Dubai: Grouping countries according to common economic characteristics, and giving them a catchy acronym, is the latest phenomenon among analysts and investors.

The fast growing emerging markets of Brazil, Russia, India and China are commonly known asBric. The newest group is Civets — Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa — who are expected to be the next group of fast-growing economies.

But is there a cluster of Muslim countries that can capture the attention, imagination and dollars of global economists, research analysts and investors?

Civets includes two of the 57 Muslim countries, Egypt and Turkey. But practitioners, academics, and students of the Organisation of Islamic Conference (OIC) countries have been seeking a grouping of only Muslim countries. Obviously, they must be linked by a common growth story, while the group must have a recall factor and a limited number of countries.

Linkages

We already have established Muslim country linkages, including some with non-Muslim majority countries like India, including the six-country GCC (Gulf Cooperation Council), the 22 countries of Menasa (Middle East North Africa and South Asia), the five of the CIS (Commonwealth of Independent States), the five of the Maghreb (North Africa), the 23 Silk Route countries, and the 57-country OIC.

Although equity and credit default swap indexes exist for some of these groupings, like the GCC, they have not captured the attention of international investors or research analysts.

But as India has the second largest population of Muslims, after Indonesia, why is it not part of the OIC? India has more and larger Sharia-compliant listed companies than its neighbours Pakistan and Bangladesh combined.

Some have suggested that one of the Group of Seven (G7) wealthy countries, having historical commonwealth ties to the Muslim world, could be an anchor for a proposed grouping. For example, United Kingdom or France for the GCC or Maghreb, respectively, but to date nothing has materialised. This rationale may have more to do with capturing the "nostalgic notion of what once was" versus any practical benefits. The failure of these groups to capture the imagination may be attributed to geographic concentration risk (GCC), risky frontier markets (CIS), being too cumbersome (OIC), and — now — too politically risky (Maghreb).

Adjusted opportunity

It may also be due to Muslim countries not faring well on country corruption indexes (Transparency International), internal strife in many Muslim countries, capital flight, brain drain, below investment grade ratings from international agencies, and better risk adjusted opportunities in other emerging markets.

There is a growth country linkage story within the OIC that captures conventional and Islamic finance, and the halal industry. These countries could lead the Muslim world in knowledge based economies, and be a catalyst of real development.

Sami stands for Saudi Arabia, Ankara (Turkey), Malaysia and Indonesia. These are emerging markets that happen to be Muslim countries on the old Silk Route.

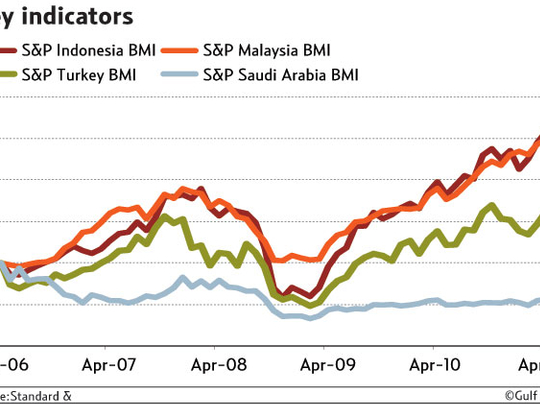

Sami also meets the three-pronged test of: (1) growth country stories, (2) being a small cluster, and (3) having a recall and recognition factor. The table shows the S&P index performance of the four countries over the last five years.

No political minefields

The investment, trade and financing opportunities in these countries are more robust and they have distanced themselves from the political minefields commonly found in emerging markets.

Much like Bric indexes convey a pulse of health, opportunities and fund flows, the Sami indexes would present not only "conventional," but Islamic and halal food (consumer non-cyclical sector) opportunities, information, insights and even could jump-start Islamic trade finance.

Indexes that obtain traction over time have companies that become ambassadors of their countries.

For example, Petro-China, Embraer (Brazil) and Wipro (India), have become global brands and country ambassadors in short periods of time.

In the Muslim world, companies like Petronas (Malaysia), Emirates airline (Dubai), Savola (Saudi Arabia), Ulker (Turkey), Indomie (Indonesia) can be the global ambassadors of Sami.

General observations

SAMI countries

1. Three are in the Group of Twenty (G20) economically significant countries: Saudi Arabia, Turkey and Indonesia. But, these countries are also the anchors for their respective geographies; Saudi Arabia for GCC (6) countries, Indonesia for Asean (10) countries, and Turkey for (5) CIS countries and beyond. These regions, especially GCC and CIS, may be viewed as early rapidly developing economies.

2. Malaysia is the recognised global leader in both Islamic finance and halal food. The Malaysian Islamic banks and Sukuk origination and issuance weathered the financial crisis better than most emerging countries.

3. Saudi Arabia is the largest oil producer and largest halal food importer. The political crisis in the Arab world has shown the importance of Saudi Arabia, as the country stepped up oil production to more than offset the loss of Libyan oil from the markets.

4. Indonesia has the largest Muslim population and is growing. The Jakarta Composite Index was the best performer in the Asia-Pacific region, outpacing the Shanghai Composite Index and the Hang Seng, up 46 per cent for year 2010

5. Turkey is the ‘sizeable' bridge between the east and west, and is currently led by an Islamist party.

The writer is the Global Head of Islamic Finance at Thomson Reuters. The opinions expressed in this column are his own.