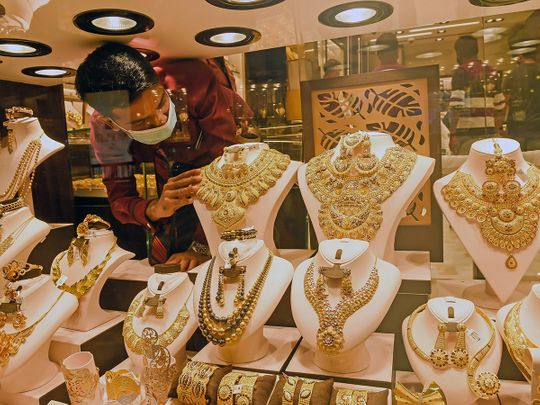

Dubai: Gold has stayed cheap since the start of August and the price of the yellow metal - increasingly popular among UAE residents - have dropped further in the past couple of weeks. Based on the current trends, analysts view how prices are expected to perform in the months and years ahead, whether it is a trend that is beneficial for consumers and investors alike.

Gold currently trades at $1,893 per ounce, representing a 0.65 per cent drop on the day. The gold market has been struggling to find momentum after hitting an all-time high in August and according to analysts, gold prices only have a bit more room to push modestly higher in the near-term and into year end - making it an ideal time to buy into it.

Gold to stay somewhat cheaper for now!

"The recent sell-off in the gold market brought back memories of the early days of the coronavirus crisis in March," said Carsten Menke, head of Next Generation Research at Switzerland-based Bank Julius Baer.

"As we expect a continued improvement of the economic environment despite a prevailing pandemic, safe-haven demand should fade and prices should move somewhat lower over the coming months. For now, it looks like prices have moved past their peak even though we acknowledge the fight against the corona crisis could sow the seeds for a new financial crisis in a few years’ time."

So, is it the best time for UAE residents to stock up on their preferred choice of investment, given that prices are seen low for now? The answer is yes, and even more so, because the consumer-beneficial downward trend isn't seen lasting for long as the prospects of gold reverting back to historic-highs and doubling over the next three years is getting comparatively shinier.

also see

- Cash, debit or credit: What’s the right mix for UAE residents this pandemic?

- UAE: Here are seven looming traps to avoid drowning in debt during COVID-19

- UAE: Shariah-compliant credit cards recommended to help avoid debt traps during COVID-19

- UAE: Common types of car and health insurance scams and how to avoid them

Price can still revert to end 2020 higher

Some analysts suggest prices can still revert to an upward trajectory soon, with prices all set to keep rising then on. Analysts at France-based lender Natixis said they see gold prices ending the year in a range between $1,920 and $1,950 an ounce, a gain of nearly 2 per cent from current prices. December gold futures, an indicator of the upcoming price trend, last traded at $1,915 an ounce, up 1 per cent on the day.

"Gold can not only get back to its historic highs next month, but also reach $2,200 by the end of the year. At that, it won’t be a surprise if this price will double in the next three years," said Victor Argonov, senior analyst at UK-based investment firm Exante. "It has become the best investment of the year."

"Central banks’ inflow of liquidity into the financial markets has made the metal fundamentally attractive," said Argonov. "It had been growing until August, then experienced a significant correction in September (down 4 per cent) and is now poised to grow again. The correction seems rather technical, encouraged by the need to fix the revenues."

What drove gold prices during COVID-19?

Rapidly rising infection rates and fears of broad-based lockdowns triggered a risk-off move in financial markets, putting pressure on equities and spilling over into the gold market as the US dollar strengthened, Menke explained.

"While a stronger US dollar and slightly higher – or rather slightly less negative – US real bond yields look like the triggers of the recent sell-off, neither the one nor the other is sufficient to explain it.. Instead, the explanation is rather that trend followers and technical traders have again exited the market after piling into gold during the record run in July and early August."

While gold is a safe haven which has proven its track record multiple times in the past it is likewise a financial asset which also attracts short-term and speculative traders and these traders are looking for short-term profits rather than gold’s safe-haven benefits, Menke further added. "They amplify price moves, to the upside as well as to the downside, blurring the fundamental picture of the gold market.

If not gold, what other 'safe' assets work?

Let's now look at it from the perspective of gold as an investment and whether for gold to move in such a way, is it unusal, and if it isn't, what is driving the price higher? Moreover, it's also worth looking at the possibility of, if not gold - which is widely considered as a safe-haven investment - what other 'safe' investments are worth piling your money in?

Investors should also look into exchange-traded funds that track gold prices. Global exchanges offer a variety of ETFs so you can pick the one that fits your strategy. The US dollar is, however, what the investors resort to when there’s a market collapse.

"While counterintuitive at first sight, such moves are not unusual for gold in times when the risk perception in financial markets changes and investors dump risky assets for US dollars. For many investors, the US dollar itself still is a safe haven," Menke added.

What still makes gold a 'safe-haven' favorite?

"Rather than the US dollar or real US bond yields, it is the investors’ demand for gold as a safe haven, which is primarily driving prices. And the demand is very much determined by the economic environment, whereby rising risks lead to increasing investments into gold and vice versa.

Higher gold prices and lower real bond yields are two sides of the same coin, reflecting a flight into safety. If the economic environment continues to improve on the back of today’s massive stimulus measures, we would not be surprised if the currently close relationship between gold and real US bond yields broke down."

Also, among other currencies, the Russian rouble and the Turkish lira, which both have had a rough ride recently, made big gains this week, when other emerging market currencies, such as the Mexican peso and the South African rand, also posted substantial gains - which analysts say could be a reflection of the markets expecting further US fiscal stimulus.

How did the COVID-19 crisis play into gold prices?

The fundamental picture is still dominated by the corona crisis, the related recession and the policymakers’ response to it. "When it comes to the issue of inflation, the question for gold is if the world will face good inflation, reflecting a pick-up in economic activity, or bad inflation, resulting from the afore mentioned loss of trust in the world’s currencies. Only the latter, which we see as a rather remote risk, would be good for gold," Menke further added.

"Looking back, we believe a short and sharp recession was fully priced into gold at lower than today’s levels.. We also believe that the summer rally was further fuelled by fears that the massive stimulus measures to fight the fallout from the corona crisis, often referred to as money printing, will inevitably lead to rapidly rising inflation, a loss of trust in the world’s currencies - most notably the US dollar - and a spike in gold prices.

"This money printing narrative nourished the bullish mood in the market and some even saw the recent weakness of the US dollar as a prelude to a longer-lasting debasement. We disagree. The dollar’s weakness was because of cyclical rather than structural reasons. Simply speaking, the US were dealing worse with the corona crisis than Europe, which is why the dollar was down versus the euro.