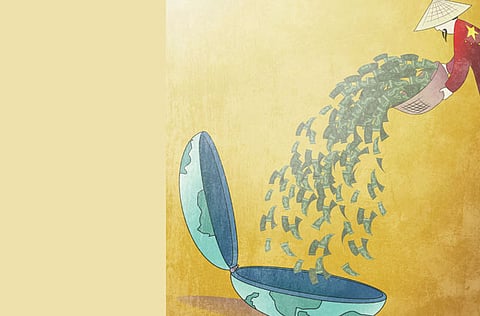

China’s turn to be the global lender

China can find creative uses to deploy proceeds from selling US Treasuries

China shall no more be the US’ beloved, reliable creditor. Theoretically, China was fuelling the world’s economic activity with its increasing purchase of US Treasuries.

The printed currency was of course what enabled the Fed’s stimulus programme to finance the growth of emerging economies, though it increased deficits for these countries. Anyway, the Chinese trend has been discretely changing.

According to a piece in ‘Project Syndicate’, as of end August, China has reduced its holdings of US Treasuries by $22.6 billion after it started selling them from May, with July being an exception.

And now, China’s State Administration of Foreign Exchange has supposedly overtaken Norway’s sovereign wealth fund as the largest in the world with $743 billion in assets. (I should mention here that another article states that the Norway fund has more than $800 billion in assets, which is normal as ambiguity exists in such cases.)

The new Chinese approach is to diversify away from US Treasuries. Why? Well, the Chinese cannot tolerate fiscal dramas which directly threaten their sovereign wealth, which unlike oil-rich Norway, has been accumulated from surpluses in the budget since 1994.

In its 2012 annual report, the China SWF — China Investment Corporation established in 2007 to diversify and recycle China’s holdings of foreign exchange — released the following details on their foreign investments. These were £276 million in Thames Water (UK, infrastructure), $300 million in Ep Energy (US, energy), $425 million in Ployus Gold (Russia, mining), €386 million in Eutelsat Communications SA (France, pan-industry), £450 million in Heathrow Airport Holdings Ltd. (UK, infrastructure), and $187 in Moscow Exchange (Russia, pan-industry).

As for private investors, UK has been the favored spot. In 2012, China’s Petrochemical Corp bought 49 per cent in Talisman while PetroChina holds a 50 per cent stake in Ineos. Also, Sinochem Group holds full ownership of Emerald Energy. Since 2005, China investments in UK reached $17.8 in UK and $9.8 billion in France.

In total, China’s offshore foreign direct investment has reached $77 billion in 2012, with $200 billion in potential mergers and acquisitions that didn’t go through, according to the Heritage Foundation.

Currency reserves

China holds $3.3 trillion in currency reserves, which gives it absolute flexibility in directing investments in whatever direction. While China isn’t going to look for alternatives for US Treasuries, it has started diverting investments and reducing its current exposure. If anything, it’s like the phase before a break-up regardless of how long the process would take.

Surprisingly, some of the investments are going back into the US but in other forms, like the 17 per cent stake in the American power company AES owned by China Investment Corporation. Ironically, the US is looking to China to invest up to $8.2 trillion, estimated by US Chamber of Commerce, to keep infrastructure in a good state between now and 2030 (Quartz).

China isn’t only investing in high-yielding long-term infrastructure and energy projects, like the consortium that will build the nuclear station in the UK, but also in projects such as the bid for a shopping mall that is to be built in the Eiffel Tower area. And so money goes out of one pocket in China and goes back into another thanks to Chinese tourists.

Overall, this might be a better conclusion than having money frozen in US Treasuries. However, for the US, this decreases its financial importance along with that of the dollar.

China has invested in energy, mining, infrastructure, tourism and real estate. Yet, China would have much more to invest from the proceeds selling its US Treasuries. China should not, and anyway would not, go full throttle investing in high return projects as careful weight needs to assigned to safer options.

China might consider bonds in different countries, but these come with their risks too. How about direct finance in countries?

China can go ahead and deposit amounts of its foreign reserves into their respective countries – banks there that is, or even buy stakes in them. Then, let banks rely on China’s cash to extend loans and spur spending, consumption and growth.

With that, wouldn’t China increase everyone’s reliance on it as a global lender? If so, wouldn’t China pretty much have the say on the flow of money from one corner of the universe to another?

Now the last thought that I want to leave you with is this: what will happen to US once China, and probably other countries too, reduce their exposure to US debt? The overall trend does point in that direction, with a 2 per cent decrease in US government debt held abroad between 2012 and 2013.

— The writer is a commercial consultant and commentator on economic affairs. You can follow him on Twitter at www.twitter.com/aj_alshaali.)

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox