Dubai : With full-scale integration said to be just weeks away, the coming together of Dubai Financial Market and Nasdaq Dubai is starting to hit all the right notes.

Market observers are near unanimous in their opinion this will create an equity trading platform that will, with time, be more than the sum of their individual parts.

"Nasdaq Dubai has had a void since inception stemming from a lack of trading volume directly from local and regional retail clients, which on other local exchanges represent a large and significant portion of turnover," said Al Mal Capital head of institutional brokerage Jalal Taji Faruki.

"Consolidation of Nasdaq Dubai with the DFM will simply allow easier access for investors who currently trade on the DFM to trade in securities listed on Nasdaq Dubai.

"At the same time it preserves the client base that has been most active on Nasdaq Dubai to date — which is the local, regional and international financial institutions."

Best of both worlds

In effect, a best of both worlds is what the merger's promoters have in mind. It was late December the Dubai Financial Market put up a Dh441.65 million cash-and-equity offer to acquire Nasdaq Dubai in full.

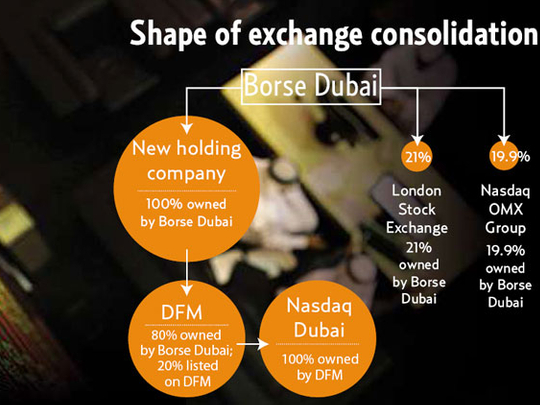

The stated aim was to widen DFM's "asset classes for investors, to allow the company's shareholders to benefit from the future growth of Nasdaq Dubai and to further develop closer operational links between the two exchanges", according to a statement issued by Borse Dubai — which owns both DFM and Nasdaq Dubai, at the time.

At the same time, market analysts believed post-merger the entity would follow the rules, regulations and governance model as already set by Nasdaq Dubai. It made sound commercial sense as those existing investors — principally the institutions, would have every reason to continue their association.

"While we are still awaiting the final details and procedures that would be implemented, based on the information we have it appears the merger would be most beneficial for investors on either exchange," Faruki said.

"The cross-exchange access to listed companies would encourage — and allow — investors to be active on both exchanges."

Opportunities

Until now, the consolidation of stock exchanges had by and large bypassed bourses in the Gulf, though they were quick to seek out opportunities when they beckoned at the global level. Of course, this was well before the downturn bit deeply into the regional economies.

But the coming together of DFM and Nasdaq Dubai suggests consolidation in this space can be attempted even during times of stress for the wider market.

"Consolidation is the right step not only for DFM and Nasdaq Dubai but other regional exchanges as well," said Nicholas Wright, who heads institutional brokerage at Mubasher Financial Services.

"The trend started in the Western markets and has proven beneficial for investors and issuers.

Incremental process

"In regards to Nasdaq Dubai and DFM, Borse Dubai is the major shareholders in both exchanges and it does make sense financially to merge them. It would give listed securities in Nasdaq Dubai an exposure to 600,000 plus investors trading on DFM while allowing DFM investors to trade more products/securities."

That may be so, but no one actually expects liquidity levels to scale new highs immediately once the merger process is completed. Analysts are insistent it would be more of an incremental process and indicative of current market sentiments.

"My expectations would be for a gradual process as investors become more active in shares listed on Nasdaq Dubai," Faruki said.

"There have also been some companies listed on Nasdaq Dubai that have announced that they will convert trading in their shares to dirhams from dollars when the exchanges consolidate.

Beneficial

"In my view this change to trading in dirhams would be the most beneficial measure a listed company can take to ensure improved liquidity. It will simply encourage local and regional retail investors who are accustomed to dealing in dirham-denominated shares to become active in trading such Nasdaq Dubai shares as well."

