Highlights

- Multinational companies like Pepsi and Amazon are electrifying their fleets — seen as a "tipping point" for EVs.

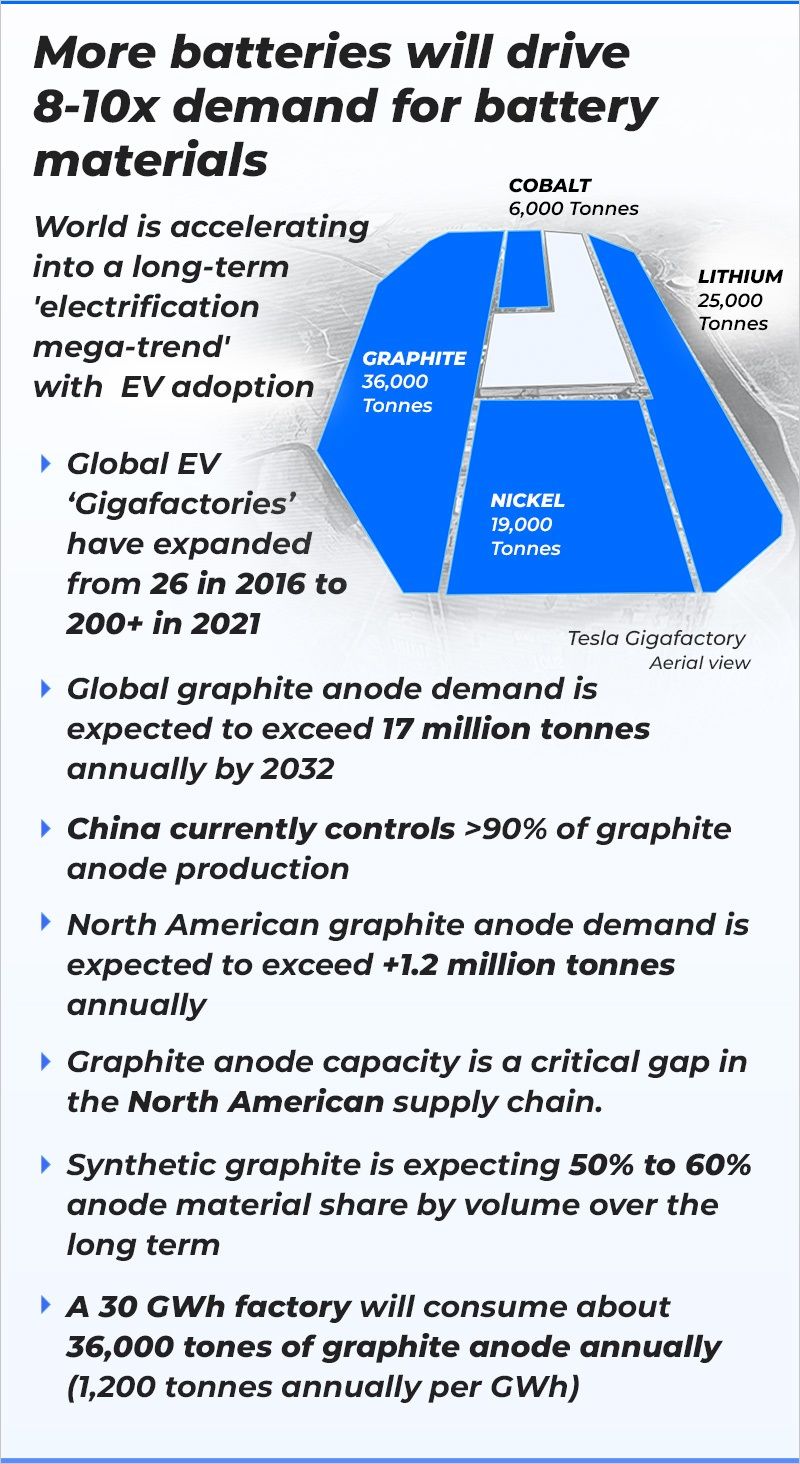

- However, a shortage in battery minerals keeps the cost of components like graphite and lithium quite high.

- With mining licenses difficult to get and battery prices not going down to $100 per kWh anytime soon, adoption of EVs will be out of reach for most consumers.

Here's the good news: EV sales are up this year (4.2 million in the first half of 2022, nearly 60% up from year-ago figures for both battery-only and hybrids).

Now the bad news: it has exposed a supply crunch not only in lithium, but also in graphite, two of minerals used in its manufacture, according to an industry report.

Exponential growth has driven a surge in raw materials demand, specificaly graphite. There's one big challenge: up to 90% of battery-grade graphite is produced in one country — China.

Industry executives recently warned at a conference in Los Angeles that investment into raw material production for EVs is badly needed to meet the spike in demand for the battery minerals, but especially so for the production of battery-grade graphite.

✏️pencils

🔥refractory material

♨️cores of nuclear reactors

🔋 anode material for lithium-ion batteries.

'Critical shortage'

The "critical shortage" of graphite production outside the mainland has triggered a move by Republican congressmen to roll out moves to shorten EV mine permitting in the US after their House win in the recent midterm elections.

Given the pent-up demand for EVs, it’s not just Tesla that facing huge EV battery supply crunch, according to a report published by Benchmark Minerals, a price reporting agency and specialist information provider for the lithium-ion battery to EV supply chain.

✏️ It usually takes about 5 years before minerals from mine get into a product, due to permitting procedures.

✏️ The current tightness in the graphite anode market is expected to last in the short term.

✏️ Graphite prices have been largely stable with low-end products at 35,000 yuan ($4,910) per tonne and high-end products at 60,000 yuan ($8,417) per tonne, according to Daiwa Capital.

