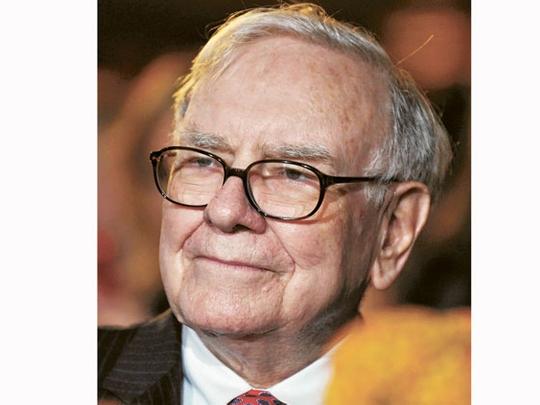

Omaha: Warren Buffett's Berkshire Hathaway Inc., holder of a derivatives portfolio worth more than $60 billion (Dh220 billion), said third-quarter profit declined 7.7 per cent on losses tied to equity-linked contracts.

Net income fell to $2.99 billion, or $1,814 a share, from $3.24 billion, or $2,087, a year earlier, Omaha, Nebraska-based Berkshire said on Friday in a statement. Operating earnings, which exclude some investment results, were $1,692 a share, missing the $1,736 average estimate of five analysts surveyed by Bloomberg.

Berkshire posted a $146 million derivatives loss, compared with a gain of $1.73 billion in last year's third quarter. Buffett, 80, seeks to add to earnings from Berkshire's insurance, energy and consumer-goods units by placing derivative bets on equity indexes and the solvency of borrowers.

The equity-related contracts produced a $700 million loss and were driven down by a weaker US dollar, Berkshire said.

Danger

"I'm sure Warren Buffett's appetite for derivatives is less than it was," said Michael Yoshikami, who oversees about $1 billion, including Berkshire shares, at YCMNet Advisors in Walnut Creek, California. The loss "suggests the danger of derivative contracts in the first place, which probably will limit the number of derivative bets they make in the future."

Credit-default swaps, derivatives in which Buffett bets on the solvency of borrowers, gained $519 million in the third quarter after posting a $1.44 billion profit a year earlier. The loss on equity-related contracts compared with a $220 million gain in the third quarter of 2009.

Book value, a measure of assets minus liabilities, rose in the quarter to $149.7 billion from $142.8 billion on June 30 as earnings and stock advances boosted capital.

Berkshire had $34.5 billion of cash as of September 30, compared with $28 billion three months earlier. The stock portfolio was valued at $57.6 billion at the end of the third quarter, up from $54.7 billion on June 30.

Berkshire gained $1,080 to $125,560 in New York Stock Exchange trading yesterday and has risen about 27 per cent this year. The Standard & Poor's 500 Index, which rose 11 per cent in the third quarter, has gained 9.9 per cent this year.

Berkshire's derivative loss for the year widened in the third quarter to $1.91 billion. In the first nine months of 2009, the gain was $2.57 billion.

Insurance underwriting profit declined to $199 million from $346 million a year earlier. The reinsurance unit swung to a loss as the weakening of the US dollar increased the cost of liabilities in other countries. The gain at car insurer Geico rose to $289 million, from $200 million a year earlier.

Investment income, which includes stock dividends, bond coupons and interest payments on investments in Goldman Sachs Group Inc. and General Electric Co fell 13 per cent to $1.24 billion at Berkshire's insurance operations.

Berkshire hired hedge-fund manager Todd Combs last month to help with investments as Buffett, the company's chief executive officer, prepares the firm for his eventual departure. Buffett, who manages stock and bond holdings as well as derivatives, hired Combs "to handle a significant portion" of Berkshire's investments, the company said on October 25.

Berkshire enters into derivatives contracts with investors seeking protection against equity-market declines and defaults on municipal debt and high-yield corporate bonds. Berkshire collects premiums on the contracts, some of which mature more than 15 years in the future. The company typically reports gains when stocks rise and the price of default protection falls.

Currency

The dollar's weakness against the yen and the euro in the third quarter may have contributed to the equity-derivative loss, according to Stifel Nicolaus & Co, where analyst Meyer Shields recommends selling Berkshire shares. Buffett has said his contracts are tied to Japan's Nikkei 225 Stock Average, the Eurostoxx 50 Index, the UK's FTSE 100 and the S&P 500.