Dubai: There’s every incentive for Dubai’s developers to get into overdrive with their new launches. Off-plan sales are now running neck and neck with transactions involving ready properties, based on the latest official data. This is so even as the overall level of freehold transactions in Dubai is likely to show a 10-15 per cent drop this year from what it was in 2015.

Where off-plan focused developers have an edge is in the pricing, where by showing greater flexibility on their launch prices, they have been able to pull investors in. Some developers, in fact, have been quite aggressive on their pricing policy.

The off-plan surge has been brought on by the recent launches at Dubai South, involving projects both from the master-developer and the joint venture it has with Emaar. All units released — numbering more than 700 units — were sold off within hours.

But even outside of Dubai South, off-plan is holding its own against ready property demand. “A geographical analysis reveals the ready market is dominated by developments in Shaikh Zayed corridor, whereas the off-plan space has been skewed towards the rapidly developing Mohammad Bin Zayed (MBZ) area,” states the latest Reidin-GCP report. “As these communities move towards completion, there will be a tilt towards end-user preferences towards this part of Dubai, which is where the bulk of affordable housing supply is coming.”

Next year, the developer Nshama is expected to deliver as many as 2,000 units within its Town Square project.

Affordable segment

According to Sameer Lakhani, Managing Director of the consultancy Global Capital Partners, “In terms of off-plan purchases increasing in popularity, this has been primarily due to the fact that there is now greater depth in terms of prices being offered, which was not the case even in 2014.

“With the entry of GRE (government-owned real estate) developers as well as leading private sector names into the affordable segment, there has been an upsurge In transactions. Demand for these areas has surged. If you see the areas that are being traded (primarily in the MBZ corridor), it stands to reason that the preponderance of transactions in the next five years will be focused on this area and this price point.”

Developers eyeing the off-plan space are spreading their projects all over. “Currently, I have limited unsold inventory across six of my earlier launches ... by end of the month, even the seventh — the “Miraclz” high-rise — should be sold out,” said Rizwan Sajan, Chairman of the Danube Group. “The moment that happens, we will be ready for the eighth launch, which will be in the Arjan area.

“I don’t think developers — especially mid-market focused ones — need to wait long to get their inventory moving. The weak market sentiments recorded in other categories is barely registering in this space.”

Dubai Water Canal

Danube has used its “1 per cent monthly instalment” as the catalyst for driving sales. “We source 25 per cent of the property value within 120 days and the rest spread over 75 months,” said Sajan.

As for the wider Dubai property market, much rests on when buying in the luxury end of the market starts to show up more frequently. Transactions involving properties in the Dh4 million and over range during the current quarter is rated as “weak-to-stable”, according to market sources.

But developers are not losing heart. Some of the biggest launches in the high-end space are scheduled for the first quarter of 2017. This will gain urgency as developers race to launch projects located at or near the Dubai Water Canal.

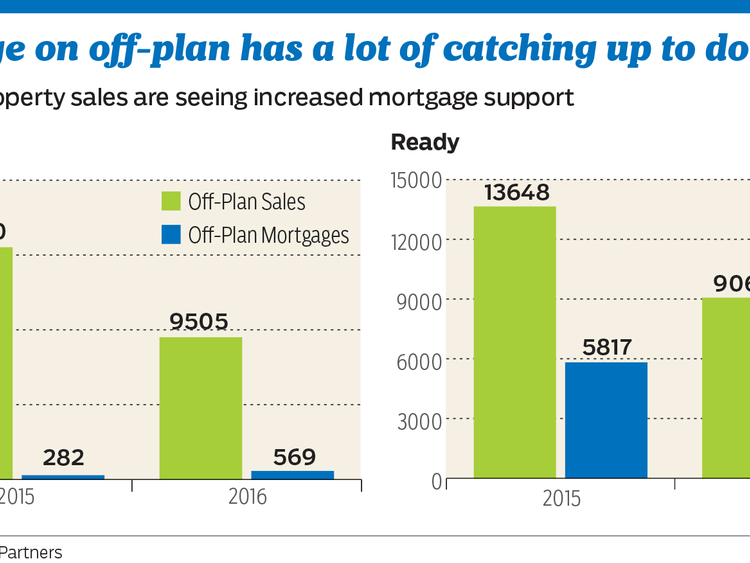

Meanwhile, the Reidin-GCP report states that the bulk of the off-plan sales are still cash-led. “We see that in the ready [property] space, mortgage-based transactions continue to show a steady increase,” it adds. “We opine that this will cross 50 per cent in the next two years.

“In the off-plan space, transactions will remain predominantly skewed towards cash, [in many cases with leverage being offered by developers], making the latter more volatile in terms of price action.”