Dubai: A significant majority of professional investment advisers based in the Gulf region plan to increase their company's or clients exposure to emerging market equities, according to the Gulf Professional Adviser Survey (GPAS) conducted by Insight Discovery, a Dubai-based market research company.

The survey commissioned by Arqaam Capital, AXA Investment Management, Friends Provident International, Northern Trust and Schroders interviewed 221 professional investment advisers and found that almost 60 per cent them have a preference for emerging market equity among the universe of asset classes while 31 per cent are looking to keep the exposures unchanged.

"There are a number of other asset classes to which professional advisers are lifting exposures. These include emerging markets fixed income and GCC/Mena (Middle East and North Africa) equity funds. By contrast, allocations to developed markets fixed income, funds-of-hedge funds and single-strategy hedge funds are falling," said Nigel Sillitoe, CEO of Insight Discovery

The survey results show about 80 per cent of professional advisers across Mena either do not use Sharia-compliant products at all or, if so, to a limited extent.

Highly rated

Although there are a number of international asset management companies who are selling funds in Mena, none has yet developed a clear domination of the market. JP Morgan, Franklin Templeton, BlackRock/BGI, HSBC and Fidelity are the international asset management companies that are most highly rated overall by the professional advisers. BlackRock/BGI, Invesco, JP Morgan and Franklin Templeton appear to have each dealt with over 40 per cent of professional advisers over the last 18 months or so.

Among the regional asset managers, Franklin Templeton is the most respected manager of MENA/GCC products. Franklin Templeton and EFG Hermes are the most respected asset management companies in terms of GCC/Mena products. However, Shuaa and Emirates NBD are the most popular regional asset management companies over the last 18 months. The survey shows that each of these two companies was supported by about one quarter of professional advisers across the region since mid-2009.

The survey observes that the Mena region is one of the last frontiers for marketers of investment funds, life insurance and organised savings products in general. As is the case in the Asia Pacific region, capital pools, which are already large, will continue to grow strongly over the next decade. It is well understood that the Mena countries will continue to generate current account surpluses (mainly) through the export of hydrocarbons to the rest of the world.

Very positive

"Although we haven't seen a growing preference for GCC equity and fixed income funds, there is a genuine and substantial interest in these assets amongst our GCC clients. In response to queries from our clients, we recently held an investment seminar at which Emirates NBD presented the case for the regional markets and the response from our clients was very positive. However at this time, this is not something our advisers seem to be increasing exposure to," said Spencer Lodge, Regional Director at P.I.C. de Vere, an independent international fin-ancial consulting group.

Mena is an obvious target market for investment funds that are Undertakings for Collective Investment in Transferable Securities (UCITS) which are domiciled in Luxembourg or Ireland.

Promoters of investment funds in a variety of countries that are distant from Europe, such as Chile, South Africa and Hong Kong, have found that the UCITS ‘brand' is trusted, and is synonymous with first class regulation and transparency. In each of the Mena countries there are local commercial banks and insurance companies with well-known brands and established distribution networks. These organisations are well placed to distribute UCITS funds.

Huge advantage

"Mena investors naturally have an orientation towards international asset classes. This is partly because domestic financial markets across the region are underdeveloped. Mena investors can invest in the US, Hong Kong and a number of other countries with minimal currency risk — thanks to the currency pegs linking their currencies to the US dollar. In this respect, the Mena investors have a huge advantage relative to their counterparts in China or Japan," said Sillitoe.

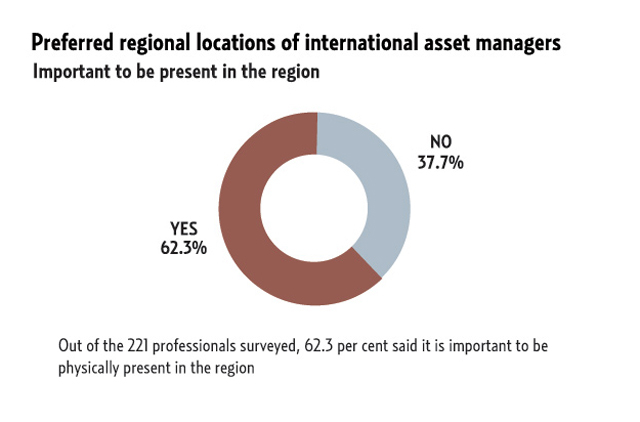

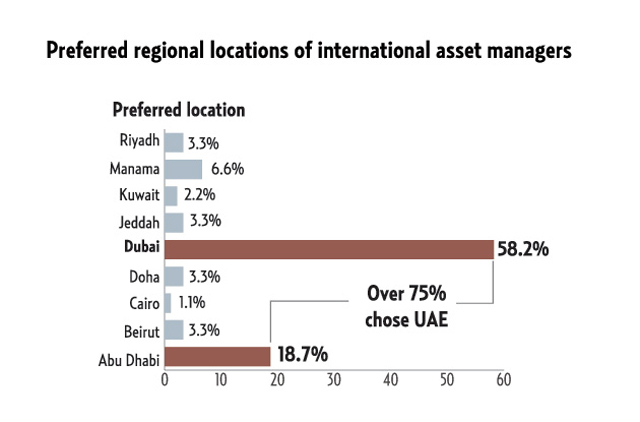

The survey shows open-architecture (advisers offering products created by third party) is becoming more established in the UAE but is not fully accepted in Qatar, Kuwait and Saudi Arabia. The trend towards open-architecture platforms, often with a guided ‘best of breed' approach, will favour the international asset management companies (Fidelity, Invesco, JP Morgan and Schroders) which are physically based in the region and can provide tactical sales support. For most investment advisers in the Mena region, Dubai remains by far the most important centre for the promotion and distribution of investment funds.

Dubai According to a recent study by JP Morgan, future gross domestic product growth is likely to be driven by factors such as growth in physical capital stock determined by new capital investment, growth in the labour force and the quality of human capital, and technological progress.

Based on International Monetary Fund forecasts for the next five years, the growth outperformance of emerging markets is expected to widen. The Group of Seven (G7) GDP growth rates have been declining from 3 per cent to 2 per cent and the tax of the current financial crisis on debt-laden economies does not bode well for the near future.

In turn, emerging market economies are expected to make up 50 per cent of global GDP by 2017.

"The potential for growth in countries such as Brazil, Russia, India and China is much more than that of the Western world," said Spencer Lodge, Regional Director at P.I.C. de Vere, an independent international financial consulting group .