Wimbledon's best-selling VIP seats are now reselling for 6-figure profits

Resale prices for Wimbledon’s VIP seats now top £200,000 as investors join the action

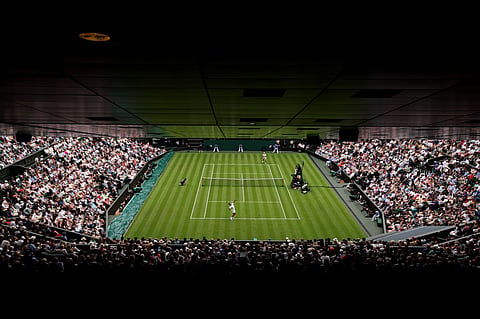

For two weeks every summer, the Centre Court at Wimbledon is where fans can watch the best tennis players in the sport’s most prestigious amphitheater. For some of the most expensive ticket holders, it’s not even worth attending.

That’s because owning so-called debentures – a guaranteed seat on Centre Court or No. 1 Court for a five-year stretch – has become so profitable that many are choosing to treat them as a tradeable asset, selling them on for a significant profit.

Centre Court debenture seats for between 2026 and 2030 are already changing hands at over £200,000 ($275,300) once the final installment is included, a profit of about 75% due to soaring demand from US buyers, according to market-maker Dowgate Capital. They went on sale last year for £116,000.

Debentures guarantee wealthy tennis lovers prime seats, as well as VIP access to lounges and restaurants. On days they can’t attend, they’re able to sell their tickets for the day – the only exchangeable tickets for Wimbledon. And investors are increasingly getting in on the action, buying up debentures solely to sell them for a profit.

“You get tennis fans coming to Wimbledon as the mecca of tennis from all over the world, particularly the US,” said Alex Cheatle, Chief Executive Officer of Ten Lifestyle Group Plc, a luxury concierge service that snags debentures for its high-net worth clients.

Valuations soar

Just as the valuations of sports teams and franchises have soared in recent years as private equity firms and billionaires race to get a piece, so has the price to attend flagship sporting events. Tickets for Premier League games have increased 800% since 1990, while a seat at the 2024 Super Bowl in Las Vegas was selling for an average of about $10,000.

Debentures are used by many sports clubs, from Arsenal Football Club to the Minnesota Vikings, to help raise funds often to cover construction costs. Wimbledon debentures were first sold in 1920, with the £100,000 raised used to fund the building of the Centre Court. Debentures have paid for everything from installing retractable roofs on the two main courts guaranteeing play when it rains – to building 12 new courts in the past six years. They will also be used to help fund an expansion plan to add 39 courts and an 8,000-seater stadium, though this has been met with local opposition.

Part of the £74 million the club expects to raise from the latest No. 1 Court debentures will go toward redeveloping exclusive areas for holders. These debentures that start in 2027 went for £73,000 each in May, a 63% increase from the previous round.

“They’re incredibly important,” said Fiona Canning, the associate director of finance and debentures at the All England Lawn Tennis Club, which manages the annual tournament. “They fund all the capital work on our site.”

Stupendous returns

The returns made trading debentures for Centre Court seats that start next summer work out at 75%. Since the first payment was made on May 17 last year, the FTSE 100 has risen less than 4% and the S&P 500 is up 17%.

Debentures are regulated because they’re considered financial instruments, similar to bonds. Regulation provides the buyer with protection and transparency, allowing buyers on the secondary market to see the prices they’re trading for.

One holder, according to Tim Webb, head of trading at Dowgate Capital, has already paid the first two installments of their Centre Court debenture – that doesn’t even start until next year – and recently sold it on for £160,000, netting a 121% profit. The new buyer would then have to pay the final installment of £43,500, taking their total spend to more than £200,000.

“There’s an awful lot of international buyers who want to come and watch Wimbledon,” said Webb. “It’s one of the most unique sporting events in the world.”

Roger Porter, a retired fund manager in London, has owned a pair of debenture seats on Centre Court for 20 years, particularly enjoying watching former British players Tim Henman and Andy Murray. The 83-year-old goes with family as often as he can, but isn’t able to attend every day, selling the ticket and more than making his money back.

“For the time that I’ve had a debenture, the value or sale proceeds for the ticket has always exceeded the purchase,” Porter said.

To attend Wimbledon, which began on Monday, fans can get lucky in the ballot for tickets at a cost of several hundred pounds. Those who can’t afford that or didn’t get their hands on a ticket can queue up for hours – often overnight – outside the venue to get a day pass to watch matches on the outside courts.

But the debenture seats, which can be at the same level as the Royal Box that hosts members of the monarchy, are the best tickets around. There are 2,520 of these on Centre Court, which has a capacity of around 15,000, and 1,250 on No 1. Court, the second-largest stadium with about 12,300 seats.

Reseller soar

Some debenture holders, like Francois, an architecture professional in London, never use their seats, instead choosing to sell the tickets. Last August, Francois — who did not want his full name to be used when discussing his own investments — purchased two 2021-2025 Centre Court debentures for £84,000. He anticipates a £15,000 profit from reselling the tickets for the single Championship he owns them for. To further increase his return, he also paid for meals at the exclusive Centre Court restaurant, allowing him to charge more for the tickets.

Ticket-buyers range from big tennis fans to those who “will try and maximize the value of every single ticket,” according to Natasha Bhatia, who founded Green & Purple, a ticket-exchange platform that uses Wimbledon’s colors in its brand.

Punters can snap up debenture tickets through resellers like Wimbledon Debenture Holders. The cheapest daily rate on that site for these tickets on No. 1 Court is currently £875. Debenture seats for the men’s final on Centre Court are on sale for nearly £10,000.

“The Wimbledon brand floats above all other tennis,” said Philippa Winton, director of Wimbledon Debenture Holders.

For the All England Lawn Tennis Club, debentures allow it to sell tickets years in advance and guarantee money coming in. It made a £14.1 million loss in the year ending July 2024, but this doesn’t include money made from debenture payments.

After great male players Roger Federer, Rafael Nadal and Murray retired in recent years, there were concerns about demand, Ten’s Cheatle said. But a new era of players, including Carlos Alcaraz and Jannik Sinner, has since emerged with plenty of talent, creating new rivalries that are gripping tennis fans.

“Who wouldn’t want to see Alcaraz vs Sinner?” Cheatle said.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox