1. Open an offshore account. A person’s single and joint bank accounts will be automatically frozen upon death, leaving the family with no access to money. Having a bank account outside the jurisdiction of the UAE and home country means the family can withdraw money for survival and emergency expenses

2. Put some money in a bank account under a family member or loved one’s name.

3. Set aside emergency funds overseas.

4. Have an honest and open discussion with your spouse or family about your finances.

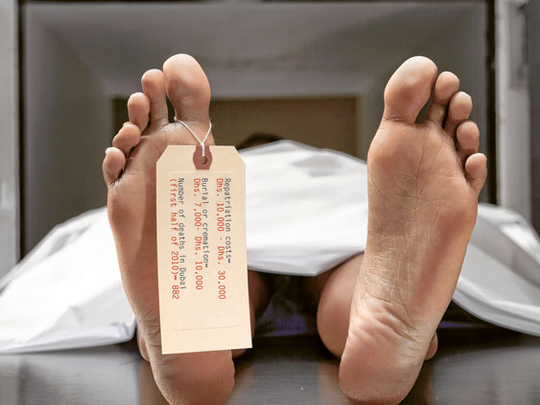

5. Draw up a will detailing how to split your assets among inheritors. Will cost, Dh3,000; legal costs, Dh1,500-Dh2,000; execution of will in court, Dh45,000-Dh50,000.

6. Buy life insurance: Check the benefits, clauses and time period between the death and the payment. Choose between term insurance and whole of life insurance. You can opt for Islamic life insurance (Takaful) or term insurance which does not rely on investments and is Sharia compliant. Men, older people, and those with risky hobbies have higher premiums. Suicide within the first two years of buying a policy is not covered.

7. Get free advice. Some lawyers and funeral service providers give free advice on steps to take after the person’s death.

8. Approach local non-government organizations or your embassy for financial assistance.

9. Death is the ultimate abandonment. Bereavement counselling is available in Dubai for those unable to deal with loss of a loved one. A 90-minute session costs Dh450.

10. Check your work package if you have funeral and repatriation coverage. Check medical insurance for repatriation costs.

11. Save about 25 per cent of your salary, not just for your death but for your family’s life.

12. Before the deceased’s account is unfrozen, debts must be paid out first from those accounts. Pay your debts regularly to avoid from piling up.

13. Make a list of your assets, liabilities, insurance, stock or investments here and abroad, so the will executor knows where to locate the money.

14. Get off your partner’s visa and onto your employer’s sponsorship if you are working. The deceased’s visa gets cancelled and you will have to leave the country.

15. Don’t rely on your company for death and services benefits.

16. Nominate beneficiaries for your life insurance so they can receive the money.

17. Draft a will and email it to your relatives. Keep the original at home or with a lawyer for records.

18. Write how you would like your body dealt with after death.

19. Write a list of emergency contacts.

20. It is cheaper to be cremated in the UAE than repatriated. Budget airlines do not provide a repatriation service.