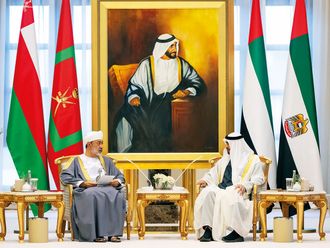

Al Nuaimi (left) and Al Buharoon study a model of the Capital Plaza. ©Gulf News |

The facility has been lead arranged by National Bank of Abu Dhabi (NBAD) while the others are Abu Dhabi Commercial Bank (ADCB), Union National Bank (UNB) and First Gulf Bank (FGB).

The Capital Plaza project will include a 250-room luxury hotel, a 25,000 square metre office building, 220 luxury apartments, including 21 sky villas and six rooftop villa type apartments, located in three towers, retail facilities and underground parking for some 1,200 cars.

The project will also include a private beach and recreation facilities with an underpass to connect Capital Plaza with the beach.

Construction of the five towers is to start this quarter and be completed in 42 months.

Hamad Rashid Al Nuaimi, chairman of Reisco, signed the documents along with Khamis Al Buharoon, head of domestic banking, NBAD, and other bankers.

Phase one of the project - estimated at Dh350 million - is being financed with a bank loan of Dh259 million. It is not clear whether the promoters will take bank financing for phase two, although bankers said it could come up for a second round.

As lead arranger, NBAD has committed Dh82 million, FGB Dh75 million, ADCB Dh50.5 million and UNB Dh51.5 million.

While the financing has a term of 11.5 years, details about the interest rate were not disclosed. "It is a good, competitive deal," a senior banker told Gulf News.

"Due to the high profile of the promoters and growing demand for commercial space in the capital, the project should do very well," said a senior banker.