Private equity fundraising lowest in six years

Investors likely to be far more selective this year, with 71% considering new relationships to generate higher returns

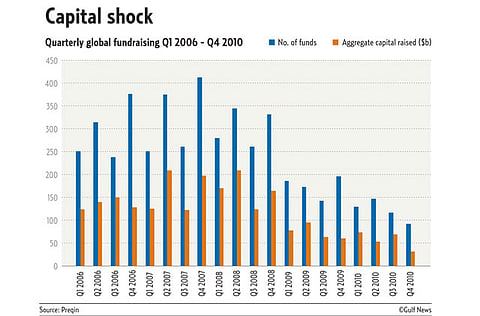

Dubai: Global private equity funds had a dismal 2010, during which they raised $225 billion (Dh826.29 billion), the lowest aggregate amount in six years. The outlook for this year is not much rosier.

A total of 484 funds achieved closing last year, according to fund tracker Preqin.

Industry executives and analysts had predicted a fourth-quarter recovery in fundraising, but this did not transpire. Only $32 billion was raised by the 92 funds that reached a final close in the last three months of the year.

"We would expect this figure to rise slightly as extra information becomes available, but it will still represent the slowest quarter since the third quarter of 2003," Preqin analyst Tim Friedman said in a note to Gulf News.

The largest fund to close last year was Blackstone Capital Partners VI, a buyout fund that raised a total of $13.5 billion, according to Preqin data.

The highest amount, $73 billion, was raised in the first quarter, while the second quarter saw the highest number of funds, 147, finish the fundraising cycle.

Venture funds were the most prolific, with 102 reaching a final close in 2010 raising an aggregate $20.4 billion. Buyout funds accounted for the largest proportion of the aggregate capital raised; $68.5 billion was collected by 88 such funds that closed in 2010.

"Fundraising in 2010 turned out to be just as challenging as many feared. Although there are many individual success stories, on an overall basis fundraising levels were extremely low," Friedman said.

"Conditions in 2011 appear far more encouraging; 54 per cent of investors plan to invest more capital in 2011 than [they did in] 2010, with only 15 per cent saying they will invest less." Preqin expects private equity fundraising to exceed $300 billion this year, with a more dramatic increase coming towards the end of the year as top-quartile managers close significant funds that have been launched recently or are in the pipeline.

Market conditions

"Market conditions are improving, and with deals and exits occurring at the highest levels for some time, investors will have to increase investments to maintain allocations," Friedman said.

Investors are going to be far more selective in 2011 than in previous years, he said, with 71 per cent considering new relationships this year in order to generate higher returns. "[Fund] managers will need to think carefully about their terms and conditions in addition to their proposed strategies in order to achieve success," he said.

As investors become more receptive, more fund managers are expected to hit the road to take advantage.