✏️ China has held the lion's share of the global natural graphite production for over 30 years, producing around 60%-80% of the world's natural graphite.

✏️ Research is also on to mass-produce synthetic graphite.

Supply crunch

For certain EV models, the wait-list is long. China, the world’s top battery maker, is also facing a supply shortfall, resulting in delivery delays and more frustrated customers.

Given the huge gap in pre-sale bookings and production (for Cybertruck and Ford F-150, for example) it's clear it will take time for battery makers to expand production capacity to meet demand.

Last December, Xpeng Motors, one of China’s top EV start-ups, faced consumer complaints after deliveries of some of its models were delayed.

Recently, Xpeng once again apologised to customers for delays in deliveries of its P5 sedans due to insufficient battery supply.

✏️ The company said it has the capacity to build 15,000 of the trucks in 2022, 55,000 in 2023, and 80,000 in 2024. With reservations in the hundreds of thousands, online reservations were temporarily shut down.

✏️ In July 2022, Tesla reported that they already received more than 650,000 pre-order deposits of a refundable $100 for their Cybertruck.

Spike in demand

It turns out that — as the demand for EVs increases — battery-grade graphite has become a scarce resource that manufacturers are running into problems with.

Due to tough licensing rules for new mines, and despite the high demand for EVs, global graphite production actually shrank in 2020, to 954,000 tonnes, a 14% drop from 2019.

Due to tough licensing rules for new mines, and despite the high demand for EVs, global graphite production actually shrank in 2020 to 954,000 tonnes, a 14% drop from 2019, according to an industry report/

Industry analysts point to an “urgent need” for EV battery makers to expand sourcing. In bid to ease market dependence from a single source, Tesla recently signed a deal to source graphite from Mozambique. It has also signed a deal with Indonesia, the world's biggest nickel supplier.

The exponential growth from the electric vehicle sector has driven up demand for raw materials. Various widely-used lithium-ion batteries — from lithium iron phosphate (LFP) to nickel cobalt manganese (NCM) cathodes (positive) — use graphite anodes (negative).

But supply gaps remain and could pose a key challenge as EV production is ramped.

“The US is presently 100% import dependent for its graphite needs,” said Anthony Huston, CEO of a company called Graphite One. “And really, when you boil it down, the US has not mined any graphite for more than 30 years.”

Graphite One is trying to create a graphite supply chain in the United States, but on-shoring takes time. The company has proposed a mining project in western Alaska, but it has to wait on a feasibility study, then permitting — then construction.

Thus, the supply of battery-grade graphite is much tighter, according to Wood Mackenzie.

The price has climbed by nearly a third from 2021. That prompted American Battery Technology Co. (ABTC) to onshore some production in part by recycling old batteries.

But until there’s enough domestic supply, US businesses are going to have to import graphite — mostly from China, said Morgan Bazilian at the Colorado School of Mines. Last year, the US added graphite to its list of critical minerals.

✏️ The main barrier: Commoditisation. Meaning, there's not enough to go around to apply for mining permits, take the mineral to a refining facility and turn them into battery-grade materials.

✏️ Thus, the supply of battery-grade graphite is much tighter, according to Wood Mackenzie.

Standardisation would also enable graphite production to attract investments, a conference in Madrid, Spain organised by Fastmarkets was told in September 2022.

Demand growth

Graphite prices have been largely stable with low-end products at 35,000 yuan ($4,910) per tonne and high-end products at 60,000 yuan ($8,417) per tonne, according to Daiwa Capital.

In 2020, global reserves of graphite were estimated to be 323.8 million tonnes. Turkey has the largest reserves of graphite, followed by China and Brazil. Together these three countries accounted for 72% of the estimated world graphite reserves. While having those huge reserves is one thing, making them available for use by industry is another. And unless mining licenses are eased, research into synthetic graphite bears fruit, or a new battery chemistry with less need for graphite is found, the EV boom could run out of oomph.

A potential supply chain crunch: Growth in graphite demand is forecast to average an 18 per cent increase year-on-year until 2030, according to Benchmark Minerals. By 2035, it is expected to double, according to energy and commodities consultancy Wood Mackenzie.

Graphite represents around 5 per cent to 15 per cent of the cost in a typical electric vehicle battery. While Benchmark Minerals forecasts a potential shortage in graphite over the near term, this could incentivise higher prices and, therefore, more supply of the mineral into the market over time.

While it's yet to be seen whether that will be enough to prevent a potential shortage in the market, a clearer picture may emerge soon.

BEV sales grew by 75% on the year and PHEVs by 37%. Greater growth is predicted for the rest of 2022, with sales expected to rise by 57% on the year to 10.6 million.

Dates for the phase-out of the sale of gasoline and diesel vehicles have been determined by policymakers in numerous economies. By 2035, sales of these vehicles will be prohibited throughout the EU, but the UK has moved up its own phase-out date from 2035 to 2030.

By 2030, 40% of cars sold in China, the largest auto market in the world, are expected to be electric.

• Canada ranks as the 10th global producer with 12,000 tonnes of production. The country imported $20.6 million worth of natural and synthetic graphite, while exports were valued at $31.6 million.

• In 2021, China was the world’s leading producer of natural graphite, producing an estimated 820,000 tonnes, or around 79 per cent of total world output, according to a report by the US Geological Survey in January.

• By 2025, China is expected to produce about 913,000 tonnes of natural graphite, according to a Frost & Sullivan report.

Without the much-needed changes in the supply equation, these cut-off dates set for internal combustion engines in various jurisdictions may prove self-defeating.

EVs with decent specs are still currently in the $40,000 to $60,000 price range. Given the prevailing economics and geopolitics, the much hoped-for $25,000 Tesla hatch (or sedan) will remain a pipe dream for most who find themselves stuck in prolonged anticipation.