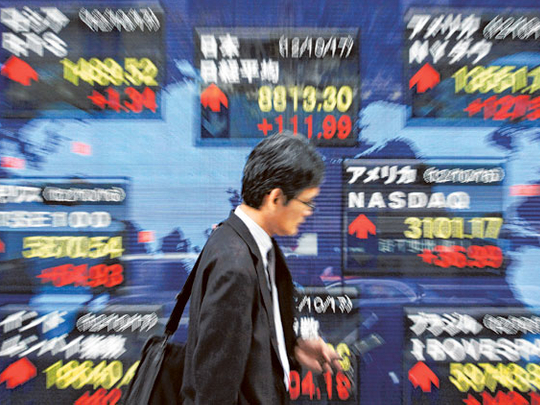

Hong Kong: Asian markets were boosted on Wednesday on increased confidence in the Eurozone after Moody’s held off cutting Spain’s credit rating, while Madrid looked to move closer to asking for a bailout.

A successful bond auction for Greece added to the sense of optimism, while the euro maintained its gains seen in late trade on Tuesday as investors sought out riskier assets.

Tokyo jumped 1.21 per cent, or 105.24 points, to 8,806.55, Sydney added 0.82 per cent, or 36.7 points, to 4,528.2 and Seoul was 0.70 per cent higher, adding 13.61 points to 1,955.15.

Hong Kong rose 0.99 per cent, or 209.57 points, to 21,416.64 and Shanghai was up 0.32 per cent, or 6.81 points, at 2,105.62.

Moody’s gave debt-addled Spain some much-needed room on Tuesday when it held the country’s rating at Baa3, one notch above “junk”, citing the European Central Bank’s willingness to buy government bonds to stabilise its borrowing rate.

It also pointed to Madrid’s commitment to implementing fiscal and structural reforms necessary to improve its finances as well as efforts to restructure the banking sector and strengthen the banks. However, the agency kept it on a “negative outlook”.

Also, a senior Spanish official has said that Madrid was considering a request for a line of credit from Europe’s European Stability Mechanism (ESM) rescue fund, the Wall Street Journal reported.

The comments soothed investors fears over Spain as Prime Minister Mariano Rajoy has so far refused to ask for help, despite the parlous state of the economy, saying he wanted to study the terms of a rescue.

“The latest headlines from Madrid imply that a formal request for aid is inevitable,” said Ashraf Laidi, chief global strategist at City Index.

Greece managed to complete a successful short-term bond auction at lower rates as hopes rise that it will be given a little more breathing space to carry out much needed reforms to get its economy back on track.

And in Germany, Europe’s key economic driver, the closely-watched ZEW institute’s calculator of investor confidence rose for the second month in a row in October, in line with a slight easing in regional debt concerns.

The news out of Europe sent the euro surging against the yen and dollar.

And in early European trade the single currency bought $1.3103 and 103.17 yen, compared with $1.3096 and 103.31 yen in New York late on Tuesday. The dollar was at 78.73 yen compared with 78.89 yen.

Wall Street provided a healthy lead thanks to impressive earnings reports from Mattel, Coca-Cola and Johnson & Johnson.

The Dow climbed 0.95 per cent, the S&P 500 rose 1.03 per cent and the Nasdaq added 1.21 per cent.

But the main focus this week is on China, where third quarter growth figures are due to be released on Thursday, with investors hoping for improved figures and the beginning of a pickup after a slowdown for most of the year.

Oil prices were mixed. New York’s main contract, light sweet crude for delivery in November, rose 21 cents to $92.30 in the afternoon while Brent North Sea crude for December delivery shed six cents to $113.94.

Gold was at $1,749.60 at 1030 GMT compared with $1,740.00 late on Tuesday.