Foreign firms gain from China's tainted food

China's largest dairy company faces protests and lower earnings

Beijing: Tainted milk from China's largest dairy company, discovered amid a state crackdown on food safety, is set to be a windfall for foreign companies such as Nestle.

China Mengniu Dairy, which supplies China's astronauts and athletes and is part-owned by the government, faces protests after regulators found toxins in its milk last month. The dairy company's shares have dropped 25 per cent in two weeks and its website has been vandalised by hackers.

The backlash may hurt Mengniu's earnings, lure consumers away from local dairy brands and drive the government to clamp down further on food makers. Foreign companies, from Switzerland's Nestle to France's Danone, may profit from renewed food-safety fears, three years after contaminated local formula killed six babies.

"This scandal is another black mark on Chinese firms' reputation," said Jessica Lo, managing director at China Market Research Group, based in Shanghai. "Foreign food brands will benefit. Companies like Danone and Nestle should see a bump in sales."

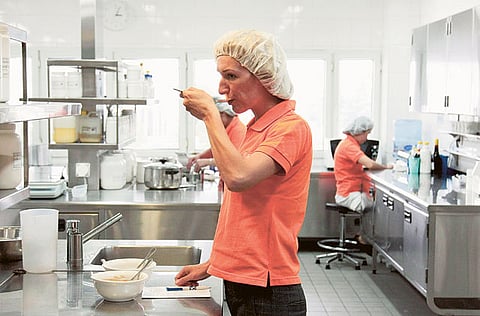

Nestle is accelerating investment in its dairy business in Shuangcheng, China, and investing in a new dairy training institute, Jonathan Dong, a spokesman, said by email. Nestle's Shuangcheng factory has close to 100 people in testing and monitoring and has a ‘very sophisticated' test capability in its factories, he said.

H.J. Heinz, the Pittsburgh-based food maker, started selling baby food packed in pouches in China last year, which costs less than food in jars. Business in China will double during the next three years, chief executive officer William Johnson said in November.

Mead Johnson Nutrition, the baby-food maker based in Glenview, Illinois, in November opened a 53,000 square-foot paediatric nutrition research institute in Guangzhou, southern China.

Share in sales

The company made $745 million (Dh2.73 billion) of sales in China in 2010, more than doubling in two years and accounting for 24 per cent of its total, according to data compiled by Bloomberg. Mead Johnson had a 12 per cent share of China's milk formula market in 2010, Danone had ten per cent, and Nestle 2.3 per cent, according to London-based researcher Euromonitor International.

China's government has tried rebuilding confid-ence in its food industry through factory inspections and regulation.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox