Dubai: With Bahrain being the latest country to double its value-added tax, the Gulf’s highest rate after Saudi Arabia, analysts validate the scenario in the GCC.

Bahrain approved hiking its value-added tax to 10 per cent from 5 per cent earlier, a member of parliament said on Wednesday, in line with earlier reports. The Bahrain Parliament recognised the measure was "a critical pillar of the kingdom’s fiscal balance programme". However, Bahrain wasn't the first to do so in the GCC.

Saudi Arabia tripled its value-added tax (VAT) rate to 15 per cent last year to bolster state revenue when oil prices slumped. The UAE and Oman imposed a 5 per cent VAT under a common 2018 framework by the GCC. Kuwait and Qatar are yet to implement the tax.

“Boosting the tax take is a high priority, particularly for the countries with the least fiscal space and reserves, such as Oman, Bahrain and, to a lesser extent, KSA,” analysts at consulting giant PricewaterhouseCoopers (PwC) had noted.

“However, there are risks that the increasing cost and complexity of taxes could weigh on local businesses, particularly during this difficult period of recovery from the pandemic.”

Spurred by the COVID-19 pandemic, lower oil prices, and a bigger global shift to clean energy, GCC governments are going from no tax to low tax and offering incentives to retain talent across the region, analysis from PwC’s Middle East Economy Watch had revealed in its 2021 report.

The tripling of VAT in Saudi Arabia in July 2020 and the launch of VAT in Oman in April should see the take double again to about $47 billion (Dh172 billion) in 2021, nearly half of all GCC taxation, multiple research show.

VAT has been the main way that Gulf governments have introduced taxation. Currently it exists in three countries and the excise duties on ‘harmful goods’ are applied everywhere except Kuwait.

In comparison, VAT and excise tax accounted for more than a quarter of total tax revenues at $24 billion (Dh88 billion) in 2019. In Saudi Arabia, expat levies phased in since 2017, raised around $15 billion (Dh55.1 billion) in 2019.

VAT, excise duties and expat levies have been introduced as customs duties, which accounted for over a third of regional tax in 2016, have declined in nominal terms.

Effective 2017, Saudi Arabia implemented an expat levy which is currently applicable to dependents if the company they work for hires more foreign nationals than Saudi nationals.

The GCC is still a “very low-tax environment by international standards” reiterated the analysts at PwC. “OECD taxes, by comparison, average 34 per cent of GDP and even KSA’s tax take is still in the bottom decile globally.”

What is the effect of increasing VAT on the economy and my savings?

For instance, in the UK, VAT brings in around 17 per cent of total tax revenues each year. A rise in VAT would improve a government's finances and allow them either to borrow less or perhaps spending more on improving public services.

As a consumption-based tax, an add-on VAT would be shifted forward to consumers through higher consumer prices. By increasing consumer prices, the VAT also reduces real or inflation-adjusted salaries.

As with any tax, its effects on the economy would depend on how government uses the revenue, but all else equal, it would be better for the economy than hiking income tax rates.

To avoid disrupting the economy in the short run, the VAT proceeds is used in the early years to stimulate the economy, and central banks accommodate the VAT by letting the consumer price level rise.

General consumption taxes like VAT do not impose on savings but income taxes impose on savings and on the income from savings (interest). Moreover, several research show that general consumption taxes like VAT have only eventually encouraged savings, leading to increased investment and growth.

Also, studies show that general consumption taxes do not affect people’s decisions about whether or not to work, while the progressive income tax system make people reluctant to work since a higher tax rate will be imposed when people work harder and earn more.

General consumption taxes encourage savings and labour supply rather than income tax and subsequently have had a positive effect on economic growth worldwide.

VAT rates hikes are favourable for GCC countries

Although the revenue of consumption taxes has declined from 1965 to 2005 (most of the reduction has taken place between 1965 and 1975) because of a decrease in revenues from excise duties and other specific taxes, VAT revenue as a percentage of total tax revenue has been rising.

Recently, more governments have become interested in using a VAT to finance a larger share of government spending. Germany increased its VAT rate at the beginning of 2007, partly to finance a cut in social security contributions. The UK also raised its VAT rate for its consolidating budget’s balances.

