Dubai : There is a distinct lack of Grade A developers in Dubai, according to some latest ratings. Only three were awarded A- while 23 per cent scored B+, B, or B-, 48 per cent achieved C+ C or C- and a total of 17 per cent achieved D by Landmark Advisory's latest Real Estate Report.

Dubai achieved an average rating of C with 71 per cent of Dubai's developers graded C+ or lower. Abu Dhabi developers on the other hand achieved an overall rating of C+ with two developers reaching the highest grade in Abu Dhabi of B+

"The lack of grade A developers in Dubai is a product of the property boom. Developers were more concerned about flipping property than working on its quality," Jesse Downs, head of research at Landmark Advisory, told Gulf News.

Evaluation

The report's evaluation of the 52 developers rated in Dubai and 9 developers in Abu Dhabi were based on three criteria; product quality, customer service, and overall perception.

Blair Hagkull, managing director Mena for Jones Lang Lasalle agreed, saying, "Now that the hype factor has reduced, successful developers have gone back to fundamentals and there is a lot greater focus on being effectively able to communicate to clients and the public in ways to resonate with their core reputations. People in the real estate industry have woken up to fact that delivery, value, service and quality are the most important."

According to Downs, in the past 18 months, product quality has been an increasingly important factor in projecting real estate price trends in the UAE.

The report predicts that for products delivered by grade A developers, sale price will increase on average by 15-20 per cent in the long term. Assets built by Grade B developers could see an average sale price increase of 5-10 per cent.

"Developer ratings impact prices in the long term. If you over promise and under deliver, it will impact on the reputation of the developer. Investors are more likely to invest in those with a good track record, hence bringing the prices up," Jesse Downs head of research at Landmark Advisory told Gulf News.

William Shintani, executive director and head of operations at FutureBrand, believes the same. "The importance of reputation is the tantamount differentiator between a developer that holds its value and one that does not. Investors will rely on the reputation of the developer and opt for the building with the better reputation."

A recent survey released by FutureBrand shows that ‘developer image' which was measured by several factors including quality of construction and value for money have declined on average by 5 to 10 per cent. Overall the average grade fell from a B to a B- or C+.

Branding

According to Matthew Green, head of research and consultancy at CBRE Middle East, the current interpretation of branding is not just its logo but a reputation for developing good products on time.

"Successful developers will typically have established a strong brand by delivering multiple projects on time, that have, by and large, met with market expectations. Too many developers in recent years have failed to live up to their promises, both in terms of unit quality and also timing of delivery.

"We are no longer seeing demand for celebrity endorsed schemes and other such gimmicks; instead we are seeing a shift towards functional property, in good locations, with adequate facilities and ideally well managed," he said.

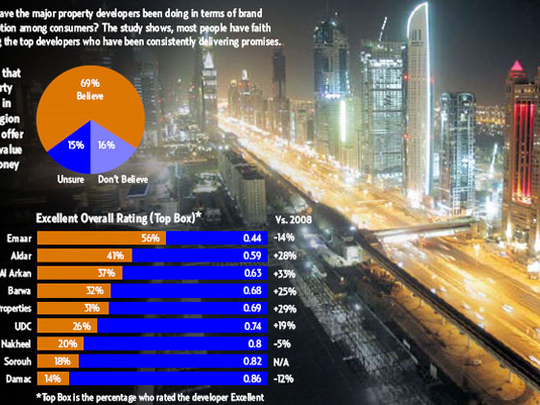

The survey states that Emaar remains the most recognised brand at 69 per cent although its lead over Nakh-eel has decreased which stands at 41 per cent. Damac's reputation has taken the biggest hit with the survey showing it is 70 per cent less familiar than Nakheel.

The FutureBrand Gulf Real Estate Study which surveyed 200 prospective home buyers in Saudi Arabia, Qatar and the UAE also shows that Emaar remains the most highly esteemed developer brand, but the rise of Aldar, Dar Al Arkan, Barwa, Dubai Properties and UDC has closed the gap significantly. Damac was positioned at the bottom in terms of reputation at 14 per cent dropping by 12 per cent from 2008.

According to the survey, nearly 23 per cent said they were less likely to buy or invest in the region again. "There has been a bit of a credibility crisis and there have been a lot of developments who aren't following through with what they're promoting," said Shintani.