Dubai: Merger and acquisition (M&A) activity reached record levels in the Middle East last year, new figures revealed yesterday.

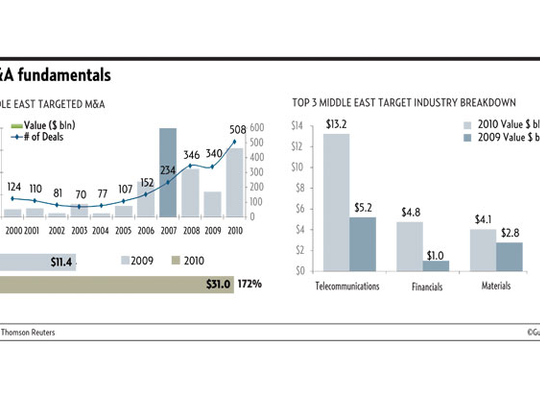

A Thomson Reuters review of the region's M&A, debt and capital equity markets found that Middle Eastern M&A, based on target nation, reached $31 billion (Dh113.8 billion), more than double the activity seen during 2009.

The top targeted deal was etisalat's planned 46 per cent acquisition of Kuwait's Zain Group for $13 billion (Dh47.7 billion).

Telecom was the most targeted industry in the Middle East with Kuwait the most active Middle Eastern country, accounting for 46 per cent of annual activity.

Morgan Stanley topped the Any Middle Eastern Involvement M&A ranking with $29.3 billion followed by UBS with $28.4 billion. Goldman Sachs took top spot in the Middle Eastern target M&A ranking with $15.4 billion in advisory assignments.

Russell Haworth, managing director of Thomson Reuters Middle East and Africa, said: "Last year, the investment banking sector in the Middle East regained some of the strength that was lost during the global downturn of the previous year. We would expect to see the same momentum regained in the Middle East in 2010 to continue into 2011."

Largest syndicated loan

Syndicated loan activity for Middle Eastern borrowers reached $30.3 billion during 2010, a 90 per cent increase from full year 2009 when activity totalled $15.9 billion.

HSBC, BNP Paribas and JP Morgan topped the full year ranking for syndicated lending in the Middle East. All three firms served as bookrunner on the largest syndicated loan in the region this year; a $4 billion financing for Aramco.

Debt capital market issuance was down seven per cent on 2009 to $37.1 billion with 60 per cent of the annual activity being investment grade corporate debt.

Financials, telecom and energy and power were the most active sectors for issuing debt in 2010. HSBC issued the most bonds last year with 21 while Qatari Diar Finance issued the top Middle Eastern bond worth $3.5 billion.

Rami Sidani, Head of Investment, Middle East at Schroders, said: "I expect consolidation to be the name of the game in 2011 as companies operate in a more mature market where the global economic crisis continues to have an impact on some industries.

"The total value of M&A deals in the region in 2010 is slightly skewed by the proposed Zain deal; I am not too sure what the numbers would look like without that planned acquisition."

Investment banking fees increased by $2.5 million to $567.2 million.