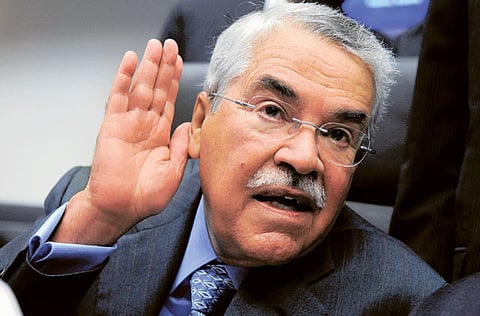

Al Naimi: Saudis determined to bring oil prices down

Denying shortage, kingdom ready to tap into spare capacity of 12.5m barrels per day

Seoul Top oil exporter Saudi Arabia is determined to bring down high oil prices and is working with fellow Opec members to accomplish that, Oil Minister Ali Al Naimi said Friday.

Brent crude has risen about 13 per cent this year, trading above $120 (Dh440.78) a barrel yesterday, threatening a nascent recovery of the global economy. Oil has traded above $100 for all but a couple of days in the past year.

"We are seeing a prolonged period of high oil prices," Al Naimi said in a statement during a visit to Seoul. "We are not happy about it. [The kingdom of Saudi Arabia] is determined to see a lower price and is working towards that goal."

The influential Saudi oil minister earlier this year identified $100 a barrel as an ideal price for producers and consumers.

Concern of a supply shortage due to production problems in some producing countries and as US and European sanctions target exports from Opec's second-largest producer Iran have helped keep Brent crude well above that mark.

Al Naimi reiterated that there were no supply shortages in the global oil market and the kingdom stood ready to tap into its spare capacity of 12.5 million barrels per day if more crude was needed.

"The story is one of plenty," he said. "Supply is not the problem."

Saudi Arabia is pumping 10 million barrels per day, the highest level since November, when the kingdom produced more than it had done for decades.

Fellow Opec producers Libya, Iraq and Angola have increased output, Al Naimi said. Non-Opec members, including Canada, the United States and Russia, had also boosted supplies, he added.

Stockpiles are full

Saudi stockpiles at home and abroad were full, he added. Inventories in industrialised countries were also filling up, he said.

"Fundamentally, the market remains balanced — there is no lack of supply," he said. "Saudi Arabia has invested a great deal to sustain its capacity, and it will use spare production capacity to supply the oil market with an additional required volumes."

The International Energy Agency (IEA) said on Thursday that the oil market had broken a two-year cycle of tightening supply conditions as demand growth weakens and top exporter Saudi Arabia increases output. The agency, which advises industrialised nations on their energy policies, said increased supply and slowing demand growth might already point to a significant rise in global oil stocks.

Stubbornly high oil prices could be expected to ease when markets woke up to the shift in trend, it added. "They [Saudi Arabia] do have the capacity to flood the market with extra oil and increase supplies because they are not happy with persistently high oil prices," Ben Le Brun, a market analyst at OptionsXpress in Sydney, said. "But more than supply, prices are high due to risk premiums for what is happening in the Middle East and North Korea. Those risks aren't likely to go away anytime soon."

Geopolitical concerns

North Korea defied international pressure to launch a long-range rocket last week. Unlike Iran, North Korea is not an oil producer. But South Korea is a refining centre, and there is concern that the launch has ratcheted up tension between the two Koreas.

Pyongyang said the move was to put a weather satellite into orbit, but critics believe it was to enhance its ability to design a ballistic missile.

China, Japan and South Korea, some of Iran's top consumers, have all slashed imports in the first two months of the year as tightening sanctions make it almost impossible to do business with Tehran.

The IEA estimates sanctions against Iran are already hurting output. The amount of crude it pumped fell in March by a further 50,000 bpd to 3.3 million bpd. A wider embargo in the second half of the year could put production about 250,000 bpd below levels at the end of 2011.