Wright said he believed there were still issues that needed to be addressed:

Trading hours needed to be the same.

Currency: One of the main obstacles was that Nasdaq Dubai securities were dollar-denominated.

Although the dirham was pegged to the dollar, retail investors seemed hesitant to trade non-dirham listed securities and pay the spread.

Local brokers: For Nasdaq Dubai to get exposure to the 600,000 plus investors in DFM, they need to get the major brokers to join the market.

If Wright's sentiments are to resonate with as many of the local brokerage houses as possible, the merged entity does have its work cut out.

Move will enable 'seamless trading'

The Dubai Financial Market's cash-and equity offer of Dh441.65 million made to Borse Dubai and Nasdaq OMX Group is to acquire the whole of Nasdaq Dubai. This would be split between Dh374.34 million ($102 million) in cash and 40 million DFM shares.

Borse Dubai currently holds a 19.9 per cent stake in the Nasdaq OMX Group. The latter's stake in DFM will not require issuance of new shares as the 40 million shares will be transferred from DFM's existing treasury shares and the other 40 million shares will be purchased from Borse Dubai.

The merger transaction will bring Nasdaq OMX into the shareholder base of DFM through a minority stake of one per cent (equating to 80 million shares).

"Consolidation across local/regional financial markets will always increase investor interest, demand and turnover," said Jalal Taji Faruki of Al Mal Capital.

"The current market situation is that if I have a client who holds shares in Emaar, for example, and they call today to sell those shares, they will have a cash balance in their account. If they would then like to buy shares in DP World for example, they would have to transfer those funds to a different account to deal on the other exchange, and also make sure they had the proper investor ID and other details required.

"A consolidation of the DFM and Nasdaq Dubai would allow investors to trade across both markets seamlessly. This is especially important with regards to the back-office and settlements side of the business which most clients will never see.

"Consolidation of that function allows and encourages local brokerage firms to be active on both exchanges. If you were take this logic of increased access to listed companies through consolidation/mergers and apply it on a national scale, the recent comments of a possible merger or consolidation between DFM and ADX would become a very exciting and welcomed prospect by investors and brokers."

Global standards

Exchange is advanced

While Nasdaq Dubai (previously known as DIFX) was launched in 2005, it shot into global prominence in November 2007 with the listing of DP World.

Market analysts are unanimous that the exchange is quite possibly the most technically advanced and regulated exchange in the region.

"The level of infrastructure, systems and rules implemented created an exchange that foreign investors and banks would be comfortable dealing on," said Jalal Taji Faruki of Al Mal Capital.

"Even the listing rules were more in-line with international standards allowing for companies to float a lower percentage of their capital compared with the local exchanges.

"The internationally accepted model of how an IPO is conducted on Nasdaq Dubai means that the bank/institution bringing the deal to market has a good deal of impact on the valuation and subsequent liquidity on the exchange."

Liquidity

"As a financial institution we can easily obtain liquidity on most Nasdaq Dubai listed companies from other financial institutions by simply placing a call to their trading desk."

But it was the pronounced lack of retail liquidity on Nasdaq Dubai that held it back from realising its full potential.

"The notable lack of retail liquidity on Nasdaq Dubai is visible when looking at the bid/offer spread and volume on the listed companies. The lack of retail volume or interest has in my mind been the most significant hurdle that Nasdaq Dubai has faced since it was launched."

Nicholas Wright of Mubasher Financial Services, cited another reason why Nasdaq Dubai has not lived up to its initial promise.

"The exchange failed [with the exception of DP World] to bring anchor issues to list, whether locally or internationally. In addition it failed to attract retail investors due to a number of reasons and thus suffered a massive shortage of liquidity since they dominate trading in this region."

The market now has set its hopes on the merged entity — and the momentum generated by this, will turn things around for the better.

Do you think this is a good initiative? Or do you prefer trading in separate markets? What will this mean for the UAE’s market? Tell us by clicking the "post a comment' link below.