Dubai: Mergers and Acquisitions (M&A) activity in the Middle East and North Africa (Mena) region surged 33 per cent by volume and more than 30 per cent in value during the first half of 2011, according to figures compiled by Zawya, an online business intelligence provider.

Zawya statistics reveals that M&A activity in the Middle East and North Africa increased in the first half of 2011, shrugging off effects of political turmoil in the region. The region witnessed a total of 173 deals compared to 130 deals closed in the same period last year.

The total deal value surged to $21.17 billion (Dh77.73 billion), up 30 per cent compared to $16.26 billion reported in the same period last year. "The report [on M&A activity in the first half] presents a positive outlook for the regional M&A activity towards the end of 2011," said Yousuf M. Saada, head of financial research at Zawya.

Regions covered in the study include the GCC and Levant, in addition to Egypt, Morocco, and Tunisia.

UAE activity

The UAE took the lead in terms of deal volume with 32 deals in the first half of 2011 compared to nine in the first half of 2010, resulting in an increase of 226 per cent. Targeted deal values in the UAE amounted to $2.07 billion in the first six months of the year compared to $633.91 million in the same period last year

Saudi Arabia saw the number of deals increase by 118.18 per cent from 11 in the first half of 2010 to 24 in 2011. Deal value in Saudi Arabia increased by 266 per cent from $467.2 million to 1.71 billion in the first half of 2011. There were four external investors, with 20 regional and domestic players, clearly demonstrating a huge appetite within the region to invest in Saudi Arabia.

The report also shows that the M&A activity surged in non-GCC countries with Tunisia, Lebanon and Morocco being the main drivers. The total targeted value of M&A activity in the Mena region during the first six months of 2011 reached $9.29 billion, out of which the GCC countries contributed 56 per cent for a total of $5.23 billion.

The largest M&A transaction in the first half of this year was worth $5.06 billion when Abu Dhabi-based International Petroleum Investment Company (IPIC) acquired an incremental 48.9 per cent equity stake in Spain's Compania Espanola de Petroleos, (Cepsa).

This eclipsed the largest deal of the first half of 2010, which was between Ezdan Real Estate Company and International Housing Company, marking a $3.33 billion deal value in return for a 100 per cent equity stake in IHC.

February peak period

One of the most prominent events of the first half of 2011 was the cancellation of etisalat's acquisition of a 46 per cent stake in Zain Kuwait for $12.09 billion, the largest M&A deal in the Mena region.

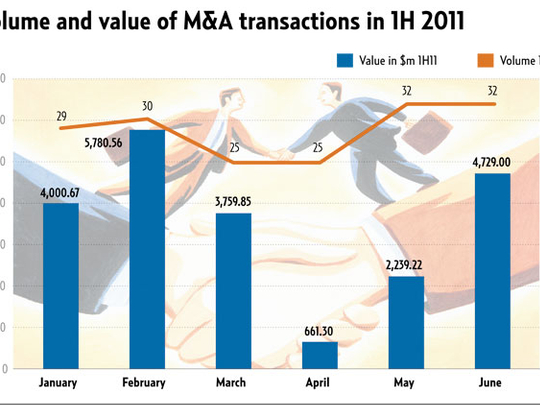

February 2011 was the most productive month in the first half of this year with 30 transactions totaling $5.78 billion. This eclipsed January 2010's 13 transactions with a total value of $5.05 billion.

The Zawya report on regional M&A comes in contrast to the 24 per cent decline in M&A transaction values reported by Zephyr, the M&A data base. A recent study by Thomson Reuters also reported that a 33 per cent decline in M&A activity in the region with M&A fees earned by investment banks declining 63 per cent compared to the first half of last year.