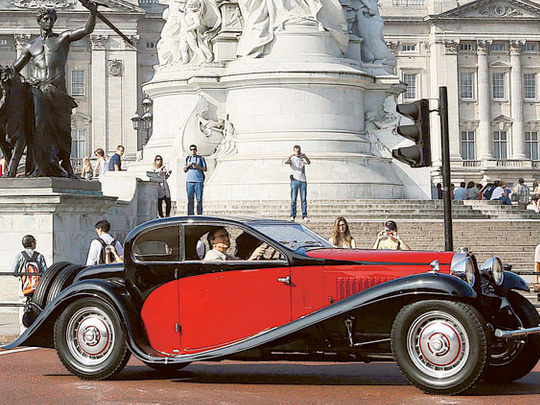

Dubai: Classic cars such as Ferraris, Bugattis and Bentleys soared by 28 per cent in value in the year to June, outstripping gold, art and luxury London property thanks to rising demand from wealthy Asians.

Property consultancy Knight Frank, which publishes an index tracking the performance of luxury goods, said the world’s wealthy were putting more money into tangible items that they could enjoy as the world economy looks to be recovering.

In July, a rare 1954 Mercedes-Benz W196 in which five-time Formula 1 World Champion driver Juan Manuel Fangio of Argentina won two grands prix, was sold at auction for 19.6 million pounds ($30.6 million), making it the most expensive car ever sold at auction.

“It’s an asset class that’s very rare and it’s very aspirational,” said Andrew Shirley, editor of the report. “A lot of Asian high net worth individuals have acquired classic cars...They keep them in their garage in the UK or Europe and they come over and drive them in rallies.”

This is in stark contrast to gold, seen as a safe haven investment in difficult periods, whose value has slumped by 23 percent over the same period following a 12-year bull run.

“The thing about gold is that it’s tangible in the sense it’s a physical thing but there’s no great enjoyment to be had from gold...Whereas a classic car, it’s still a safe haven play but it’s something you’re going to enjoy,” Shirley said.

After classic cars, the next biggest gainers in the index were coins and stamps, up 9 and 7 per cent respectively. Art, which had surged in value in the run-up to the credit crunch, fell 6 per cent over the period as buyers become more cautious and selective, he said.

In his nostalgic ballad “Made in England” Elton John pays tribute to a blue Cortina, but he would have been closer to home if he had sung about his very own pink and white 1989 Rolls-Royce Phantom V.

Elton is one of a growing group of celebrities who have taken a close interest in the classic car market. His Rolls was one of more than 20 classic cars, including Aston Martins, Bentleys, Ferraris and Jaguars, that the singer auctioned for nearly £2m some years ago.

Most collectors buy because they are passionate about old cars, but many are well aware of their rising value and buy accordingly. Other well-known fanatics include actor Billy Connolly, singer Jay Kay and radio DJ Chris Evans. The latter summed up the lure of fast cars when he bought a 1961 Ferrari California Spyder in 2008 for £5m, saying: “It seems a lot of money, but in five to 10 years’ time it’ll be out of my range.” It was a good decision. A Ferrari 250 GTO recently sold for a record £22.7m a decade after it was bought for just £6m.

“Classic cars are proving to be one of the most lucrative and robust investments around, providing the right marque and model is chosen,” says Gary Axon, Goodwood Motorsport spokesman. “Over the past three to four years, values for older classic motor cars at auction or in dealer and private sales have bucked the global recession, proving as prudent an investment as the other two current leading recession-proof commodities, fine art and vintage wine.”

The classic car market has been a difficult one to play, however. For years it defied attempts to track its movements because, unlike wine, gold or other traded commodities, there was no independent guide to trends. So, in 2007, banker Dietrich Hatlapa took his love of classic cars a step further and created the first authoritative independent index, along with the Historic Automobile Group International research organisation to support it.

The index now covers 50 cars worth at least £100,000, each with only 1,000 examples built and all with an established collector community. The index shows values racing up 16 per cent in 2012.

But there are risks. Classic cars need regular maintenance, and spare parts will often be expensive. And despite big sums paid for the best cars the market has not returned to the frenzy of the late 1980s, when certain models were changing hands five or six times a year. The market stalled when recession hit in 1990 and the price of an E-type Jaguar fell from a peak of £100,000 to less than £40,000.

However, experts say marques with a prestigious history, such as Aston Martin, Bentley or Bugatti, or with a racing heritage, such as Ferrari or Jaguar, are reliable investments. So too are lesser classics from the 1950s to the 1980s, more affordable machines such as Jaguar E-types, Maseratis and earlier Lancias. James Knight, group motoring director at Bonhams auction house, said nine out of 10 classic cars coming under the hammer last year found new homes.

“In recent years wealthy people have had money earning next to nothing in the bank, so they put it into something they can enjoy and buy a car,” says Knight. “As long as you buy sensibly and the car doesn’t need a lot of work doing, there’s a good chance it will increase in value two or three years down the line.”

He says cars increase in value for a number of reasons. Sometimes it can be a manufacturer producing great modern cars that rekindle interest in their predecessors. Sometimes interest is fuelled by the celebration of an anniversary for a particular model. A car that has gained on both counts is the Aston Martin DB5 – specifically because of its connections with James Bond.

Remarkably, there are tax benefits too. “Classic cars as an investment are exempt from capital gains tax (CGT), so this is considered a tax-free investment,” says Tim Gregory, partner at accountancy firm Saffery Champness.

“But you should be careful not to buy and sell so often that you could be regarded as a dealer. The profits you make could then be subject to tax.”

The non-financial rewards of owning a classic car are many. “The sector has bragging rights,” says Mohammad Syed, head of strategic solutions at Coutts private bank. “Anyone can buy, or have purpose-built, a super-yacht, a big estate or a private jet, but you can’t replicate a unique historic car with provenance. This is something that no amount of wealth can recreate.”

He says the super wealthy want something unique which gives them access to exclusive events and social circles. For example, LVMH hosts an invitation-only car rally for high-end collectors. Other examples of strictly invitation-only events are the Pierre Corthay/Rothschild car run and the Concours of Elegance at Windsor Castle, which features 60 of the rarest motor cars in the world.

—Compiled from agencies