Investors brace for a stormy week after global selloff, Trump tariffs, weak US jobs data

Rate cut bets rise, volatility looms as jobs data and Trump tariffs shake global markets

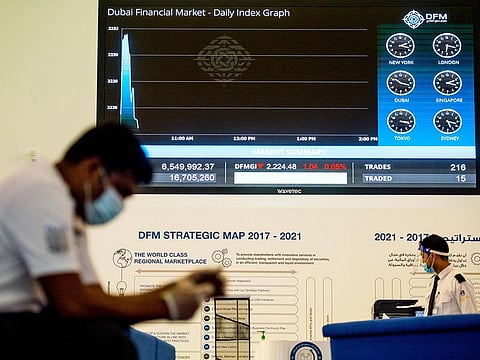

Dubai: Investors head into the first full trading week of August with caution after global markets logged their longest losing streak in nearly a year, rattled by fresh tariffs from US President Donald Trump and signs of a rapidly weakening US jobs market.

The key focus this week: whether the Federal Reserve could move to cut rates sooner than expected — and whether this will be enough to stabilise sentiment across equities, bonds and currencies.

US nonfarm payrolls rose by just 73,000 in July, far below expectations. Adding to the gloom, the previous two months' jobs growth was revised down by nearly 260,000, pulling the three-month average to just 35,000. The unemployment rate ticked up, reinforcing concerns that the labour market — long considered resilient — is now flashing warning signs.

That was enough to trigger a sharp fall in short-term US Treasury yields on Friday, as traders priced in a 90% chance of a Fed rate cut in September, and fully priced in two rate cuts for 2025.

This week's US inflation report (due Thursday) could cement those bets. Any downside surprise in CPI would likely reinforce the growing market view that the Fed is nearing a policy pivot, despite its previously cautious tone. Comments from several Fed officials scheduled to speak this week will also be closely watched for clues on whether the central bank is ready to shift its stance.

More Fed signals needed

“The Fed may see a clearer path to a September cut, especially if data over the next month confirms the trend,” said Ellen Zentner of Morgan Stanley Wealth Management.

Beyond monetary policy, geopolitical uncertainty remains a wild card. Trump’s latest tariff hike — part of his escalating campaign against what he calls unfair global trade practices — has revived fears of a renewed trade war, which could weigh on global supply chains and corporate earnings.

Last week’s selloff stretched across major regions: US stocks dropped, European bourses posted their worst week since April, and Asian equities fell for a sixth straight session, the longest streak of 2025.

As the new week begins, sentiment remains fragile. While strong earnings from major tech names failed to lift broader markets, the next set of macro triggers could swing risk appetite either way.

Investors will be watching for clarity on three fronts: whether the Fed is now leaning toward cuts, how deep the economic slowdown runs, and whether trade tensions escalate further. Until then, markets are likely to remain volatile — with policy and geopolitical signals driving the next major moves.

- with inputs from Agencies

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox