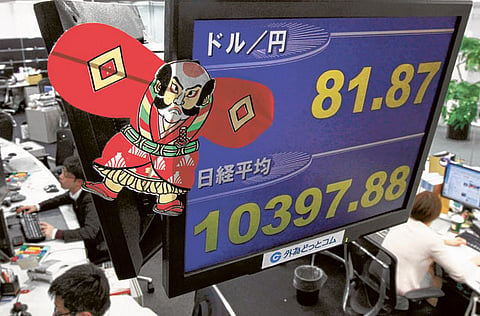

Nikkei ekes out new eight-month closing high amid US jobs fears

Sentiment in Tokyo supported by gains on the Shanghai market

Tokyo: Japan's Nikkei average edged up to a fresh eight-month closing peak yesterday as investors stayed cautious ahead of key US jobs data, while a drop in commodity prices was offset by a strong performance by Chinese equities.

The Nikkei was trapped in a tight range, moving in and out of positive territory throughout the day after the previous day's drop in Wall Street stocks made investors nervous before December's US employment report later during the day.

Sentiment in Tokyo, however, was supported by gains on the Shanghai market, as heavy lending by banks at the start of the year has flooded the Chinese stock market with cash while investors look forward to better corporate earnings for 2010 than previously expected.

"The mood on the Nikkei turned mildly positive in the afternoon lifted by the Shanghai market, which started on a very strong note," said Takashi Ohba, a senior strategist at Okasan Securities.

The benchmark Nikkei ended the day up 0.1 per cent or 11.28 points at 10,541.04. Immediate resistance now looms at its May 14 peak of 10,551.69.

The broader Topix index gained 0.2 per cent to 926.42.

Trading volume was high, with around 2.3 billion shares changing hands on the Tokyo Stock Exchange's first section, well above last week's average of around 1.3 billion.

With rising expectations for the world's largest economy to recover, investors aggressively added lagging Tokyo equities with high exposure to the US market and low price-to-book ratios, such as automakers, investors said.

Toyota Motor Company gained 2.2 per cent, while Nissan Motor Company picked up 4.4 per cent.

Foreign investors were net buyers of Japanese stocks in the week to January 1 for the ninth straight week, with net purchases totalling 23.5 billion yen (Dh1.03 billion), the Finance Ministry said yesterday. Analysts said such buying may continue through the January-March quarter as expectations for decent results from US and Japanese firms would likely provide momentum for further gains.

"Nothing has changed market expectations that stocks will rise further," said Masatoshi Sato, a senior strategist at Mizuho Investors Securities

Investors are eyeing long-term resistance, which could be tested if the US jobs data was better than expected, at 10,638, an intra-day level hit on May 13 when the fiscal crisis in Greece rocked markets.

Investors expect non-farm US payrolls for December to show an overall gain of 175,000, with the unemployment rate falling to 9.7 per cent from 9.8.

Inpex Corporation, Japan's biggest oil and gas developer, fell 1.7 per cent with oil trading near a two-week low yesterday, heading for its steepest weekly drop in seven weeks and as a stronger dollar and weaker US equities deterred buyers.

Trading houses weakened, with Mitsubishi Corp falling one per cent and Mitsui and Company losing 0.7 per cent.

Shares in Chiyoda Corp tumbled 8.6 per cent after Bloomberg News reported the engineering and construction company lost a contract to develop Qatar's Barzan gas project.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox