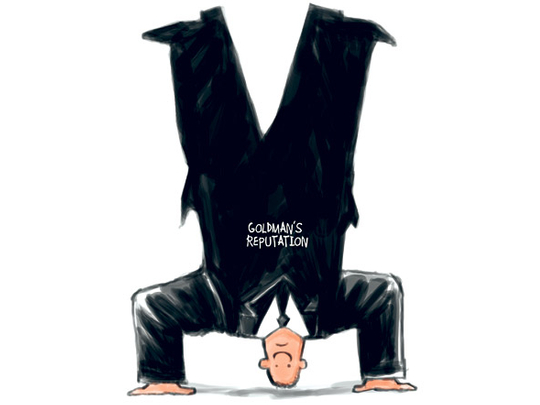

Bashing Goldman Sachs Group has been elevated from a national pastime to something far more serious: a bona fide threat to the company's operations. Don't just take my word for it, though. We have it from Wall Street's highest authority. That would be Goldman Sachs itself.

Among the new items in the investment bank's latest annual report is a 219-word risk-factor disclosure, cautioning that the constant drumbeat of criticism is taking its toll. This isn't to say Goldman is acknowledging there might be something wrong with the way it does business. That would be a wholly unnatural act.

Rather, the problem as identified by Goldman is the way other people have chosen to respond to its existence. So many critics are popping off in the press. So many government investigations are being launched in response. And there's so little precious time for Goldman's leaders to deal with it all.

"The financial crisis and the current political and public sentiment regarding financial institutions has resulted in a significant amount of adverse press coverage, as well as adverse statements or charges by regulators or elected officials," Goldman said in the annual report it filed March 1.

"Press coverage and other public statements that assert some form of wrongdoing, regardless of the factual basis for the assertions being made, often results in some type of investigation by regulators, legislators and law enforcement officials or in lawsuits."

Responding to such matters "is time-consuming and expensive and can divert the time and effort of our senior management from our business", Goldman said. It concluded by saying: "Adverse publicity, governmental scrutiny and legal and enforcement proceedings can also have a negative impact on our reputation and on the morale and performance of our employees, which could adversely affect our businesses and results of operations."

With that disclosure, wittingly or not, Goldman's management team paid the news media the highest possible compliment, while simultaneously admitting a major failure of its own. The message for the press is: "How flattering! Goldman says we matter!" For Goldman chief executive officer Lloyd Blankfein, it's this: "My bank, on my watch, has let its good name be put in danger."

A Goldman spokesman, Ed Canaday, declined to comment.

While commercial brilliance and a rising stock price have their place, the paramount job of the people who run Goldman is to protect the firm's reputational value. Take away the public's trust, and there would be no Goldman: Counterparties wouldn't trade with it, governments and corporations wouldn't hire it, and talented people wouldn't work for it.

Goldman, which earned $13.4 billion (Dh49.2 billion) last year and paid its employees $16.2 billion, used to receive the benefit of a doubt from the public when its conduct came into question. Nowadays, it's the gray areas that often generate the most outrage.

Is Goldman to blame for helping Greece mask some of its debt? Nowhere near as much as the Greek government is, but the work Goldman performed looks dodgy anyway. Did Goldman force the US government to bail out American International Group? No, but Goldman benefited just the same when AIG used taxpayer money to pay the obligations it owed Goldman at 100 cents on the dollar.

Was Goldman running the treasury department when its former CEO, Hank Paulson, was in charge there? Officially, no; however, it sure did seem that way at times. Does Goldman manipulate markets or front-run its customers' trades? While there hasn't been any proof it does, it certainly could were it so inclined.

Ultimately, what bothers the general public most is how much money the bank and its employees have made, so soon after the government invested trillions of dollars to rescue the financial system — including Goldman Sachs. Yet even today, the company's executives remain arrogant enough to claim that Goldman doesn't have a too-big-to-fail guarantee from the government, not even an implicit one.

There are precedents for the sort of risk-factor disclosure Goldman made. One company that jumps to mind is Halliburton, the oilfield-services giant that morphed into a national pariah soon after its former CEO, Dick Cheney, became US vice-president. Halliburton cited its former relationship with Cheney as a risk factor during the run-up to the 2004 presidential election. It, too, said the problem was that the company had become a target for reasons beyond its own behaviour.

Halliburton's stumble

"To the extent we or our subcontractors make mistakes in our government contracts operations, even if unintentional, insignificant or subsequently self-reported to the applicable government agency, we will likely be subject to intense scrutiny," the company said in a 2004 Securities and Exchange Commission filing. "Some of this scrutiny is as a result of the vice-president of the United States being a former chief executive officer of Halliburton."

By 2007, Halliburton had spun off its Kellogg Brown & Root division, whose Defence Department contracts in Iraq triggered Justice Department investigations. Since then, both Halliburton and KBR largely have faded from the national spotlight.

While breaking up Goldman wouldn't be as simple, at some point the bank may have to try something just as drastic if it can't find a way to detoxify its reputation. Restoring Goldman's public standing should be Blankfein's top priority. Yet there's no indication he has any idea how to accomplish this.

Truth is, it might no longer be possible.