Understanding international trade

You got something that I need, and I got something that you need; let’s trade

Whether an economy is one that is mainly dependent on oil exports, let’s say Venezuela, or one that relies mostly on mining like many countries in Africa or even one that has branded itself as a trade port like Hong Kong; international trade is always emphasised.

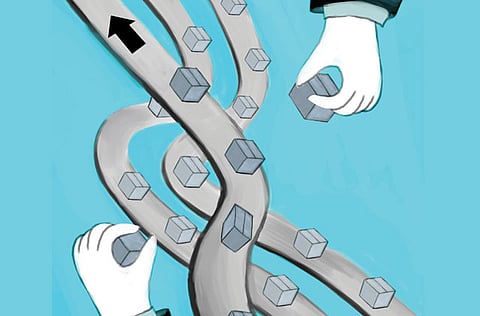

The story of international trade can be traced back to thousands of years ago, even if the concept in its entirety has changed and evolved as means of transport and financial dealings had. And once you take out of the picture the complications of national dealings — generally governed by the World Trade Organisation — as well as the hardship of having to forecast and hedge the fluctuations risk in currencies; the logic is straight forward. You got something that I need, and I got something that you need; let’s trade.

With this said, the dilemma to any economy lays mainly in mastering how to balance what flows into the country with what flows out of it, while taking into account the value of the nation’s currency against currencies of other trading nations.

Just like personal bank accounts, countries have what is called a “Current Account”. This account measures the outflows out of a country against inflows into it. Within the current account calculation, another account exists that deals only with exports and imports; referred to as “Trade Balance”.

In a recent report, Greece had its current account deficit reduced because of a decrease in imports as a result of the reduced consumption mood that the country has been in. And since it still is in the Euro Zone, a strong Euro doesn’t really serve the exports sector. What China has realised is not only that cheaper production promotes exports, but also that keeping a constant downward pressure on its Yuan is an export catalyst. And to beat the US in world trade, it went ahead and invested most of its holding of US dollars in the US itself to reduce its circulation and exert an upward pressure in its valuation. To acknowledge the Chinese unprecedented tactics; China has in fact beaten US to being trading national number one worldwide.

Another example from an emerging part of the world is Brazil who recently celebrated the devaluation of its Real as a vague declaration of an upward shift in exports. Why is it important to have a trade surplus than deficit? Well, foreign international trade is a source of foreign currencies. An increase in foreign currency holdings replenishes the central bank’s reserves to back up its national currency as well as provides a safe cushion for currencies exchange. Companies are now targeting countries like Philippines, Indonesia, and Vietnam because of their already depreciated currencies.

Once foreign subsidiaries are operational, the company gains from cheaper costs and the country gets to reduce its trade deficit or increase its trade surplus.

My last example here is from Africa. Kenya has recently introduced the tech sector into its GDP, not only to do things better at home, but to encourage its tech exports that hit $360 million in 2010 as per a report in The Economist.

Trade hence exports are vital for all economies to be sustainable, especially those that rely mostly on natural resources. For that, a balance should be carefully managed between cost of production and currency value. Borders don’t really matter anymore neither does the size of an economy.

Germany, the largest economy in Europe, has reported a current growth that is led mainly by exports and increasing home demand, while France, second largest economy in Europe; is negotiating with EU members a possible devaluation of the Euro to make its exports cheaper.

UK, being at an advantage here, plots an unannounced devaluation of the Sterling to increase exports which eventually creates jobs. Ireland, on the other hand, can do almost nothing against an increasing favoritism by EU members to import cheaper meat products from Argentina. Having the EU as its currency, no political and economic influence as that of France, as well as the horse meat issue; case closed. Now the last thought that I want to leave you with is this: what would happen if all countries raced towards direct and indirect currency devaluation?

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox