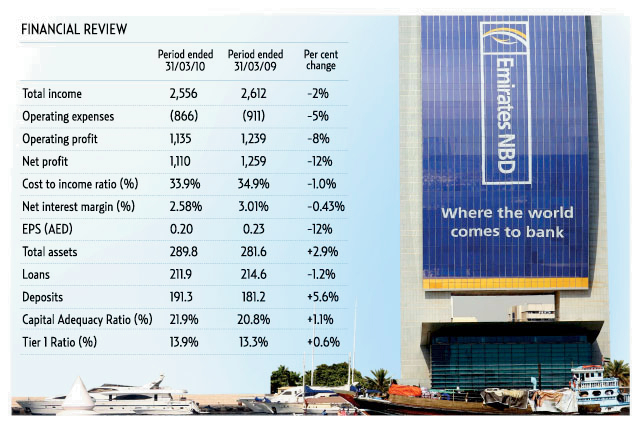

Dubai: Emirates NBD, the largest bank in the Gulf region in terms of assets, reported a net profit of Dh1.11 billion in the first quarter of 2010, 12 per cent down from Dh1.259 billion reported in the same period last year.

The bank's first-quarter results were above the average net profit forecast given by analysts of Dh617 million.

The results were an improvement on the fourth quarter, when profit slumped to Dh178 million.

"Emirates NBD's core business remains strong and the successful completion of the merger at the end of 2009 positions the bank to continue to realise more success and provides the ability to capitalise on value-adding opportunities for our shareholders," Ahmad Humaid Al Tayer, chairman of Emirates NBD, said in a statement.

Lower impairment losses

Deepak Tolani, an analyst at Al Mal Capital said yesterday that a pick up in marked-to-market investments and a decline in impairment losses helped the bank to report better than expected results.

Tolani had projected the first quarter profit at Dh933 million. Total assets up were 3 per cent at Dh289.8 billion at the close of the first quarter compared to Dh281.6 billion at the end of 2009.

Customer loans were down 1 per cent, weighing in at Dh211.9 billion compared to Dh214.6 billion at the end of 2009.

"Credit metrics remain in line with our expectations and our focus on balance sheet optimisation has yielded a significant improvement in our funding profile while maintaining strong capitalisation levels," Rick Pudner, Emirates NBD's chief executive officer, said.

Net interest income declined 10 per cent to Dh1.729 billion in the first quarter of 2010 from Dh1.928 billion in the first quarter of last year.

The net interest margin declined to 2.58 per cent from 3.01 per cent.

Deposit spreads rise

The margin decline resulted mainly from reduced loan and treasury spreads partly offset by increased deposit spreads.

The bank's bad loan provisions rose 20 per cent from a year earlier to Dh554.7 million taking its non-performing-loans-to-total-loans ratio to 2.63 per cent.

Overall loans fell 1 per cent from December to March, while bank deposits grew 6 per cent.

Emirates NBD officials yesterday said that the provisions reported in the first quarter do not include any relating to its loan exposure to Dubai World, but insisted that negotiations are moving in the right direction.

"The UAE Central Bank has issued a statement allowing banks to withhold making provisions on Dubai World loan exposure in the first quarter," Pudner said during a conference call.

Non-interest income recorded a year-on-year improvement of 21 per cent to Dh827 million in the first quarter of 2010.

The increase was largely driven by a partial reversal during the quarter of mark-to-market losses on investment and other securities reported during 2008, offset to some extent by lower fees relating to trade finance and underwriting.

On the liability side, customer deposits were up 6 per cent at Dh191.3 billion in the first quarter of this year from Dh181.2 billion at end of last year.