Governments in developed countries have historically prioritised economic growth over all else. The trend of the increasing VAT rate may continue into the foreseeable future.

When it comes to understanding what sort of effects a change in the VAT rate has on the economy, many believe that a rise in the VAT rate will have a bad effect on aggregate public consumption and will weaken economic growth.

Similarly, a reduction in the VAT rate is sometimes an argument for strengthening economic growth by stimulating aggregate public consumption under a recession. However, economists also insist that the effect on aggregate public consumption and economic growth is limited.

Although there is a decline of aggregate public consumption and economic growth after raising the VAT rate, there is also an increase of aggregate public consumption and economic growth before the raise that will offset the negative effect after the raise.

Other economists say that people should not fear the negative effect of the VAT rate because the decline is only temporary. However, as the rise in the VAT rate will decrease people’s disposable income, the income effect on the aggregate public consumption is clearly negative because.

(Disposable income is the amount of money left to spend and save after income tax has been deducted. Individual consumers can use disposable income to help build their budget and understand how much money they can allocate to certain expenses.)

However, with GCC countries known for having zero to minimal income tax, this works in an expatriate’s favour.

Let’s understand the economic relation between VAT and public consumption

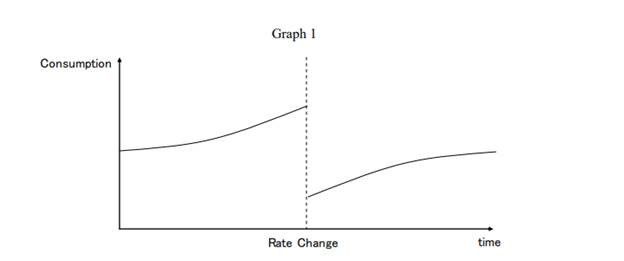

In theory, if there is an announcement that a government will raise VAT rate, people will buy items which can be stocked before the rise of the VAT rate. After the rise in the VAT rate, the aggregate consumption will decline because people will use their stock instead of buying new items.

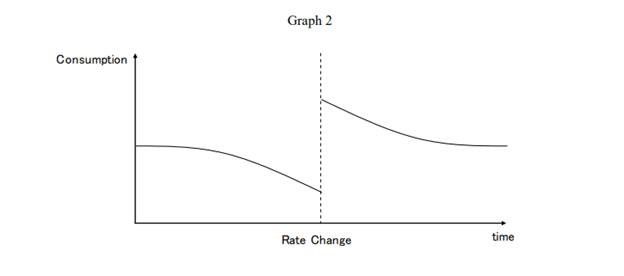

After that, the aggregate consumption will grow up gradually as people run out of their stock and need to buy new items. The movement of aggregate consumption when the VAT rate is raised will be like Graph 1. Similarly, the movement of aggregate consumption when the VAT rate is reduced will be like Graph 2.

It will be like Graph 1 when the VAT rate is raised and like Graph 2 when the VAT rate is reduced. Thus, the effect of the change of the VAT rate on aggregate consumption and economic growth is easily understood theoretically, but it is difficult to grasp the significance of this effect in practice.

It goes without saying that aggregate public consumption and economic growth are not determined only by the change in the VAT rate.

Bottomline: How will VAT affect my money and the GCC economy in the short- and long-term?

As a consumer, a higher tax will obviously lead to an increase in our everyday prices, resulting in more inflation and less purchasing power.

Fortunately, most VAT laws in the Gulf region provides for a broad scope of products that are basic necessities such as certain food items, medicines, rental of residential properties, healthcare, education and local transportation.

This will reduce the impact of the introduction of VAT on prices, especially for low- or medium-income groups, which comprises majority of the income groups.

When it comes to the economy, in the short term, the introduction of VAT may result in a decline in economic activity, largely caused by the fact that some consumers may have brought their purchases forward to avoid paying an additional VAT. This is an expected economic phenomenon.

For the long term, with the introduction of VAT, the governments will have an additional source of revenue and be (a little) less dependent on revenue from their primary sources.

This should reduce the economy’s budget deficit and allow the government to use the additional revenue to stimulate the economy where deemed necessary.