Dubai: In just a few weeks, the Indian rupee has earned the dubious distinction of being the worst-performing Asian currency this year and the third worst-performing in the world.

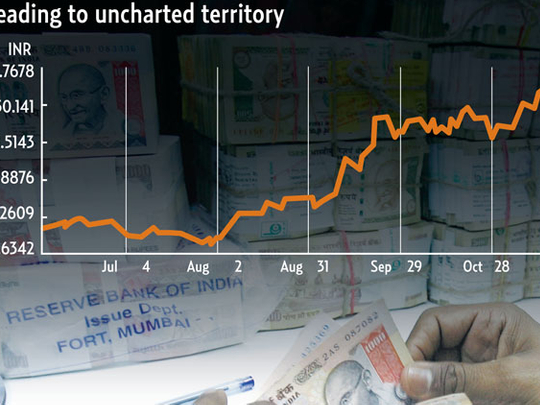

The rupee slipped to 51.20 (Dh3.59) per dollar, a 32-month low last Friday. Although there are varying views on the speed of the rupee's decline, analysts and currency traders agree that the rupee's weakness will persist and the currency has yet to hit bottom.

"There is a big supply demand mismatch of foreign exchange in the Indian market," said Sudhir Shetty, chief operating officer of UAE Exchange Centre.

"While foreign portfolio investors have liquidated their positions on the stock market and repatriated the money, there has been a big spike in demand from importers for dollars. Exporters are keeping forex earnings offshore, expecting a further decline. All these factors are adding to the rupee's woes."

Many factors

The rupee has fallen 15 per cent since July on worries about the European debt crisis and concern about the slowing of the domestic economy as a result of high interest rates caused by 13 rate hikes by the Reserve Bank of India (RBI) that failed to dent near double-digit inflation.

Analysts said the Eurozone debt crisis is just one of the many factors that have accelerated the rupee's recent decline and several domestic factors are also forcing the currency down.

"[A] high inflation rate, coupled with high interest rates have adversely impacted corporate performance which in turn has resulted in equity markets tanking about 17 per cent this year, forcing may foreign investors to withdraw their investments [and] adding pressure on the rupee," said Pradeep Unni, senior relationship manager at Dubai-based Richcomm Global Services DMCC.

With India being a net importer, with oil constituting the largest portion of its import bill, the rupee's weakness is likely to add to inflationary pressures and raise the current account deficit.

The deficit has to be funded through equity (foreign direct investment) or through borrowings. A spike in deficits will likely further erode investor confidence and work against the rupee.

Despite the threat of the rupee falling into a vicious cycle of low growth, investment flight and high deficits, the RBI has been reluctant to intervene in the currency markets.

India has foreign exchange reserves of around $320 billion (Dh1.1 trillion).

Last week RBI's deputy governor Subir Gokarn said it would be a "risky strategy" if the bank were to "try and resist or try and do something for which we do not have a capacity."

Despite such a public stance, analysts believe that the rupee's exchange rate at 52 per dollar will be a key resistance level, and if breached, the RBI is likely to restore it through active market intervention.

NRIs rush to exploit currency's misfortune

Dubai: In recent weeks exchange houses have been experiencing a big rush of non-resident Indians (NRIs) seeking to remit money back home at the prevailing attractive exchange rates.

"All those who have some money to spare are taking advantage of the attractive exchange rates. Some are even borrowing money in dirhams and sending [it] home," said K.V. Shamsudin, director of Barjeel Geojith Securities.

In the last three months, an estimated $21 billion (Dh77.1 billion) has been remitted to India by NRIs around the world. Most of the remitted funds are finding their way into non-resident ordinary (NRO) rupee deposits. In September, a record $565 million flowed into such NRO accounts — the highest in at least 30 months.

"Domestic banks are offering attractive rates of up to 10 per cent per annum on NRO fixed deposits. While many NRIs are temporarily parking the remittances in bank deposits a substantial portion will eventually be invested in real estate," Shamsudin said.

Local currency exchange houses said in recent weeks that big ticket remittances have been dominating their transactions.

Indian banks expect rising NRO inflows as the interest rate differential between developed nations and India is at an all-time high, bankers said.