London : Gold prices yesterday fell towards $1,100 (Dh4,040) an ounce in Europe on Thursday as the dollar's rise to a five-month high versus the euro curbed buying of the precious metal as an alternative asset.

Spot gold was bid at $1,103.65 an ounce at 1031 GMT, against $1,111.10 late in New York on Wednesday.

US gold futures for February delivery on the Comex division of the New York Mercantile Exchange fell $8.60 to $1,104.00.

The dollar yesterday hit a five-month high versus the euro as investors spooked by concerns over Greece's rising debt sold the single currency.

Bond yields

Tobias Merath, head of commodities research at Credit Suisse, said while the strong dollar was negative, falling bond yields in the United States, which made gold a more attractive alternative asset, were supporting the metal.

"Bond yields in US have been coming down, and this is a positive factor for gold because gold is a non-yielding asset," he said.

"We have had two diverging factors at work — the dollar strengthening, but yields falling because of the risk aversion/bond rally."

The euro extended losses after a reading of the euro zone purchasing managers' index missed consensus.

Strength in the dollar versus the euro curbs gold's appeal as an alternative asset and makes dollar-priced commodities more expensive for holders of other currencies.

"Bullion should continue trading against the US currency, tracking the broader market," VTB Capital said in a note.

"We see our key support holding at $1,090 in case we lose more ground."

On the wider markets, oil prices were steady, supported by strong Chinese growth data.

Asian stocks fell as investors worried China would take more measures to temper growth after its fastest quarterly growth in two years, and European shares were flat.

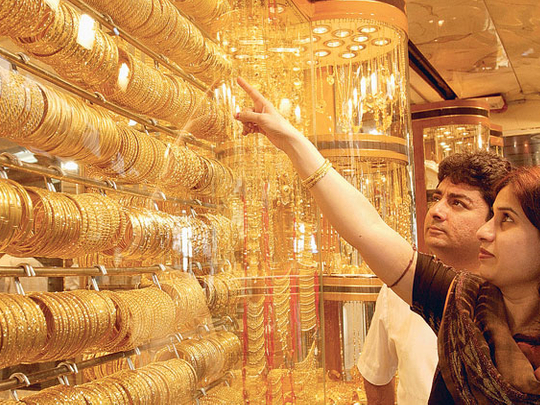

In India, historically the world's largest consumer of gold, traders continued to buy as prices hit new two-week lows.

"Yesterday's sales were highest in the month," said a dealer with a state-run bank.

Meanwhile holdings of the world's largest gold-backed exchange-traded fund (ETF), New York's SPDR Gold Trust, were steady on Wednesday, but are down 21.7 tonnes or 1.9 per cent this year. In the same period of 2009, they rose 22.7 tonnes.

Holdings of the main silver ETF, the iShares Silver Trust, have also fallen 154 tonnes in 2010 to date.

Traders say some investors with an interest in precious metals ETFs are pulling money out of the SPDR and the iShares fund in favour of new US platinum- and palladium-backed ETFs.