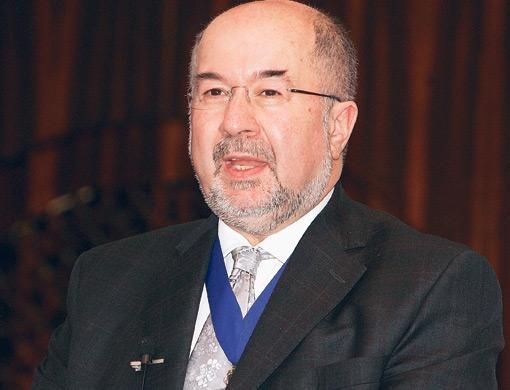

Dubai: A UK sukuk bond in sterling may well be offered "sooner rather than later", according to the Lord Mayor of the City of London. Ian Luder was at the Dubai International Financial Centre with his delegation, and later addressed students in the Executive MBA programme at Cass Business School.

Twenty-two banks in London already offer Islamic finance services, an indication of the growing importance of Sharia financial products for the UK's financial services industry. Luder emphasised though that there must be an agreed world standard for Islamic finance products for the market to meet its potential.

"We are still working towards amending the legislation for the treatment of the repayment on the sukuk of the coupon, so it's in line with the treatment for the interest on a normal coupon," said a delegation member.

At the same time, it was underlined that though there are no "special favours for Islamic finance in the UK, there are no unnecessary impediments in place either."

Earlier in the day, Luder and his delegation met with senior officials at DIFC to discuss the potential for close interaction with the City of London.

"Our meeting with the Lord Mayor of the City of London was an opportunity to discuss the significant opportunities for cooperation between the financial industries of UK and the UAE.

"Both our financial hubs have gained considerable knowledge and expertise in the course of their development and both DIFC and the City of London can work together to use this knowledge for the development of key financial sectors in which we have a mutual interest, especially Islamic finance," said Nasser Al Sha'ali, chief executive officer of the DIFC Authority.

The Lord Mayor is head of the City of London Corporation and his key role is to promote the interests of the UK financial services industry, especially in the current economic conditions.