Dubai: Ramadan is a period of introspection for Muslims and Islamic financial institutions to better observe Islamic teachings, appreciate our blessings and be moved to action by the burden of others.

In short, it's a month of narrowing the gap between the rich and the poor.

For Islamic finance, it is a merger of faith and finance. For the halal industry, it's a merger of faith and food, and for Shariah-compliant hotels, a merger of faith and hospitality.

Ramadan offers the most brand-building opportunities through public relations exercises such as sponsoring Ramadan tents and Azans, launching of new products and donations to mosques and orphans, as well as handouts of corporate gifts to clients.

But four questions come to mind:

1. Is Ramadan the most opportune time to recruit more customers?

2. Do the photo opportunities and press releases cancel out the spirit of donations and good intentions?

3. Should the right hand know what, when, where and how much the left hand is giving?

4. Is Ramadan becoming a PR bandwagon everyone is jumping on?

If Ramadan is a month of engagement in direct ibadah (worship), individual sacrifice, abstaining from food, water, smoking, marital relations from sunrise to sunset, should there not be an engagement of optional charity, beyond the obligatory zakat donations? Is it not that kind of ethic that differentiates Islamic financial institutions from their conventional counterparts?

During the fasting month, many Islamic banks ‘pause' customer payment on financing contracts of big ticket items like mortgages. The rationale of this gesture is to reduce the customer's burden as they may need extra money for iftar, family gatherings, charities and Eid-il-Fitr gifts.

Spirit of sacrifice

Is this suspended monthly payment built into the tenor of the Islamic mortgage contract? Granting that Islamic finance is not charity finance, where is the spirit of sacrifice for the Islamic bank? To some, this appears to be the deft smoke and mirrors of financial engineering.

The social responsibility of Islamic finance needs to be shown and felt in the community. The Islamic mortgagee is a bankable customer who probably knows he/she will be eating their next meal at sunset. Obviously, that cannot be said for majority of the 1.6 billion Muslims living in abject poverty in places like sub-Saharan Africa.

A sacrifice worth publicising is if the Islamic bank took the Ramadan suspended payments and established a Qard-ul-Hassan fund and give out money to local Muslims and non-Muslims having financial difficulties, and the remainder sent to NGOs in the least developed Muslim countries.

If Islamic finance is indeed for all of mankind, then disbursements must also be valid for all humankind. The donations, photo opportunities and news coverage, especially in the highly-influential western media, is a much needed investment in branding Islam. After all, the philosophical foundation of the Islamic financing system is to put an emphasis on the ethical, moral, social and religious dimensions, to enhance equality and fairness, for the good of the society.

Halal industry

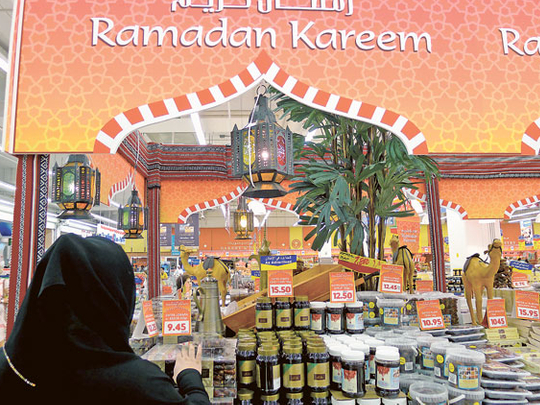

The halal food producers, much like Islamic financial institutions, seem to come alive during Ramadan as they introduce new product lines and menus under their brands. It would be interesting to see halal food companies setting up a competition for favourite recipes of their customers and include the winning entries in the company's offering.

It’s about opening channels to customers who may have felt “food disenfranchised.” Obviously, the logical consequence of such events is a Halal “food show” sponsored by companies with vested interest. A direct benefit of such shows for Muslim food lovers is to guide them on healthy eating habits, share innovative recipes and most ideally, culinary methods which promote weight loss during Ramadan.

The halal food industry has a certain responsibility. They must engage the customer by involving them in the process of meaningful dialogue beyond the commonly used focus groups.

Shariah-compliant hotel

Ramadan is a month of massive food and beverage (F&B) promotions, thanks to all major hotel chains. It is the busiest month for hotels, where all F&B outlets are packed. Islamic hospitality is an important essence of the religion, and Ramadan, should be positioned as a hybrid between the Oscars and the World Cup for Shariah-compliant (SC) hotels.

SC hotels should think of a collaboration to showcase the variety of halal food products and Iftar feast from the 57 Muslim countries and offer premium-priced suites at charitable rates to ride on the Ramadan campaign.

Ramadan offers the ultimate brand-building platform for SC hotels, but they must first think outside the box to create a festive Ramadan ambiance over and above the decorative ornaments and lighting effects. More importantly, because the Ramadan atmosphere is just as celebrative for Muslims as Christmas is for Christians or Diwali for Hinuds, the onus is on the Islamic banks, halal food providers and SC hotels to make Ramadan a joyous celebration and Syawal, a season to be happy for the Ummah at large.

The writer is Global Head of Islamic Finance at Thomson Reuters. Views expressed here are his own and do not reflect that of his organisation or of Gulf News.