Dubai: The public revolts against regimes across the Middle East and North Africa from the beginning of last year have taken their toll on the profitability of the banking and financial services industry in the region. Bankers and analysts say the impact is likely to linger for many years.

Rating agencies and international organisations such as the Institute of International Finance (IIF) and the International Monetary Fund (IMF) have projected a gloomy outlook for the banking sectors of the affected countries, particularly Egypt and Lebanon.

Last month, rating agency Moody's changed its outlook for Lebanon's banking system to negative from stable. Moody's cited slower economic growth following a sharp GDP deceleration in the first half of 2011; downside economic risks due to regional political uncertainty, particularly in Syria; and the banks' asset and loan exposures to other regional countries experiencing political unrest and/or an economic slowdown such as Egypt and Jordan as the rationale for the rating action.

"Although non-performing loans (NPLs) of Lebanese banks improved during 2006-10, it is now more likely that this trend will reverse. In addition to the weakened domestic operating environment conditions, the banks (predominantly the larger ones) have material exposures to countries undergoing political transition or experiencing political unrest (particularly Syria and Egypt)," said Stathis Kyriakides, Assistant Vice President and analyst at Moody's.

Debt exposure

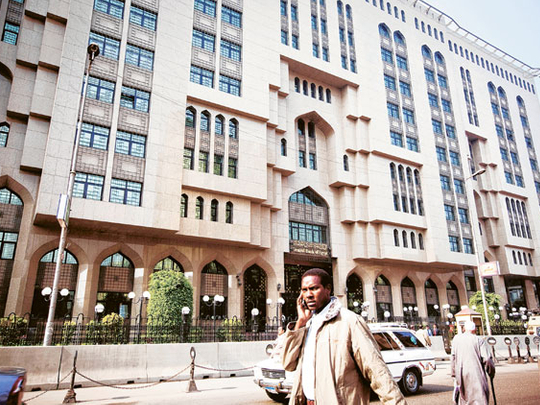

Recently, Moody's downgraded five of Egypt's biggest banks amid concerns over their large holdings of its sovereign debt and the transitional government's ability to support the banking system. The banks in question — National Bank of Egypt, Banque Misr, Banque du Caire, Commercial International Bank, and Bank of Alexandria — had both their local currency and foreign exchange deposits downgraded by the rating agency.

The decision was based on its assessment of the banks' exposure to Egyptian government bonds — which stand at between four and seven times their equity bases, according to Moody's — and doubts about the government's ability to provide systemic support if required.

The decision follows the downgrade in November of Egyptian government debt by both Moody's and Standard and Poor's.

Rating agencies are worried about the large quantities of Egyptian government bonds on the balance sheets of the country's banks.

"This has increased the Egyptian banking system's "susceptibility to event risk in the context of Egypt's eroding credit fundamentals, signalling the increasing convergence of default risks between Egypt's government rating and bank ratings," Moody's said in a report.

The Egyptian central bank has struggled to support the currency since the revolution early last year — with outflows from its foreign exchange reserves peaking at $3 billion (Dh11 billion) in the spring.

"Efforts to protect the currency have resulted in a big outflow of foreign exchange reserves. With the reduced potential to borrow outside, domestic banks will have to bear the burden of public borrowing programmes," said George Abed, IIF's Senior Counsellor and Director for the Middle East and Africa.

Rating agency Standard and Poor's recently said it is maintaining a high-risk assessment of Egypt's banking sector due to political and economic uncertainty. S&P's has given Egypt's banks a Banking Industry Country Risk Assessment score of 8 out of 10, reflecting what it says are the country's risks in resilience, credit and econ-omic imbalances.

A statement from Standard and Poor's claimed the main risks facing Egyptian banks relate to their operating environment. "Egypt is sensitive to a sharp econ-omic downturn because of the low level of wealth in the country (GDP per capita is below $3,000) and the fast-growing population. Public finances have also weakened. Combined, these factors are likely to weaken asset quality and profitability indicators for banks," S&P said in a recent rating update.

Turn-around?

Egyptian bankers are, however, optimistic about a near-term turnaround. Tarek Amr, chairman of the Federation of Egyptian Banks, said recently that despite economic and political difficulties, Egypt had a resilient economy.

"We have a very strong banking sector which continues to resist different economic and political crises," he said. "Strong local demand continues to also provide a strong base for economic activities."

Bankers from other countries affected by the political uprisings argue that the impact of the regional political turmoil will be temporary and the sector is likely to gain in the medium-to-long-term because of the transition to democracy and reform.

Political stability

Senior bankers from Tunisia, Libya and Egypt, speaking at the 15th Annual Arab Banking Conference held in Beirut in November, said political stability will be key to economic recovery in their countries.

"Completing the transition to democracy is the most important step to restore investor confidence essential to foster growth, job creation and economic recovery," Mustafa Nabli, Governor of the Central Bank of Tunisia, said in his keynote speech. Nabli said the situation had started to improve in Tunisia after the country succeeded in holding parliamentary elections, deemed free and fair by the international community.