malls, strip malls, as well as office blocks, and expanding our hotel portfolio,” he told Gulf News in an interview.

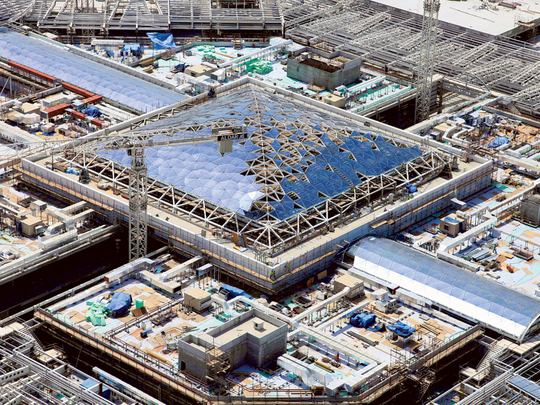

Such expansion will be seen with the opening of Yas Mall in November, new residential units the company is currently assessing and new hotels including the upcoming Courtyard by Marriott.

Despite high demand for its various units in Abu Dhabi, Al Dhiyebi said that Aldar’s primary focus remains the emirate of Abu Dhabi, and that it is currently not seeking penetration into the Dubai market.

“Due to the growth that we’ve seen year-on-year and especially from 2013 to 2014 in our hospitality sector in terms of both occupancy and rate, we realise the market fundamentals and demand indicators are strong, which leads us to look for new opportunities within our land bank to capitalise on that,” Al Dhiyebi said.

He expected the opening of the Marriott hotel by the end of this year to attract a lot of guests and be met with high demand.

“Because of its location — it’s connected to a shopping mall, office towers, residential towers, it’s a five-minute walk to the Corniche, and it’s within 10 minutes of any asset in downtown Abu Dhabi, so it’s in such a strategic location, that we’d expect it to be quite popular,” he said.

The 195-room, four-star hotel is part of the wider World Trade Centre development.

Aldar had earlier announced that revenues for its hotel portfolio for the first six months of this year reached Dh283 million, marking an increase of 13.1 per cent from the same time last year. Meanwhile, average occupancy rates within the portfolio stood at 82 per cent at the end of June — up from 78 per cent in 2013.

The opening of the new Marriott hotel is only expected to elevate Aldar’s hotel portfolio, which currently includes nine hotels — seven of which are located on Yas Island.

Commenting on Aldar’s residential portfolio, Al Dhiyebi said: “We are currently looking at over 23 new developments that are under various stages of design and development. Each of those projects will be assessed, and at the right opportunity, we will launch those projects into the market for either sale or lease.

“We are busy looking at new opportunities in terms of how we can capitalise our land bank, how we can respond to the market without flooding the market with units,” he said.

The new developments are located across Abu Dhabi and include residential units (for sale and lease), retail options, and hotels.

“[Demand for real estate] is growing in a very sustainable and positive way. We can see it in various sectors. We can see offices expanding, which shows that there is job creation and that the economy is expanding. We have seen it in the residential projects as well, with all the leases that we’ve had this year. We have seen demand for retail and that shows that retailers believe in the Abu Dhabi market and the fundamentals of it, and we have witnessed it in hotels,” Al Dhiyebi said.

He noted that such demand is long-term and non-speculative.

Despite the new projects, Al Dhiyebi said that there was still more potential for demand and supply, and that the market was not a saturated one.