London: Concerns over Europe's fiscal problems hit the euro and sterling Wednesday, while world stocks hovered near their recent six-week highs, though they were still up 66 per cent from a low hit one year ago.

Copper rose on the back of strong trade data from China, a big metal consumer. Crude prices, however, were flat on worries over higher US inventories.

The euro was down 0.2 per cent against the US currency at $1.3575, extending Tuesday's weakness after ratings agency Fitch said it still had a negative outlook on Portugal's credit rating.

Sterling hit one-week lows against dollar and euro in early London trading hours on concerns over its sovereign rating and apprehensions about the credit ratings of UK banks. It lost 0.4 per cent to trade below $1.50 at $1.4929.

"Fiscal concerns are resulting in extreme pessimism for both currencies in the near term," said Lee Hardman, currency economist at Bank of Tokyo-Mitsubishi UFJ.

The dollar was up 0.2 per cent against a basket of currency.

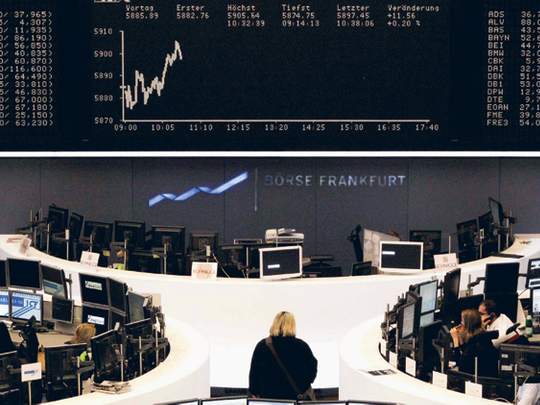

World stocks measured in the MSCI All-Country World Index was flat at 300.61, hovering near a six-week high of 301.61 reached on Monday.

The pan-European FTSEurofirst 300 index was up 0.1 per cent, and Greece's share benchmark advanced 1.2 per cent as worries over the country's debt problems eased after Athens last week announced more austerity measures and secured five billion euros of debt funding from the market.

But some analysts were cautious about equities' outlook.

"I have an impression that we are very much near the top. All the people who were bullish have bought already so there is nobody left to buy," said Koen De Leus, economist at KBC Securities. "There are a lot of sentiment indicators that really indicate to rough times ahead."

Asian shares outside of Japan put on 0.4 per cent to hit a seven-week high as Chinese data showed exports and imports in February were better than expected.

The news boosted copper prices and the Australian dollar, which jumped to above $0.915 as China is the biggest buyer of Australia's commodity exports.

Copper prices advanced 0.5 per cent and gold was also 0.5 per cent higher. Oil prices were steady to trade above $81.50 a barrel.

Euro zone government bond prices drifted lower as investors prepared for what could be the second-heaviest week of supply so far this year.

Germany will issue 6 billion euros of two-year Schatz at 1000 GMT and up to a billion euros of an index-linked 10-year Bundei. But the biggest test could come from Portugal which issues 750 million euros of 4.95 per cent April 2021 OTs.