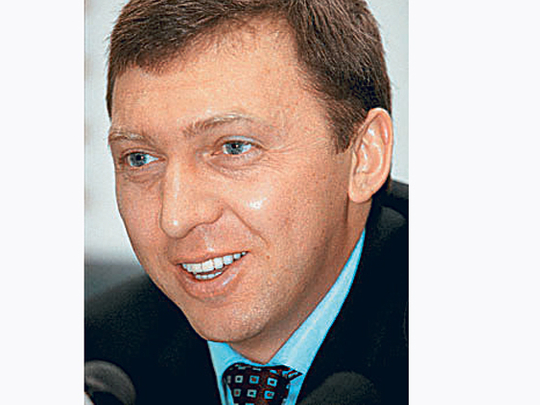

Moscow: Billionaire Oleg Deripaska, whose United Company Rusal became the first Russian company to sell shares in Hong Kong, picked the securities unit of Bank of China to help manage the sale of mining company SMR, according to two people familiar with the plans.

BOC International Holdings has the mandate to manage the Hong Kong initial public offering, said the people who declined to be identified because the talks are private. The bank may also help arrange the IPO of Deripaska's power generator EuroSibEnergo, which is yet to decide where to list, the people said, adding the sales may take place this year.

Any sale in Hong Kong will need to convince investors that the companies, owned by Deripaska's EN+ Group Ltd., won't repeat Rusal's 21 per cent drop since its listing in January, the worst IPO performance on the exchange this year. Rusal may pave the way for as many as 10 Russian companies to sell shares in the city, bourse operator Hong Kong Exchanges and Clearing Ltd. said.

"EN+ is still interested in the public offering of shares of its assets, but we won't discuss any details," Andrei Petrushinin, spokesman for EN+, said by phone in Moscow.

Rusal, the world's biggest aluminum producer, dropped 0.4 per cent to HK$8.50 (Dh4) at 12.29pm in Hong Kong. The shares touched a low of HK$7.37 on February 18, down from the IPO price of HK$10.80.

BOC International will be the sole sponsor of the SMR share sale, said one of the people.

An official in the public relations department of BOC International, who didn't want to give her name, declined to comment. She said spokeswoman Maria Kong was out of the office.